- Home

- UpFront

- Take One: Big story of the day

- ICEs and EVs will coexist: Sudarshan Venu

ICEs and EVs will coexist: Sudarshan Venu

The managing director of TVS Motor Company reckons both have much headroom to grow—globally and in India. He, however, emphasises that electric vehicles are at the front and centre of the company's future

Rajiv is based out of Delhi-NCR and writes stories on startups, corporates, entrepreneurs of all kinds, and yes, marketing and advertising world. His ‘historic feats’ include graduation in history from Hansraj College, master's in medieval Indian history from Delhi University, and PG diploma in journalism from Bharatiya Vidya Bhavan. Another forgettable achievement was spending over a decade at The Economic Times as his maiden job. For the first seven years, he learnt the craft on the desk, and the remaining years were spent unlearning and writing for Brand Equity and ET Magazine. What keeps him going, and alive, apart from stories is the heavenly music of immortal legend RD Burman.

Nyrika Holkar, Executive director of Godrej & Boyce Mfg Co Ltd (G&B)

Image: Mexy Xavier

Nyrika Holkar, Executive director of Godrej & Boyce Mfg Co Ltd (G&B)

Image: Mexy Xavier

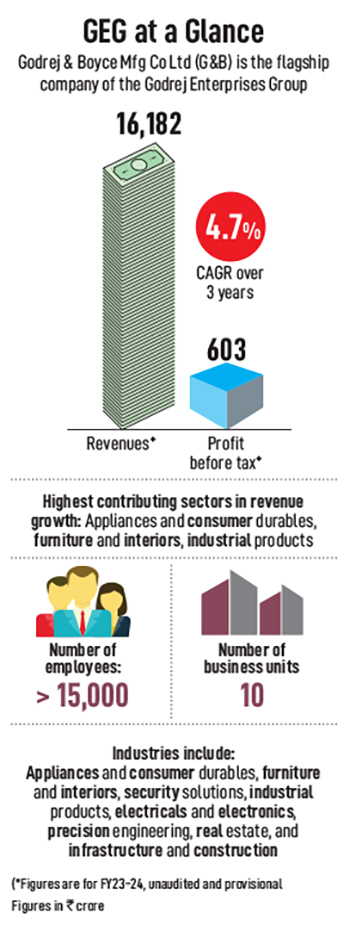

When a 20-something Ardeshir Godrej decided to start making locks in 1897—he had already tried his hand at being a lawyer and making surgical tools, and had failed at both—he might not have imagined that his entrepreneurial spirit and values would continue to live on, and thrive, 127 years and four generations later. The Godrej Enterprises Group (GEG)—one arm of the family-run Godrej conglomerate that announced an amicable division of its businesses on April 30—today includes companies in sectors as diverse as appliances and aerospace, home and interiors and precision engineering. In FY24, its revenues crossed ₹16,000 crore, with a profit before tax of ₹603 crore (see box: GEG at a Glance).

Related stories

“It’s really a question more of trusteeship than ownership,” says Nyrika Holkar, a fourth-generation family member, and executive director of Godrej & Boyce Mfg Co Ltd (G&B), the unlisted, flagship company of GEG. “It’s about being able to steward the assets of the company, the brand, and leave it in a better place than we found it.”

The wide-ranging portfolio of industries in which GEG is a player includes consumer-facing businesses and industrial businesses, whether it’s aerospace, processing equipment, tooling, and project businesses. It also owns land, including prime property in Mumbai.

“At Godrej Enterprises Group, we have always thrived on deep-rooted values and strategic foresight. Our vision to pioneer progress for our people and the nation, across generations, is what has kept us relevant for over 127 years. We continue to be committed to that vision,” says Jamshyd Godrej, chairman and MD of Godrej & Boyce, and head of GEG.

