Why India's consumption spending may remain weak even post-pandemic

The pandemic came in the middle of the formalisation of the economy, which has impacted the unorganised sector disproportionately. The reopening of economy may not automatically lead to spending recovering, say experts

Image: Sam Panthaky/ AFP

Image: Sam Panthaky/ AFP

Over the past decade, companies associated with India’s consumption economy have been stock market darlings. They’ve seen valuations rise rapidly even as earnings growth has, at times, been tepid.

During the pandemic, investors largely ignored a period of lost earnings in these companies. The hope is that it would be business as usual once Covid-19 memories fade, vaccinations take place and markets open up. The equity market has, for the most part, not discriminated when it comes to businesses like hospitality, aviation and cinemas, which could see a longer-term impact, and consumer staples or autos where the numbers have held up better.

The Nifty Consumption Index at 6,414 is 24.9 percent higher than its February 2020 level. At 10,267 the Nifty Auto Index is 22 percent higher. This is while earnings growth for their constituents has been tepid or declined. Both have tracked the Sensex, which at 52,653 is 25 percent higher.

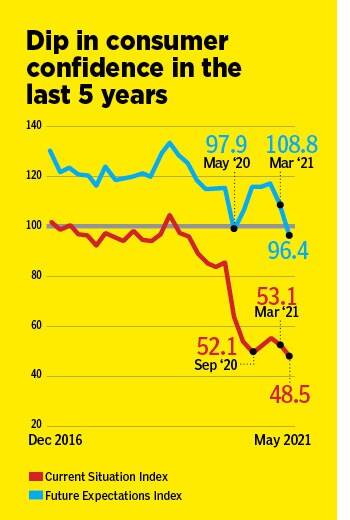

But what if the Indian consumption story were to settle on a lower base post pandemic? How would the markets react then? Could an expectation of slower growth result in valuations coming off?

India’s consumption trajectory is notoriously hard to forecast even in the best of times. Rural demand picks up when urban slows. Slowing salary growth has been replaced by zero-cost EMIs and personal loans. And while certain products may be consumed less on aggregate, the basket has only grown in the last decade. Coming up with a reasonable estimate post-pandemic is hard to do not least because estimates of private final consumption vary on account of a low base in 2020. But since consumption spending makes up about 60 percent of economic growth, a fall in spending could have a negative impact if government spending, capex and exports don’t make up the shortfall.