What's at stake for investors when promoters pledge the family silver

In the aftermath of Adani pledging their entire stake in ACC and Ambuja, a look at other top promoter pledges

Investors usually stay away from companies with high promoter pledges

Investors usually stay away from companies with high promoter pledges

On September 21, almost as soon as the Adani Group completed the acquisition of Holcim’s India units, came news that the new promoters had pledged their entire shareholding in the acquired companies.

An exchange filing by Deutsche Bank AG’s Hong Kong branch said the shares had been pledged “for the benefit of certain lenders and other finance parties”. At current market prices, the pledge amounts to a total of Rs 93,780 crore.

X

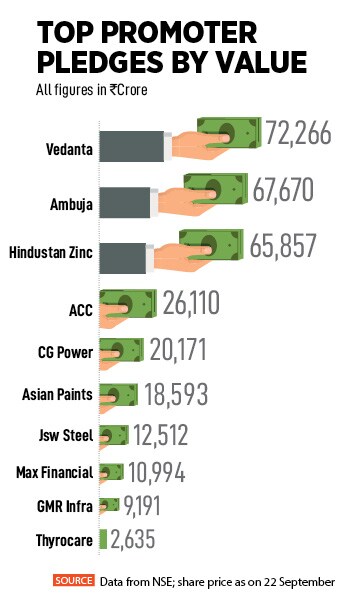

That hasn’t stopped large companies from pledging almost their entire stake in to lenders. Case in point: Two companies owned by Anil Aggarwal–Vedanta and Hindustan Zinc that have a combined Rs 1,38,123 crore pledged as per market prices on September 21.

That hasn’t stopped large companies from pledging almost their entire stake in to lenders. Case in point: Two companies owned by Anil Aggarwal–Vedanta and Hindustan Zinc that have a combined Rs 1,38,123 crore pledged as per market prices on September 21.