ACE: Riding high with India's infrastructure story

Action Construction Equipment has been a key beneficiary of the country's rapid infrastructure buildout

(From left) Sorab Agarwal, whole time director, Mona Agarwal, whole time director and Vijay Agarwal, chairman and managing director, ACE

Image: Madhu Kapparath

(From left) Sorab Agarwal, whole time director, Mona Agarwal, whole time director and Vijay Agarwal, chairman and managing director, ACE

Image: Madhu Kapparath

By 1995, Vijay Agarwal had spent over a decade working for Escorts. By his own admission, he felt “stifled” within the company. Escorts had not gone anywhere for a while and its employees were just doing the same thing day in and out. Agarwal wanted an exit ramp and worked on getting out quickly.

On a small plot on Delhi's outskirts, Agarwal, who had studied at the prestigious Faculty of Management Studies at Delhi University, pooled in ₹15 lakh from his savings and got to work doing what he knew best—making cranes and looking for customers. He named his company Action Construction Equipment (ACE) after an earlier name didn’t pass muster with the registration authorities. He also learnt first-hand about the challenges of running a business.

Cranes were leased by operators who then rented them out on a daily or monthly basis. They’d only buy from a new company if they were able to finance them and make money while renting them out. The return on investment had to work in their favour. This meant Agarwal had to work not just on making cranes but also on getting them financed. He tied up with SREI and Magma Fincorp to get his customers financing. Initially, business was slow, but as customers saw the value proposition, he started getting his first orders.

The first crane rolled out in March 1996 and the business had a slow start in 1997 with sales of 25 cranes. Still, Agarwal says it was a better product at a cheaper price and it managed to get his former employers riled up. They did everything to shut him down, including suing him for product infringements, in lower courts in places far away from Delhi—Ranchi, Jamshedpur and Kolkata. It took several years, but ACE eventually prevailed. Agarwal says he never wavered in his belief that he could make a product that was better than that of his Indian and multinational rivals.

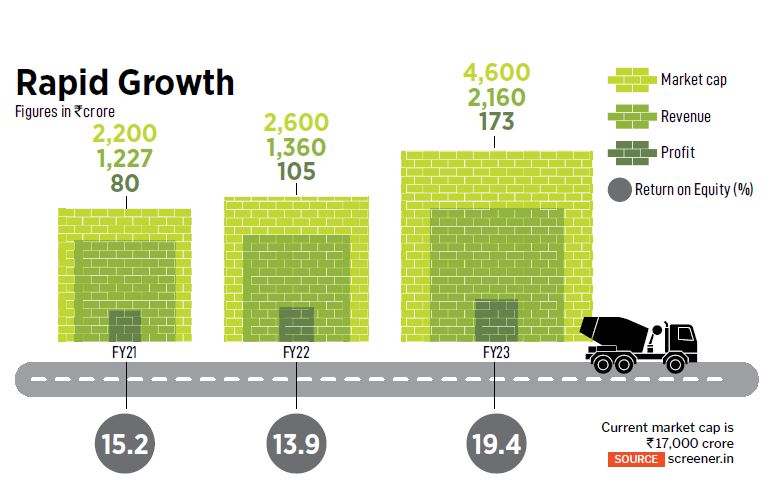

Almost three decades on, it is clear that the 76-year-old founder has passed this test with flying colours and is likely to be a key beneficiary of increased spending on infrastructure and manufacturing. ACE is now a ₹17,000-crore company (by market capitalisation) and a market leader in pick-and-carry cranes and tower cranes in India. It also makes construction and agricultural equipment. With growth taking off in the last three years, it plans to get aggressive on exports that make up 9 percent of its ₹2,700 crore revenue. The business is debt-free and generates enough cash for expansion without leveraging. “Our base case is that the business should be three times as large in the next five years,” says Sorab Agarwal, executive director at ACE.