Going for a six: Jio's newest investor is Abu Dhabi fund Mubadala

Jio's sixth deal—in six weeks—is also its first with a sovereign wealth fund

Image: Omar Marques/SOPA Images/LightRocket via Getty Images

Image: Omar Marques/SOPA Images/LightRocket via Getty Images

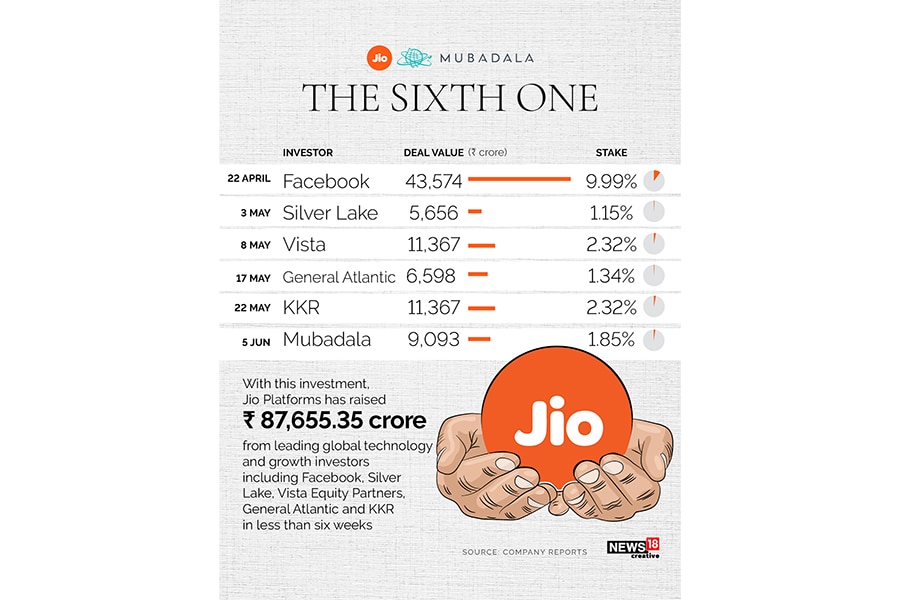

Six weeks after it received an investment from Facebook, Jio Platforms signed on Abu Dhabi state fund Mubadala Investment Co Investment Company as a partner. The deal marks the sixth investment for the company after Facebook, Silver Lake, KKR, Vista Equity Partners and General Atlantic.

Shares of its parent, Reliance Industries, hit an all-time high of Rs1,600 a share, taking its market cap to Rs10,14,000 crore. It is also a step closer to its stated aim of being a zero net debt company by March 2021.

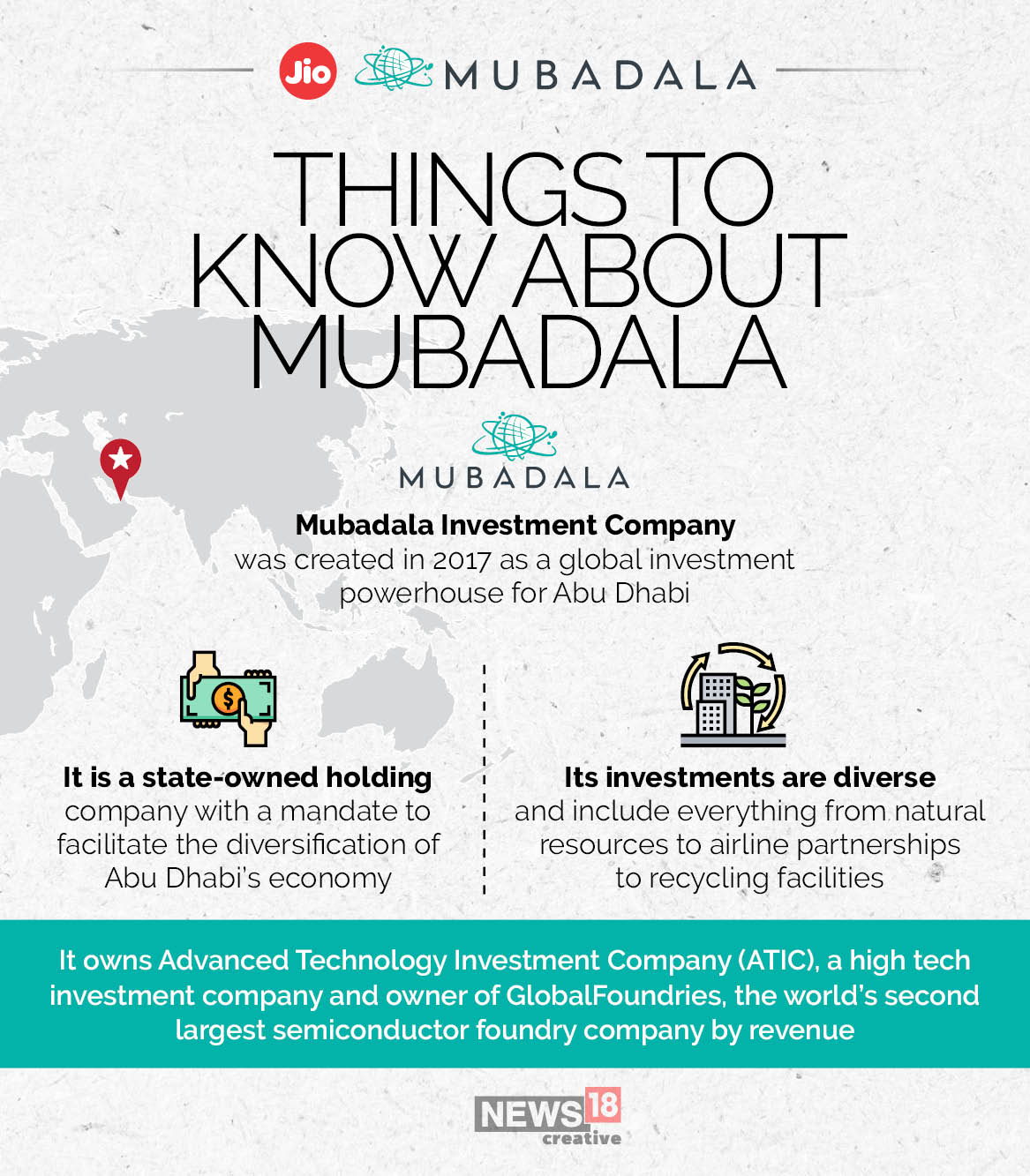

Mubadala plans to invest Rs9,093.6 crore for a 1.85 percent stake in Jio Platforms, at an equity value of Rs4,91,000 crore and an enterprise value of Rs516,000 lakh crore. With this deal, Jio Platforms has raised a total of Rs87,655.35 crore from investors as it prepares to position itself as a platform company with a presence in telecom, retail and payments.

The money raised by Jio Platforms has prompted its competitors to explore deals to strengthen their balance sheets. Media reports have pointed to Google partnering with Vodafone Idea and Bharti Airtel partnering with Amazon as they compete with Jio on not just voice and data, but also value-added services—cinema, music, online learning, among others. Vodafone Idea and Bharti Airtel have denied the investment reports in exchange filings.