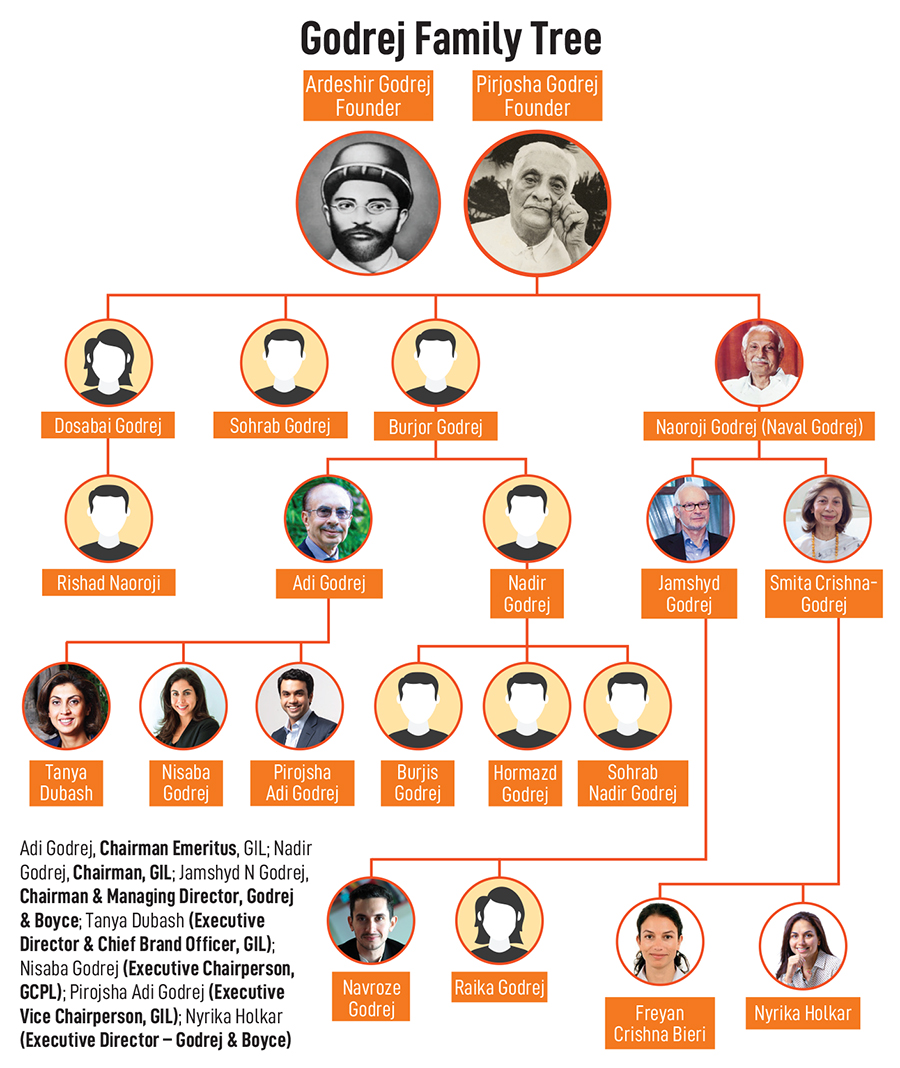

Holkar, who is Godrej’s sister Smita Crishna Godrej’s daughter, is scheduled to take over the baton from her uncle (see Godrej Family Tree). Although a definite timeline for the transition in leadership has not been laid out yet, Godrej is mentoring Holkar, who is a qualified solicitor, and leads digital strategy, brand, legal and M&A for G&B and its subsidiaries (See: Meet Nyrika Holkar).

Holkar, who is Godrej’s sister Smita Crishna Godrej’s daughter, is scheduled to take over the baton from her uncle (see Godrej Family Tree). Although a definite timeline for the transition in leadership has not been laid out yet, Godrej is mentoring Holkar, who is a qualified solicitor, and leads digital strategy, brand, legal and M&A for G&B and its subsidiaries (See: Meet Nyrika Holkar).

