Fusion Microfinance: The newest kid on the block

With consistent growth and new business lines, Fusion Microfinance adds to the list of investible companies in the sector

Devesh Sachdev, Managing director of Fusion Microfinance

Image: Amit Verma

Devesh Sachdev, Managing director of Fusion Microfinance

Image: Amit Verma

A little over half-way through my interview, Devesh Sachdev makes an off-the-cuff remark that speaks wonders for the confidence he has in his business. “Any of my employees would be willing to sign the balance sheet,” says the managing director of Fusion Microfinance. In a finance company this confidence is significant. Over the last decade, there have been numerous instances of fudged numbers by companies, auditors signing off and then resigning, and independent directors resigning when they are uncomfortable with the numbers reported.

In a business with few hard assets, cooking the books is easy, and Sachdev is clear that is a problem Fusion will never face. “I wanted to build a good company. Not [necessarily] a large company,” he says.

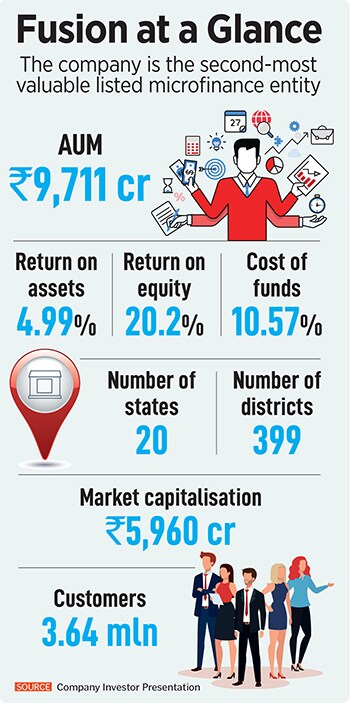

It is with this endeavour that Fusion Microfinance has emerged as the second-largest listed company in India in the microfinance space. After a successful listing in November 2022, the stock has been on a tear. It is up 63 percent from its listing price to Rs 599 a share, taking its market cap to Rs 5,960 crore; the stock trades at 2.6 times book value. In comparison, CreditAccess Grameen, which has a market cap of Rs 22,963 crore trades at 4.6 times book value. As the market sees more quarters of its performance, Fusion’s stock may re-rate further.

The company has put in place strong growth levers. Its recent Q1FY24 numbers saw asset under management (AUM) grow to Rs 9,711 crore, up 31 percent in the last year. At Rs 120 crore for the quarter, profit after tax was up 60 percent. The business had a return on equity of 20. 1 percent and a return on assets of 4.9 percent.

The company is also trying to show that microfinance investments can make for consistent compounding. The sector hasn’t been a happy hunting ground for investors and there is still a lot of scepticism on whether companies can perform through cycles. They stumbled during demonetisation and then during the Covid-19 pandemic. But still, the largest CreditAccess has compounded at 29 percent a year since its August 2018 listing and now with Fusion’s performance (although over a much smaller time period) investors may be getting some confidence in the sector.

It was against this backdrop that Fusion Microfinance—it was named Fusion as a portmanteau of the words financial and social—started operating in 2010 in states where no one had ventured till then. “The first thing we did right was start our operations from Uttar Pradesh and Bihar,” says Sachdev. There were naysayers who thought his strategy of bring diversified across north India with rural branches was a cocktail for disaster.

It was against this backdrop that Fusion Microfinance—it was named Fusion as a portmanteau of the words financial and social—started operating in 2010 in states where no one had ventured till then. “The first thing we did right was start our operations from Uttar Pradesh and Bihar,” says Sachdev. There were naysayers who thought his strategy of bring diversified across north India with rural branches was a cocktail for disaster.