New mall supply in India to increase sharply this year

Eleven million square feet of mall space will be added in 2017, estimates Cushman and Wakefield

Image: Ritu Manoj Jethani / Shutterstock.com (for illustrative purposes only)

Malls in India have faced a variety of headwinds in recent years. Faced with rising competition from e-commerce retailers, brick-and-mortar store owners have baulked at higher rentals. Land in large cities has become increasingly hard to acquire and mall operators, until recently, were unable to sell their assets to private equity players or convert them into a real estate investment trusts (REITs).

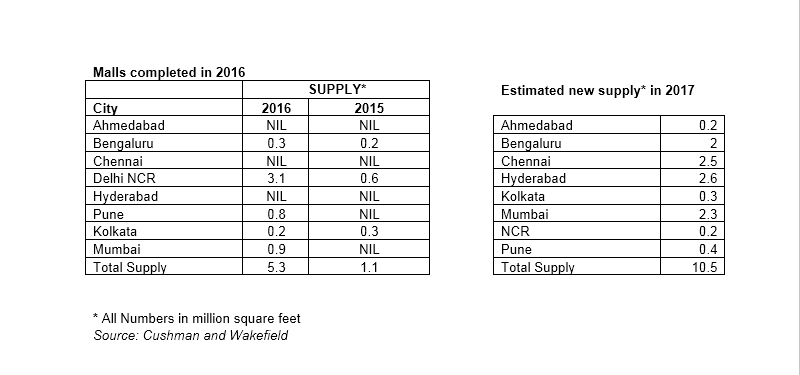

All this resulted in a significant reduction in supply of land, just 1.1 million square feet of mall space was ready for bare-room fit outs in 2015.

After years of sluggish growth, new mall supply picked up in 2016. According to a report by international property consultants Cushman and Wakefield, developers across the country completed 5.3 million square feet of malls in 2016. But this figure is skewed due to the completion of the DLF Mall of India in Noida. Billed as the largest mall in the country it accounted for 2 million square feet of overall mall space and the Delhi NCR region accounted for 60 percent of the share of the fresh supply in the market in 2016.

“Retail mall spaces have, in recent times, seen interest from institutional investors which is providing an additional boost to developers to take up retail malls space building,” said Anshul Jain, managing director, India, Cushman and Wakefield.

Jain expects an additional 11 million square feet to be added in 2017. Hyderabad and Chennai lead with malls aggregating 2.6 and 2.5 million square feet being added this year. Bengaluru and Mumbai are close behind.

Jain said that there was a short-term set back in actual spending due to demonetisation, announced in November. But he expects consumer spending to pick up pace in the longer run as the economy stabilises, e-commerce acceptability picks up and there is increased liquidity due to the implementation of the seventh pay commission.

Further, implementation of the Goods and Services Tax (GST) will bring in greater operational efficiencies in supply chain management and managing costs for international retailers who will be able to implement their global best practices more seamlessly in the country, Jain said in a note.

He argues that once India also starts listing REITs, quality retail spaces will be seen as a viable mid- to long-term investment asset for investors.

X