How GetVantage is democratising access to working capital for underserved businesses

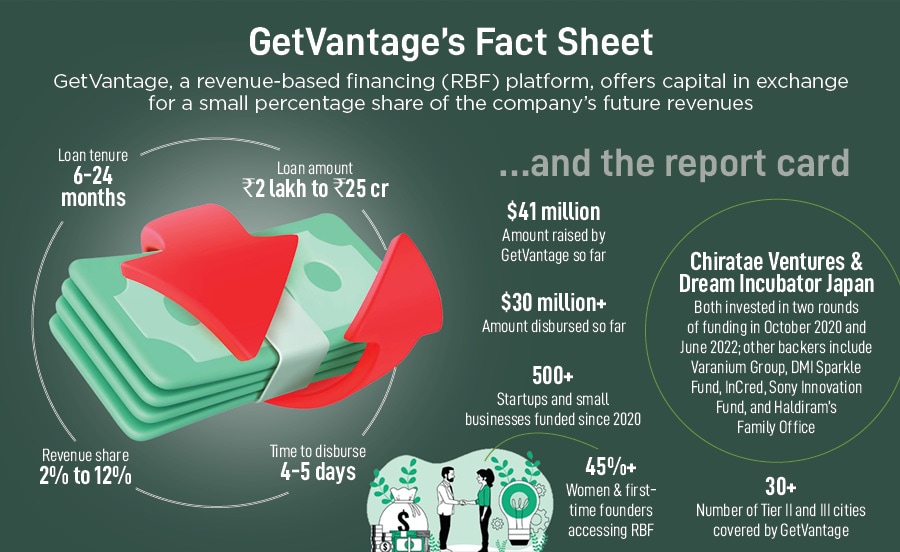

Bhavik Vasa and Amit Srivastava are betting big on the ease, speed and non-dilutive nature of revenue-based financing to give GetVantage an edge in the hyper-cluttered debt and VC world. But can they make it the preferred currency for founders or will it stay a niche concept?

L-R Bhavik Vasa and Amit Srivastava co-founders of GetVantage

L-R Bhavik Vasa and Amit Srivastava co-founders of GetVantage

Raipur, Chhattisgarh. Devkar Saheb’s official induction into the startup world started with the first season of Shark Tank India. “Pichle saal April main ek episode dekha tha YouTube pe, aur pehli baar funding aur venture capital (VC) ke baarey main pata chala (I saw an episode of Shark Tank India on YouTube last April, and got to know about funding and VC for the first time),” recounts the 32-year-old entrepreneur, who founded an ayurvedic FMCG and personal care brand Shri Chyawan Ayurveda in 2018, scaled the bootstrapped venture over the next few years, and closed FY22 with an operating revenue of Rs3 crore. “Shark pata tha, Shark Tank nahin jaanta tha (I knew about shark, but not Shark Tank),” he bursts into a loud guffaw before quickly taking us back to his muted upbringing.

Born into a family of landless agricultural workers in Chhattisgarh, Saheb dropped out of a government school after class 10, joined a Gurukul, studied and worked with the institution till 2017, and started his venture the next year. “Main business bulata tha, venture nahin. Mujhe to startup bhi nahin pata tha (I used to call it a business and not a venture. I didn’t even know the word ‘startup’),” he laughs, adding that till last year, he used to address himself as a director of the company. “Ye entrepreneur aur founder pata nahin tha (I was unaware of terms like entrepreneur or founder),” he confesses and eagerly showcases his wide range of branded products—rusk, snacks, flour, detergent, cookies, biscuits—over a Zoom call. “Even today, not many know about VCs, equity, funding and unicorn in Tier II and beyond,” he reckons, underlining the grim reality of lack of access to venture capital, venture debt and angel money across large parts of India.

Is Shri Chyawan Ayurveda still a bootstrapped company? “Technically, yes and no,” smiles Saheb. In one of the startup events in Delhi last year, the founder got introduced to GetVantage, and took a loan of Rs20 lakh from the revenue-based financing (RBF) platform. “I didn’t dilute any stake and got money. So, I am still bootstrapped,” says the rookie founder, who suddenly starts talking like a startup pro and lists out virtues of keeping equity intact, and not diluting too early and too much. “Who would have backed a school dropout?” he asks. The big world of venture capital looks for degree and pedigree. “I had none,” he says, claiming that his venture is likely to close FY23 at an operating revenue of Rs4.5 crore. “I will take my business to Rs100 crore, and then look for VC money,” he says.

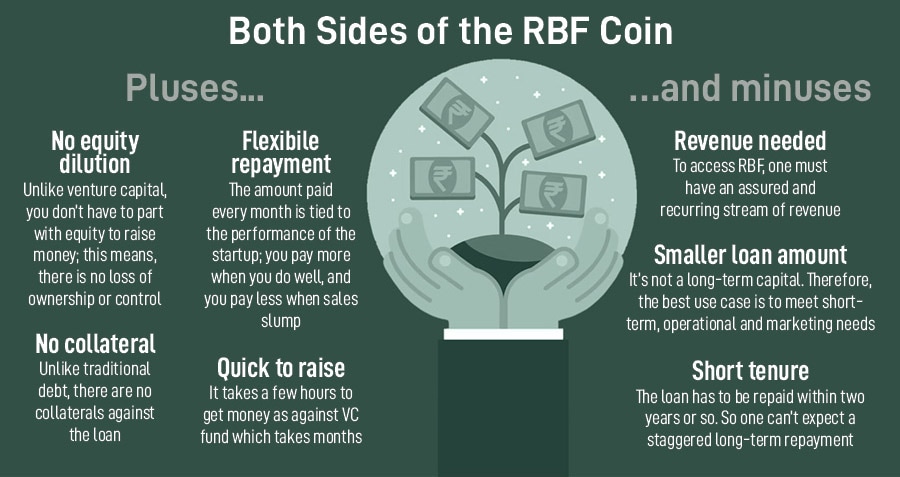

Meanwhile, in Delhi-NCR, a big player like BluSmart—an electric cab-hailing player which counts BP Ventures among its backers, and has a fleet of over 3,200 cars taking on Uber and Ola across Delhi-NCR and Bengaluru—too saw merit in taking the RBF route and raising Rs25 crore from GetVantage. Bhavik Vasa, founder and CEO of GetVantage, explains why companies of all shapes and sizes are hopping on to the RBF wagon.