CarDekho: An IPO drive from Jaipur

From starting CarDekho in Jaipur in 2008 to entering global markets and building multiple brands to making a transition to a 'House of Founders', Amit and Anurag Jain have crafted their long journey in a calibrated way. The brothers are now busy preparing for their next milepost: IPO

Amit Jain (left) and Anurag Jain, Cofounders, CarDekho

Amit Jain (left) and Anurag Jain, Cofounders, CarDekho

There is an uncanny and humourous connection between American Will Rogers and the Indian stock market. “There are three kinds of men,” the celebrated writer, actor, cowboy philosopher, and political commentator once reckoned, alluding to how people learn. The first set learns by reading. Then there are a few who learn by observation. “The rest of them (the third kind) have to pee on the electric fence and find out for themselves,” underlined Rogers, whose weekly half-hour live Sunday evening radio programme—The Good Gulf Show—captivated Americans in the 30s.

Meanwhile in India, Rogers’ ‘three kinds of men’ theory makes perfect sense in a different context. Sample this. There are three kinds of founders when it comes to the way they prepare for IPOs and a public listing. The first kind is a stickler for tradition. They go by the established playbook of building a sustainable company for years, most of them get listed after decades, and the rest, after a decade.

The second kind learns by observation. They are the ones who stay away from the trap by looking for what went wrong, what clicked, and what must be shunned. And the last kind of founders are mavericks—much like the new-age startup cowboy entrepreneurs—who try to impress the market with their topline growth and the paraphernalia around their unicorn status. The idea is to plaster the heavy loss side of the narrative, depict the rosy picture of growth, and sell the fairytale story to retail investors. Unfortunately, much to their chagrin, they eventually discover that they are outsmarted by the public market, which backs sustainable and profitable growth stories.