Holkar explains that the family and group have been guided by a very strong value system that has held everything together. “If one looks back at how the company originated, it was deeply intertwined with India’s independence and was started as a way to ensure both economic and political freedom. Without that economic freedom, being sustainable would have been very difficult,” she says.

In a family that has championed innovation and manufacturing from scratch, and has patiently incubated multiple, successful business units in varied sectors, Holkar finds herself in an ecosystem that is vastly different from her predecessors. The amount of time, effort and money that a new business opportunity can be allotted in order to turn successful has shrunk dramatically, with surging competition, not just for markets, but also talent and funds.

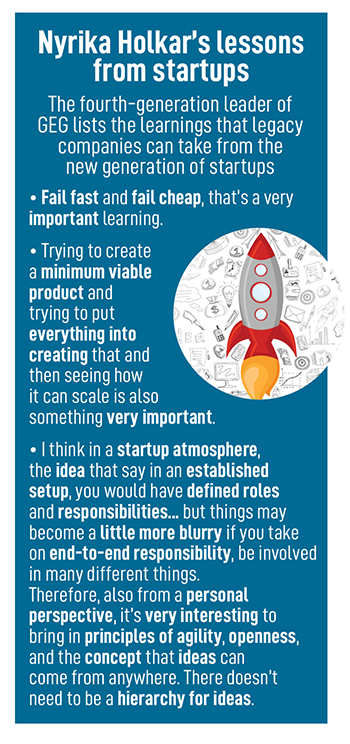

“I think you have to choose your bets and maybe go with fewer bets [compared to previous generations],” she says. “What is important and exciting today is that we have a very vibrant set of startups and instead of looking at reinventing the wheel, the opportunity today lies in leveraging existing pockets of expertise. How do you scale it? How do you partner with them? How do you collaborate?”

As an example of GEG’s new collaborative approach, she highlights its interests in the aerospace sector, in which the company is investing about ₹250 crore to set up a plant in Khalapur, about an hour from Mumbai. “Earlier, in the aerospace domain, all R&D was done by Isro and DRDO. Today, the sector has opened up to a very vibrant startup network and we have also partnered with several startups on different projects,” she says.

The reason behind these partnerships has been the kind of value, expertise and agility that startups bring to the processes. “It’s incredible, it’s something we need to imbibe and learn from. Also, in terms of talent, in terms of being able to leverage the best of what is out there today, it’s really an opportunity that’s exciting.” Holkar also feels that partnerships and collaborations are ripe opportunities to bring some of the learnings into her own organisation, which may be less nimble but has very strong values of capabilities, expertise and experience. “How do we marry them, because both are equally important,” she says. (See: Nyrika Holkar’s Learnings from Startups)

