Why debt is juicier than equity investments today

Investing in debt is more lucrative now. Alternative Investment Funds and Do-It-Yourself platforms are the key beneficiaries

Investors are increasingly allocating a larger portion of their portfolios—which remain heavily skewed towards equities, real estate and gold—to debt.

Illustration: Chaitanya Dinesh Surpur

Investors are increasingly allocating a larger portion of their portfolios—which remain heavily skewed towards equities, real estate and gold—to debt.

Illustration: Chaitanya Dinesh Surpur

Imagine being able to make double-digit returns with lower levels of risk and volatility than equity investments. That’s a deal few would spurn.

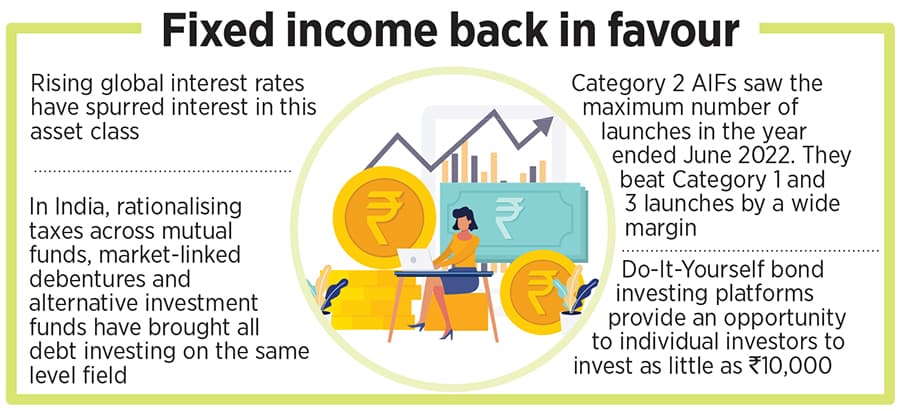

That is also the promise that debt funds hold. In the last 18 months, as interest rates globally have headed north so have investments into this asset class. The US 10-year government bond, considered a proxy for the global risk-free rate, now trades at 3.6 percent—up 250 basis points in the last 18 months. As a result, all debt investments globally are offering higher yields. The consensus on interest rates remaining higher for longer means that these investments should stay in favour for quite some time.

The situation is no different in India on account of both higher yields as well as a recent change in tax laws. Investors are increasingly allocating a larger portion of their portfolios—which remain heavily skewed towards equities, real estate and gold—to debt. With markets at nearly-all-time highs and earnings growth in the high teens, they have toned down their expectations of future returns from equities.

For Indian investors on the debt front, there is plenty to choose from. The total outstanding stock of bonds in India stands at $2.3 trillion of which corporate bonds make up $509 billion, according to data from the Clearing Corporation of India and the Securities and Exchange Board of India. “Globally, the size of the bond markets is 1.2 to 1.4 times the GDP,” according to Vishal Goenka, co-founder of Indiabonds.com, a bond buying platform.

Changes to tax laws have also brought all forms of debt investing at par. In February, the Budget removed the favourable tax treatment accorded to market-linked debentures In late March, the Finance Bill brought debt mutual funds also under the slab rate.