Morning buzz: Services PMI at 12-month low, Byju's CEO says crisis will be over in 45-60 days, and more

Here are the top business headlines this morning to get your day started

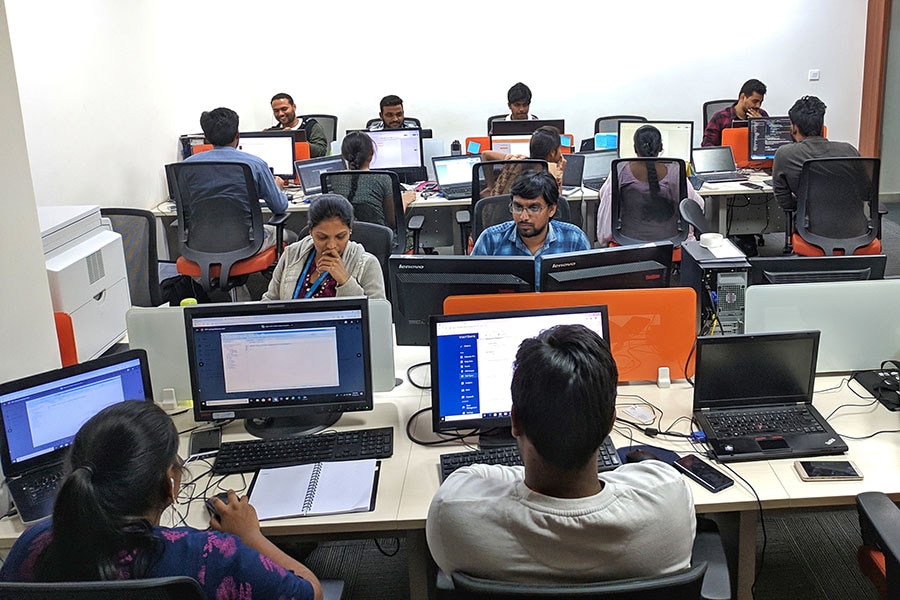

India’s services sector PMI saw a decline to 56.9 in November from 58.4 in October.

Image: Shutterstock

India’s services sector PMI saw a decline to 56.9 in November from 58.4 in October.

Image: Shutterstock

Services PMI moves to 12-month low

India’s services sector PMI saw a decline to 56.9 in November from 58.4 in October. While the expansion was weak, it was nevertheless above the long-term average. The survey asked questions to 400 companies in transport, information, communication and finance. Between April and September the services PMI averaged 60.(Business Standard, Economic Times, Financial Express)

4-5 bankers decline offer for the top job at NE Small Finance Bank

Bankers approached the top job at North East Small Finance Bank have declined the offer. It is not clear how Slice’s ownership will impact the bank. Rajan Bajaj will be the largest shareholder in the bank where Slice plans to infuse Rs 600 crore. Candidates also fear that even two months after the merger was announced there is no clear business plan in place.(BusinessLine)

Byju’s CEO says crisis will be over in 45-60 days

Byju Raveendran has told a group of senior executives that the crisis would be over in 45-60 days. He said that, despite everything that is going on, investors like Ranjan Pai have infused capital into the company. Raveendran has also infused his own capital into the company, which delayed employee salaries citing a technical glitch.

X