Also read: Wagh Bakri: Brewing a slow and steady growth story

Inventors at Heart

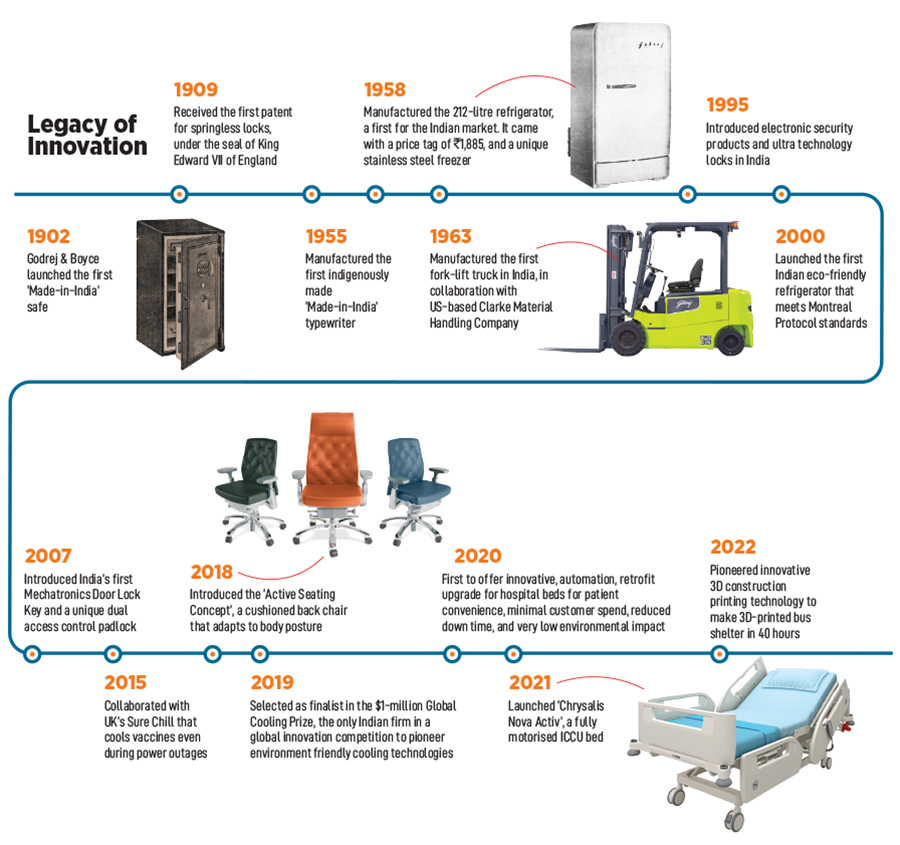

One of the guiding principles for the Godrej family, says Holkar, has been innovation, especially innovation that fills a need in the country. The combination of inventiveness and strong business acumen that was embodied by the company’s founders Ardeshir and his brother Pirojsha in the late 19th century, had resulted in them getting patents for the world’s first springless lock, and making India’s first indigenously manufactured fire- and burglar-resistant safe, and a process to make soap from vegetable oil. Over the decades, G&B has filed over 155 patents, of which 110 have been granted (See: A Legacy of Innovation).

Starting from the early successes with innovation to critical space missions today, as well as infrastructure, and pioneering materials that are recycled and brought back into infrastructure processes, innovation remains an integral part of GEG. “I think it’s very important for brands to stand for something and to play a strong role in shaping the preferences of individuals,” she says. “We remain very committed to doing that.”

“Over the last century, we have focused on being nation-first, people-first, and future-first, which further drives us to enrich the lives of one-third of India’s population through our ventures. We continue to be on this path. It is also important for us to keep adapting to an evolving landscape,” says Godrej.

Holkar is carrying this spirit of innovation forward, not just in conventional sectors but also into new and emerging fields. She believes there is tremendous headroom for growth in GEG’s core sectors such as consumer businesses, furniture, security locks and appliances—where the post-Covid shift in consumer preferences has presented challenges as well as immense opportunities—but also in new sectors such as energy, sustainability, aerospace and aviation.

“We have a strong focus on design, whether it’s across the consumer businesses or the nation-first businesses, and a strong focus on technology,” she says. GEG is making significant inroads into emerging sectors, that it believes hold opportunities in the future. “Today they are nascent, such as energy and renewable energy, for instance green hydrogen. These are opportunities that play to our strengths and are also in keeping with our vision for the future.”

Take, for instance, the Process Equipment business unit, which makes critical components for energy plants around the world. As the world is witnessing a shift in energy reliance—thanks to geopolitical tensions countries increasingly want to be energy self-sufficient, and at the same time turn to renewable energy in order to meet net-zero targets—this division is getting future ready to take on global demands.

“LNG [liquefied natural gas] is playing a transitional role [between conventional and renewable energy] because it is much lower on carbon emissions compared to crude oil,” says Hussain Shariyarr, executive vice president and business head, Process Equipment. “Then we have blue hydrogen, and green hydrogen; solar will also continue to grow. After the [March 2011] Japan earthquake, nuclear energy was not looked upon very favourably, but now European countries and the US are looking at nuclear seriously again; India had never really given up on nuclear power and the prime minister has now made some major commitments towards it.”

