Economically India has come out better than what many would have thought

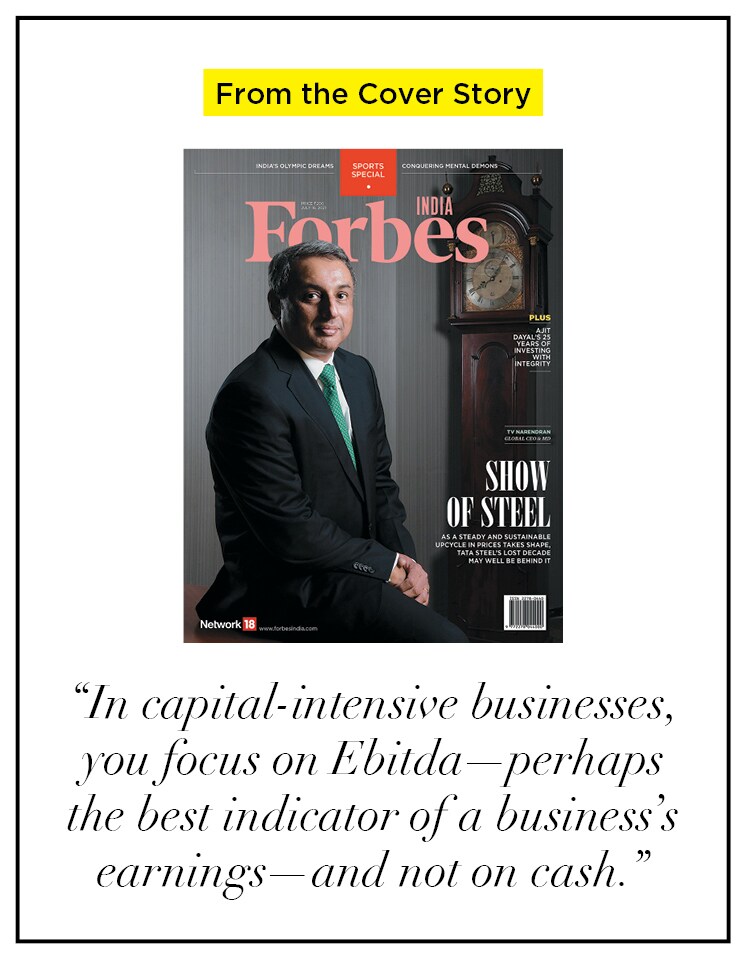

Forbes India put TV Narendran on the cover in July 2021 when Tata Steel, flush with reporting record profits, was paring down debt at a record pace. The stock had once again come in favour as investors fancied its chances over the next decade as the Indian steel industry consolidated around five large producers. The managing director of Tata Steel analyses the business and economy post Covid

T V Narendran, CEO and Managing Director, Tata Steel

Image: Mexy Xavier

T V Narendran, CEO and Managing Director, Tata Steel

Image: Mexy Xavier

When we met in 2021, we were recovering from the disruption that China had caused to the global steel industry between 2014 and 2016. We were seeing a period where steel prices were stabilising at higher levels. We had also crossed the Delta phase of Covid pandemic.

So at the time we would've been quite positive about a post-Covid recovery. Governments across the world were spending a lot of money on this and India had also started spending more and more on infrastructure, which was good. As the budgetary allocation increased, the on-ground spend followed.

Since then, India has been a strong story. The country has handled the situation well over the last couple of years – dealing with the impact of the war on the macroeconomic situation and the resultant geopolitical issues.

Economically, India has come out better than what many would have thought. India is able to continuously focus on growth through building infrastructure and investment, which is positive for the industry.

Also listen: Jayanta Banerjee on how tech is helping Tata Steel as the multinational behemoth's focus shifts to India

In the long products business, on the other hand, the top five producers would probably account for 40 per cent of the capacity or less. It is a highly fragmented business with a number of small players in the clusters of Chhattisgarh, Punjab, and Gujarat. This is a high variable cost business, and not a high fixed cost business. So, while there is room for some consolidation, there is always a play available for the smaller players in this segment – the long products business.

In the long products business, on the other hand, the top five producers would probably account for 40 per cent of the capacity or less. It is a highly fragmented business with a number of small players in the clusters of Chhattisgarh, Punjab, and Gujarat. This is a high variable cost business, and not a high fixed cost business. So, while there is room for some consolidation, there is always a play available for the smaller players in this segment – the long products business.