Allcargo: Proving its mettle in a tough business

The logistics company has built an enviable bouquet of offerings. Why then are the markets not impressed?

Shashi Kiran Shetty, Founder and Chairman of Allcargo Group

Shashi Kiran Shetty, Founder and Chairman of Allcargo Group

An American business sending a half-container load of goods to Antwerp, or an Indian company supplying auto parts to a car manufacturer in Gurgaon or leasing space in a logistics park could conceivably do this by entering into an agreement with just one company Allcargo Logistics. With its wide variety of offerings in the logistics space, the company has positioned itself as a one-stop shop for businesses that need to move goods quickly.

It’s a unique offering that resonates with business owners and is not something that Allcargo’s Indian rivals have been able to build. “Pre-2020, we didn’t have any presence in the domestic [logistics] market. The company now stands a lot taller in the domestic arena,” says Shashi Kiran Shetty, founder and chairman of Allcargo Group. Over the last three decades he has scaled the business to a market cap of Rs 9,000 crore.

In doing so, Allcargo has emerged as the world’s largest consolidator of ocean freight in the less-than-container load (LCL) category. Its latest quarterly numbers released in February 2023 showed it had a 15 percent share of a worldwide market, which is fragmented. It now aims to start building scale in the full-container-load category, where its share is 1 percent. Together, the global ocean freight business accounts for 90 percent of topline and makes the company a play on the global trade cycle.

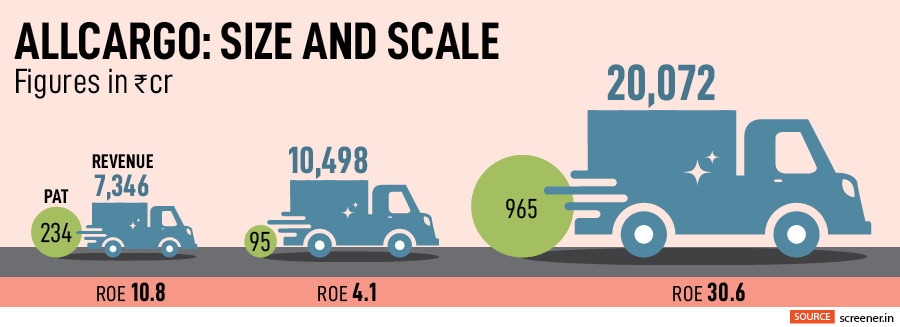

While Allcargo has clearly demonstrated its ability to scale and build a worldwide lead in the LCL business, the market has been less than impressed by the sum of its parts. Over the last five years, even as business has grown—topline has grown fourfold to Rs 20,000 crore and profitability has moved up sixfold to Rs 1,000 crore—the market has not rerated the stock. It continues to languish at 10 times earnings.

Powered by higher freight rates, there’s no mistaking the fact that in the last three years Allcargo has had a dream run. In the two years from March 2020, its revenues surged from Rs 7,346 crore to Rs 20,072 crore in March 2022. Profits rose from Rs 234 crore to Rs 965 crore. Its stock has tracked the rise in earnings, taking it to Rs 9,000 crore market cap.

Size also ensures it is able to cut out agents in several markets, explains Shetty. Often, agents compete among themselves, and this harms the business. Taking bookings directly gives the business a level of control over demand and allows it to negotiate better with shipping lines. In the first six months of 2023, the company plans to develop an 100 more trade lanes, in addition to the 2,600 they have at present. A trade lane is one shipping route; so, New York to Rotterdam would be one trade lane.

Size also ensures it is able to cut out agents in several markets, explains Shetty. Often, agents compete among themselves, and this harms the business. Taking bookings directly gives the business a level of control over demand and allows it to negotiate better with shipping lines. In the first six months of 2023, the company plans to develop an 100 more trade lanes, in addition to the 2,600 they have at present. A trade lane is one shipping route; so, New York to Rotterdam would be one trade lane.