Shariyarr says his unit is very well placed in the nuclear power sector, and is making critical components for the Nuclear Power Corporation of India (NPCI). We are already a key supplier to NPCI, with lots of projects in the pipeline,” he says.

Godrej Process Equipment is also getting enquiries from France and the US, he adds. Where green hydrogen is concerned, it has supplied equipment to prestigious projects in Saudia Arabia and Singapore. The business has invested about ₹300 crore in the last three years, and plans to invest another ₹300 crore in the next three years to build the required infrastructure in terms of manufacturing, quality and people so that it is future-ready.

With FY22 as a base, in the last two years the Process Equipment unit’s revenue has grown 60 percent, a compound annual growth rate (CAGR) of about 27 percent. Shariyarr says its market share has doubled, and it has a global market share of five percent, with most of the growth coming from the Middle East and the US. After the growth, its revenue stands at roughly ₹1,000 crore.

“Holkar is steering GEG towards a sustainable and innovative future with a leadership style that blends visionary thinking with practical execution,” says Shariyarr. “She respects the company’s legacy while pushing for greater agility and collaboration. Her vision is to ensure that GEG not only maintains its legacy but also evolves to meet future challenges.”

Or, take the example of another relatively recent business unit within GEG, the electricals and electronics division, which was set up six to seven years ago. It has become one of the largest divisions within G&B, says Raghavendra Mirji, the executive vice president and business head of the Electricals & Electronics division. The division is into commissioning of entire turnkey projects in power infrastructure, which are mostly government-initiated projects, as well as MEP (mechanical, electrical and plumbing) parts of large commercial buildings, such as malls, hospitals, and schools.

“There is a clear push for infrastructure in the country, irrespective of who is in the government. We have created our business portfolio in such a way that, keeping the nation-first policy of G&B, it is perfectly poised for future nation-building,” says Mirji. “We are well-placed for higher growth in future, especially in areas such as renewable energy. For instance, we have a solar portfolio, and also the MEP [mechanical, electrical and plumbing] aspects of green buildings.”

The revenue of the division was ₹546 crore in FY21, and last year it was ₹1,300 crore. “In the last two years, the CAGR is 22 percent, and in three years it is 33 percent,” adds Mirji. Going forward, he is aiming to cross ₹1,500 crore in FY25, and is eyeing more than 20 percent growth over the next two to three years.

“Holkar’s leadership marks a dynamic shift for GEG, emphasising agility and collaboration. Her approach is more democratic, valuing inputs from across the organisation and encouraging a more collaborative work environment,” says Mirji. “She balances respect for the company’s heritage with a commitment to modernisation and sustainability.”

(From left): Godrej Interio’s robotic welding line, autonomous guided vehicle and greenfield manufacturing plant at the Khalapur campus of GEG, which also houses its aerospace and other manufacturing plants

(From left): Godrej Interio’s robotic welding line, autonomous guided vehicle and greenfield manufacturing plant at the Khalapur campus of GEG, which also houses its aerospace and other manufacturing plants

It is not just in emerging fields that Holkar is pushing for collaboration, but one of GEG’s recent strategic moves in its core sectors includes the acquisition of a 51 percent stake in a leading Indian security solutions company and expanding its R&D facilities.

With post-Covid consumer behaviour shifting to online purchases, and preferences moving to premium products, the Locking Solutions and Systems Division is focusing on technology and digital solutions. “Because of Covid, people have started looking at premium products—not just in terms of colours, material and finish, but in terms of technology and safety mechanisms—and moving up the value chain. People are also buying digital locks, which are the ultimate in safety,” says Shyam Motwani, executive vice president and business head, locks and architectural fittings and systems business of G&B.

