How Ankit Agrawal's cover drive sheltered InsuranceDekho in the funding winter

It was the worst funding February in four years, but InsuranceDekho's maiden raise of $150 million churned out the biggest Series A round in India. With another $60 million following briskly, Ankit Agrawal continued with his cover drive in 2023

Ankit Agrawal, Founder and CEO, InsuranceDekho

Image: Madhu Kapparath

Ankit Agrawal, Founder and CEO, InsuranceDekho

Image: Madhu Kapparath

Gurugram, December 2022. The war room wore a sombre look. The signs were ominous. Over the last six months, the fertile terrains of growth got morphed into a treacherous battleground, there were confirmed reports of heavy casualties everywhere, and the tailwinds of 2021 transformed into fatal headwinds. The troops were quickly running out of ammunition. The morale was hitting a new low with every passing day, and the signs of fatigue were conspicuous on the dreary faces of the soldiers. The terrible thing, though, was that there were no comforting signs of things coming back to normal anytime soon. The worst part, however, was the fact that India had not witnessed, and was not prepared for, such a brutal and prolonged combat.

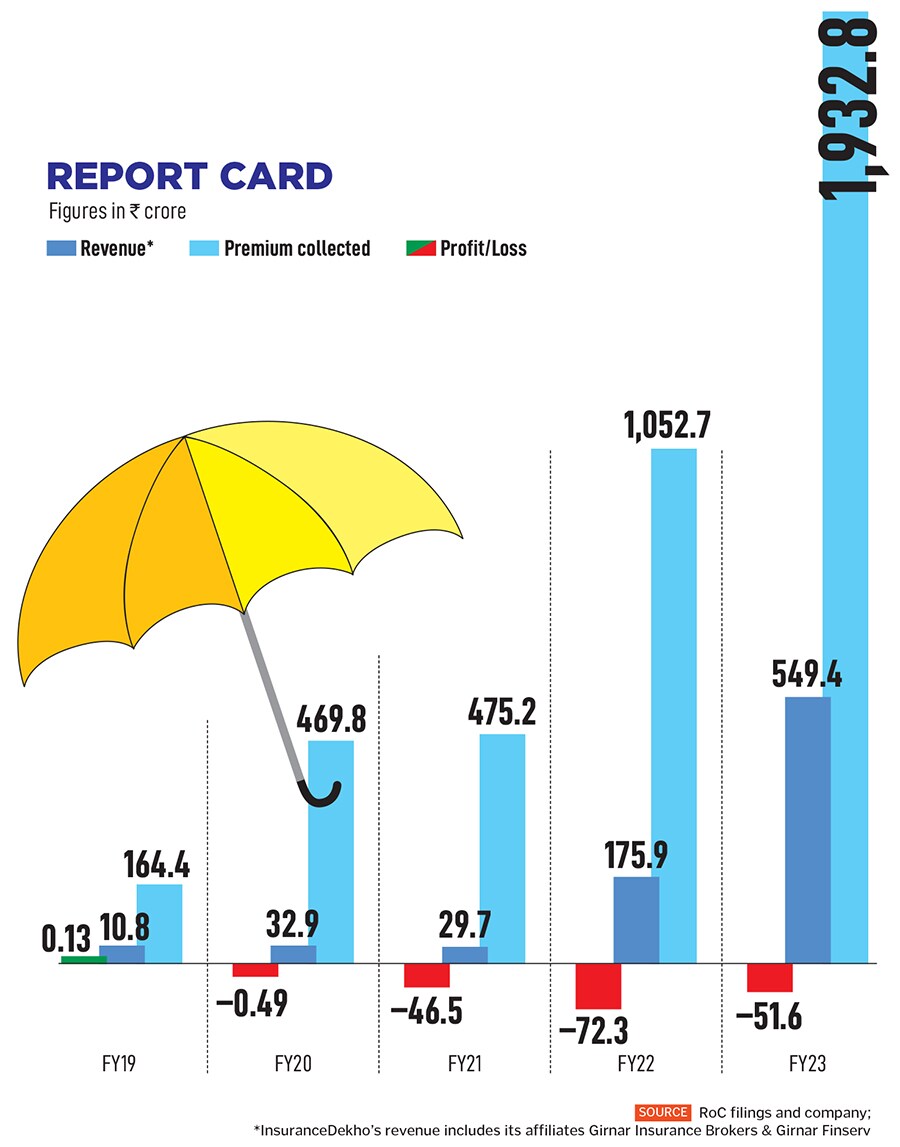

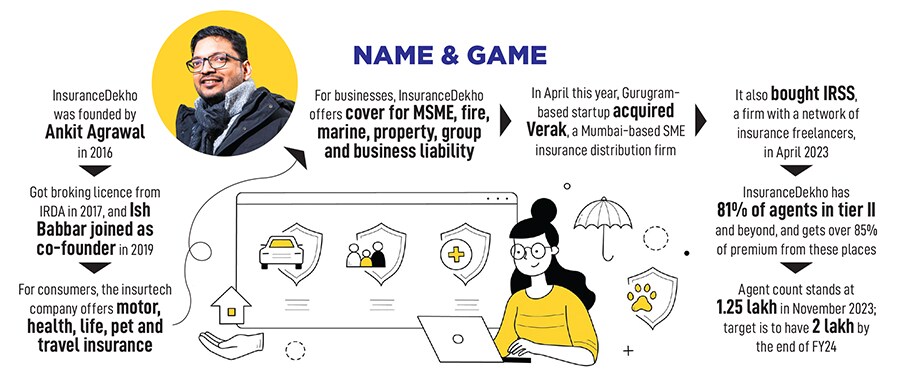

Meanwhile, inside the war room in Gurugram, the distressing signs were unnerving and visible. The three army generals—Ankit Agrawal, Puneet Kumar and Aman Batra (CEO, CFO and investor relations’ honcho, respectively)—found themselves huddled every morning, every week, for over six months. “It was one of the worst times to raise venture money,” confesses Agrawal, head of the pack and founder of InsuranceDekho, the insuretech company that was set up in 2016, got a broking licence from the regulator the next year, and rolled out operations from 2018. The rookie founder was alluding to a bitter funding winter, which started to set in around July last year.