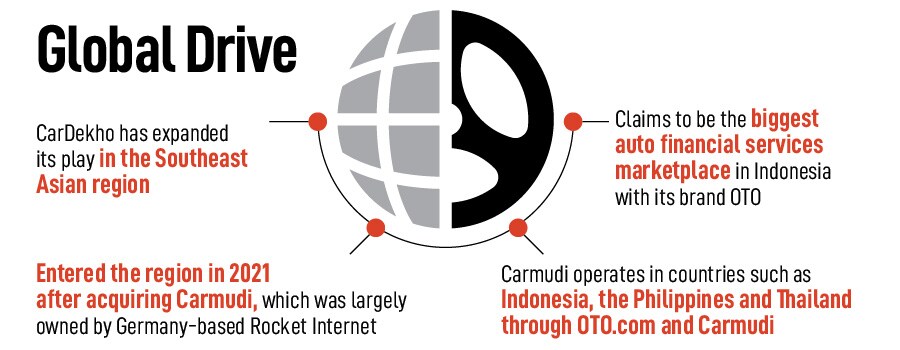

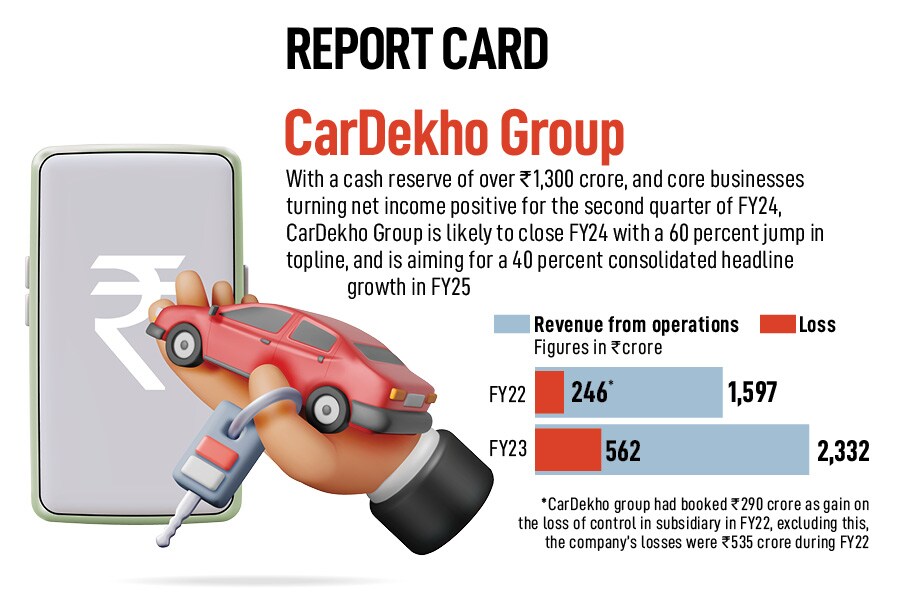

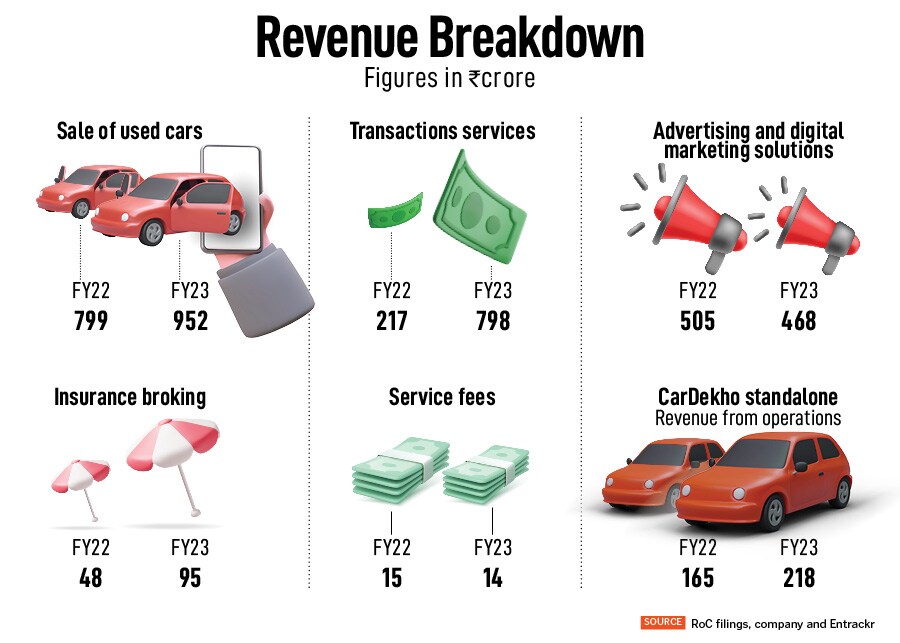

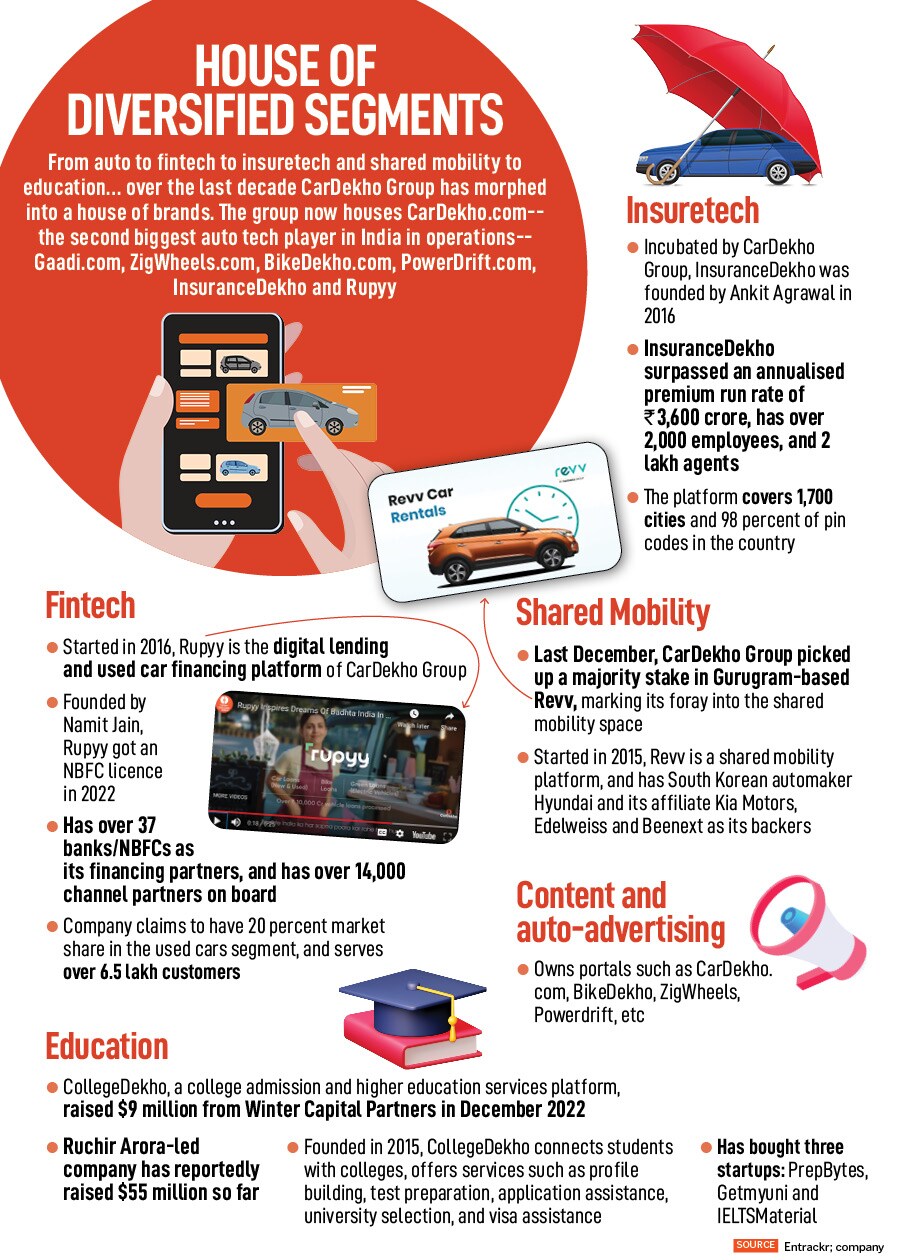

Meanwhile, in Jaipur, the Jain brothers—Amit and Anurag—are learning via observation. “There's been a lot of learning from the debacle of a bunch of tech companies in the way they got listed on the public market,” reckons Amit, who co-founded CarDekho along with his brother Anurag from a garage in 2008. “What we've picked from their playbook,” chips in Anurag with his insight, “is that taking a company public makes sense only when it is profitable.” Amit augments the profitability theory by adding one more layer. “We will go IPO only once we have at least four to six trailing quarters of profitability,” says the chief executive officer of the auto tech company, which started in Jaipur, and over the next one-and-a-half decades morphed and diversified into a house of brands such as CarDekho—the second biggest auto tech player in India in operations, Gaadi.com, ZigWheels.com, BikeDekho.com, PowerDrift.com, InsuranceDekho, and Rupyy.