“As far as locks are concerned, we are spending our entire R&D budgets on digital technologies, and technologies that are available today. We have a multi-generational product planning pipeline in place for the next three to five years,” he explains. As of now the percentage of revenue coming in from premium products is about 15 percent, and Motwani would like to see this double in the next couple of years. Post pandemic, in FY23 and FY24, the vertical has doubled its revenues, ending the last financial year with a topline of ₹1,100 crore to ₹1,200 crore.

Motwani adds that Holkar is steering the growth of GEG with a modern, inclusive leadership approach. “Through her efforts in fostering a culture of innovation and operational efficiency by embracing new technologies, she is ensuring that GEG’s legacy continues to thrive in the modern world,” he says.

And it is not just about making more advanced and sophisticated security systems, but marketing them appropriately as well. The company is enlisting and enrolling stores around the country, and converting them into premium, exclusive experience stores for the Godrej brand. These premium products will not be available in other hardware and home improvement stores.

Also read: Hinduja brothers, still in arms and lock-step, have eyes on the future

Different Generations, Same Genes

In a conglomerate that has diversified far beyond its original products and sectors, the requirements and contributions from each generation of the family have also been different. As the companies have grown in size and scope, along with the changing dynamics of the world in which they operate, different members of the Godrej family brought different sets of skills and expertise to the table.“If we start with the founders,” says Holkar, “my grand-uncle Adershir had a very inventive bent of mind, and went into many different things. He used to make tools for surgery and he had a few businesses that failed, and then he came into the locks business. He got the first global patent for the springless lock, and went on to get the first patent for a safe; he also made the first indigenously manufactured refrigerator. He was very driven by the idea that India needed to be able to have an industry of its own and shouldn’t be reliant on foreign imports.”

For Pirojsha, Ardeshir’s brother and partner, the idea of community building was very important. So, when he first bought land in Mumbai’s Vikhroli neighbourhood, in the middle of a jungle with wild animals, “everybody thought he was quite out of his mind,” recalls Holkar. (During World War II, Pirojsha had bought 3,000 acres in Mumbai from the British, and another 400 acres later, taking the total to 3,400 acres. More than 3,000 acres of this lies in Vikhroli, and the rest in Bhandup and Nahur. Almost 2,000 acres of this land is covered in ecologically critical mangroves.)

No one wanted to move into Vikhroli at that time; Holkar’s grandmother used to tell stories of when she had to go door-to-door to convince people to send their children to the school that the Godrej family had set up over there. Pirojsha realised the importance of having an infrastructure around people. So, whether it was a school, or healthcare facilities, or housing, he thought of all the elements that a community would need, and which are important to build if you want people to move to a new place.

“That model has been extremely successful, and even if we look around today, it [the Godrej offices in Vikhroli] really feels like a campus and a community,” says Holkar.

Holkar’s grandfather, Naval, joined the business straight after high school and started on the shop floor. He loved machines and mechanics, and had a natural affinity towards them. He was able to scale the business exponentially because of his deep connect with people, and he worked his way up. “People even today think of him in a very different way because of his nature, his magnetism, his charisma, and his ability to be a pioneer in the sustainability space,” says Holkar.

Holkar’s maternal uncle, Jamshyd, championed the green building movement and brings to the business a lens of not looking at sustainability as something ancillary or external to the business but as something that is an integral part of it. “The guidance that he always gives businesses is that you shouldn’t have to ask consumers to pay more for sustainability. It should be priced in, and it should be a viable alternative to anything else. That’s the challenge for businesses today, but also the opportunity,” says Holkar.

“As we, as a country, are working towards net zero by 2070, corporate India has to take a very strong ownership of the movement for anything to really happen. My uncle can be credited with pioneering this movement,” she adds.

Holkar feels that the real challenge for her cousins and herself is to keep the 127-year-old legacy relevant, important to consumers whose preferences are changing, and resonate with a younger generation that has very different priorities; the challenge also is to shape not only products and services, but business models to put India on the global stage.

