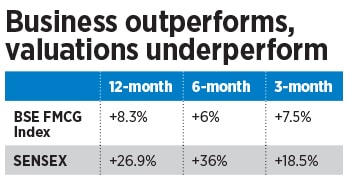

Covid-19 helped India's FMCG companies sell more. Still, there is no outpouring of investor love

Despite a bright business outlook, FMCG companies are expected to underperform the market

Image: Indraneel Chowdhury/ NurPhoto via Getty Images

Image: Indraneel Chowdhury/ NurPhoto via Getty Images

Indian consumer staples companies saw business boom during the Covid-19 pandemic. As consumers stayed home, they ate more biscuits, used more dishwashing gel and soap, and applied more disinfectants. The net result was volume and revenue growth that surprised even the most optimistic of earnings estimates made before the pandemic. This time, however, these companies are expected to underperform the market.

After three quarters of sustained performance, the numbers can no longer be dismissed as a flash in the pan. The first quarter of this fiscal or the ‘lockdown quarter’ saw pantry-loading by consumers. Volume growth, although different for different companies, was generally in high single digits, while margins rose on account of a decline in advertising expenses. Some categories like skin care products underperformed.

The second quarter saw brisk sales that the market put down to pent up demand and strong sales in rural India, while the third quarter saw a continuation of rural sales and an increase in discretionary categories. Analysts have priced in a strong fourth quarter on account of a low base effect.

As a result, companies are on track to report revenue and profit growth in the mid-teens in fiscal 2021. In its recent earnings conference call, the management at Hindustan Unilever (HUL) pointed out that the worst of the Covid-19 disruptions were behind them. This comes after nearly five years of high single-digit growth on account of low volume growth and a decline in inflation, which meant that companies could not revise prices upwards. HUL, Dabur and Marico saw revenue growth of 4, 2 and 5 percent respectively in the last five years.

“If you had gone back to the same time last year and forecast, people [in the industry] would have said this level of growth is difficult,” says Rahul Arora, CEO at Nirmal Bang, who has tracked the industry for over a decade. He believes the sector has several tailwinds for 2021, before the base effect comes back to bite it.