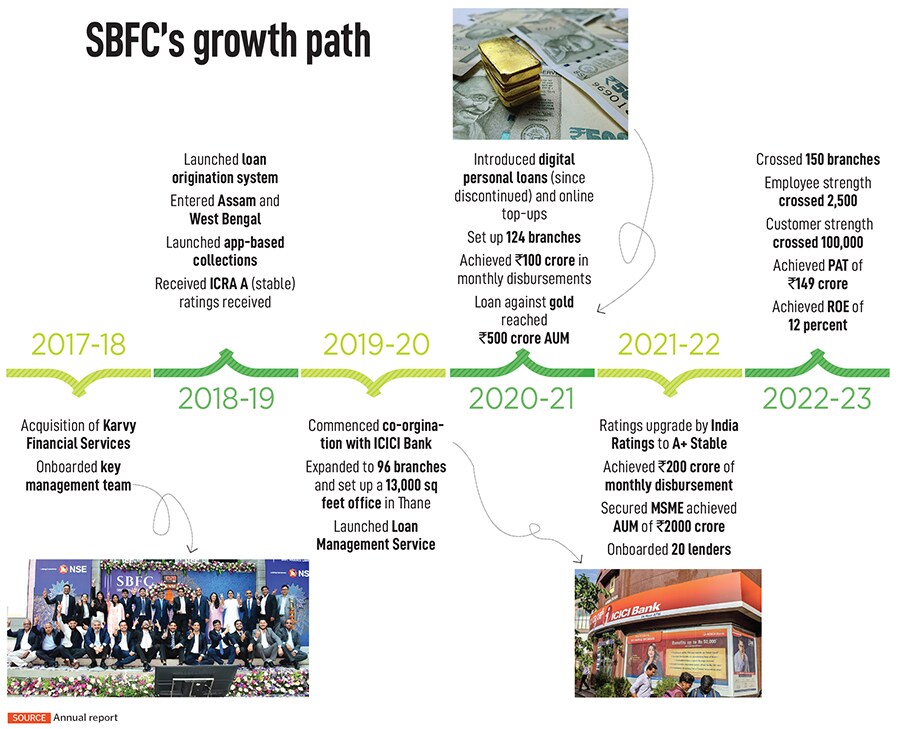

SBFC Finance: Enabling lending to small businesses

Large banks usually don't prefer lending to small India's 64 million MSMEs fearing default. It is here that Aseem Duru identified a huge market gap, building his company SBFC Finance into a Rs 8,000-crore enterprise

(From left) Pankaj Poddar chief risk officer, Aseem Dhru, MD & CEO, Narayan Barasia, CFO, and Mahesh Dayani, chief business officer of SBFC

Image: Bajirao Pawar for Forbes India

(From left) Pankaj Poddar chief risk officer, Aseem Dhru, MD & CEO, Narayan Barasia, CFO, and Mahesh Dayani, chief business officer of SBFC

Image: Bajirao Pawar for Forbes India

It was during the formative years of HDFC Bank that Aseem Dhru honed his skills in lending to small businesses. He also had a bird’s eye view of the challenges.

Sample this: A dealer of seeds and farm inputs or a tailor would run the business on the basis of informal records. Audited accounts don’t exist and neither do GST filings. At best, an income tax return would allow a loan officer to assess the income of the loan seeker.

Conventional wisdom reasoned that lending to this segment was inherently risky. Credit assessment was difficult, default rates were high and ticket sizes small. Add to that the challenge of setting up a large distribution network and most large banks reasoned it was not worth the effort.

But businesses like this number 64 million, and says Dhru, “This is huge whitespace waiting to be catered to.” His travels across the country also taught him that borrowers were not habitual defaulters. Instead, it was an adverse event or the seasonality in their incomes that made them miss payments. Sure there would be some write-offs but he was confident a business that factored in a 2 to 2.5 percent default rate would be a viable one. If one could lend in exchange for a security the business had a chance of success. In 2017, Dhru had the chance to test his hypothesis.

Fast forward to 2024 and SBFC Finance is a listed entity worth ₹8,000 crore. The business which listed in August 2023 at ₹81, a premium of 44 percent to its IPO offer price of ₹54-57 per share. Since then, the stock has performed well on the bourses and traded at a market cap of ₹8,500-9,000 crore. And, in a sign of the quality of the business franchise, the market has placed a price-to-book multiple of 3 times.

This has also been a time when investors are warming up to the idea that lending to small businesses is an investible proposition. The last decade saw the emergence of affordable housing finance companies with Aavas, Aptus and Home First building large franchises lending to borrowers outside the salaried class. They’ve managed to keep credit loss numbers in the 1 to 1.5 percent range and a return on equity of 14 to 17 percent.

This has also been a time when investors are warming up to the idea that lending to small businesses is an investible proposition. The last decade saw the emergence of affordable housing finance companies with Aavas, Aptus and Home First building large franchises lending to borrowers outside the salaried class. They’ve managed to keep credit loss numbers in the 1 to 1.5 percent range and a return on equity of 14 to 17 percent.