“Being part of a successful multi-generational legacy instils a deep source of pride. Across generations, our family has always been mindful of this responsibility. It means upholding our reputation, guiding the organisation authentically, and always enriching the lives of all our stakeholders,” says Godrej.

Also read: 4 Tips for managing the succession challenge

What Lies Ahead

With the Godrej family announcing an amicable division of business assets between different family members, GEG will now be controlled by Jamshyd Godrej, and his niece Nyrika Holkar, and their immediate families. The other branch will be known as Godrej Industries Group (GIG), and will have Nadir Godrej as chairperson and will be controlled by his older brother Adi Godrej, Nadir Godrej, and their immediate families. Pirojsha Godrej, son of Adi Godrej, will be executive vice chairperson of GIG and will succeed Nadir Godrej as chairperson in August 2026. Ambareesh Baliga, an independent market analyst, was quoted in media reports, saying, “Compared to some of the other family separations, the split in the assets of Godrej was done in a very dignified manner with nothing discussed among the family members coming out in the public domain. Any family separation takes a decent amount of mindshare of the members. To that extent, the decisions have been reached and there is clarity on who controls what company in the Godrej fold. The focus will now turn back fully to the businesses they handle.” The amicable nature of this division is also evident in the no-compete clause between the two branches of the family.

Ambareesh Baliga, an independent market analyst, was quoted in media reports, saying, “Compared to some of the other family separations, the split in the assets of Godrej was done in a very dignified manner with nothing discussed among the family members coming out in the public domain. Any family separation takes a decent amount of mindshare of the members. To that extent, the decisions have been reached and there is clarity on who controls what company in the Godrej fold. The focus will now turn back fully to the businesses they handle.” The amicable nature of this division is also evident in the no-compete clause between the two branches of the family.

For employees within GEG, however, transitions to the next generation of the Godrej family are expected to be smooth and business-as-usual. “I have seen one transition in the past, and we would not call it a transition because we did not feel it. There was such a long and smooth overlap,” says Shariyarr, who has worked at Godrej for 31 years. “It’s a very professionally driven company. The Godrej family is not directly involved in the day-to-day operations and their role is more about creating an enabling environment. The fundamentals and value system remain the same, and have remained constant from one generation to another.”

Motwani seconds this view and says that the Godrej family is certainly not involved in the daily details of the business units, and its involvement is largely to look at new and emerging lines of businesses, technology areas that might appear green-field today but hold promise in the future and can be invested in, and reviewing the business units. “The individual business unit heads are thoroughly empowered to handle the daily functioning of their units,” he says.

He adds that three things stand out about the way in which the Godrej family, especially the GEG branch, approaches the businesses. “There is a lot of respect for individuals in this organisation, a lot of empowerment at the business unit leadership level, and the organisation cares about its employees and their families,” he explains. “It has its own aspirations, areas of interest for future growth with existing and potentially new businesses, like any other business family would have. There is a tremendous amount of knowledge and expertise within the seniors and younger members of the family, especially in the fields of technology, design, engineering, and marketing. It is also very professional.”

“As we look ahead, it is essential that our next-generation leaders embody our vision of pioneering progress and sustainable value,” says Godrej. “With a heritage of 127 years, we are convinced that a pioneering spirit, innovation, and sustainability are crucial. By investing in passionate people and practising financial prudence, we are committed to building on our legacy for the next 127 years and beyond.”

As Holkar prepares to take on the baton from her uncle Jamshyd, there is much more than revenues and balance sheets riding on her shoulders. As the world around us experiences rapid technological changes, geopolitical flux and environmental emergencies, Holkar has to hold on to the values that have stood the test of time, while charting a new, collaborative path that combines the best of legacy businesses and young startups. All while keeping the spirit of invention and nation-building alive and tinkering.