In four months, by November 2022, the winter turned frosty. Look at the numbers. While in November 2021, startups in India raked in a staggering $4.33 billion in funding, the corresponding number for the next year dipped by over 67 percent to $1.3 billion. The greenhorn had got his assessment right. It was indeed a terrible time to raise money. But for a startup like InsuranceDekho, which was hitting the funding market after four years of being incubated by GirnarSoft—the parent company of CarDekho—the timing looked disastrous. The market had turned dodgy, funding was drying up at a disconcerting pace, and everybody—industry observers, experts and sceptics—was more than certain that InsuranceDekho would find zilch takers.

In four months, by November 2022, the winter turned frosty. Look at the numbers. While in November 2021, startups in India raked in a staggering $4.33 billion in funding, the corresponding number for the next year dipped by over 67 percent to $1.3 billion. The greenhorn had got his assessment right. It was indeed a terrible time to raise money. But for a startup like InsuranceDekho, which was hitting the funding market after four years of being incubated by GirnarSoft—the parent company of CarDekho—the timing looked disastrous. The market had turned dodgy, funding was drying up at a disconcerting pace, and everybody—industry observers, experts and sceptics—was more than certain that InsuranceDekho would find zilch takers.

The gloomy prediction had one more crucial layer, which was highlighted by the naysayers. The fag end of the last year was also a time when many sealed deals—the term sheets were signed, diligence was completed, and the amount just had to be wired—didn’t fructify. “Almost every other day we used to hear the news that some or the other deal bombed,” recounts Agrawal. He himself was in touch with 15 funds, around half a dozen evinced interest and sent the term sheet, and the rest fell out of consideration because the founder didn’t find them valuable to steer the startup from “zero to IPO” stage. Last November, InsuranceDekho was in the midst of completing the funding paperwork, which was already getting dragged out by a few months because of the overseas presence of a bunch of potential backers in Europe and the US.