Morning Buzz: 55 million taxpayers may have opted for new regime, three family offices pick up Rs435 crore SoftBank stake in FirstCry, and more

The new tax regime eliminates deductions, but offers a low tax rate. Its popularity would only be known next financial year; FirstCry plans an IPO

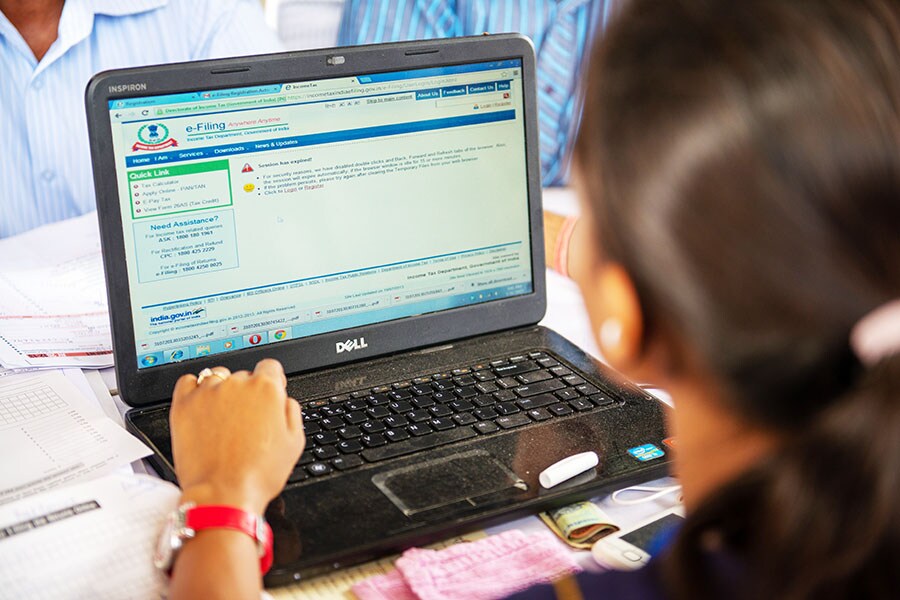

Fifty-five million taxpayers with a taxable income of up to Rs7 lakh have opted for the new tax regime this assessment year.

Image: Shutterstock

Fifty-five million taxpayers with a taxable income of up to Rs7 lakh have opted for the new tax regime this assessment year.

Image: Shutterstock

Family offices pick up SoftBank’s FirstCry stake

The family offices of Ranjan Pai, Harsh Mariwala and Hemendra Kothari have picked up SoftBank’s stake in FirstCry. The deal is valued at about Rs435 crore. FirstCry plans an IPO, and the family offices have bought the stake in a secondary market transaction. Other investors include Premji Invest, TPG and Mahindra Retail.(Economic Times)

Gaja Capital and Piramal consortium in race for Nainital Bank

A consortium of investors led by Gaja Capital and Piramal Alternatives are frontrunners for a stake in Nainital Bank, a subsidiary of Bank of Baroda. Investors in the consortium include the Burman family and the family office of Shiv Nadar. Other investors who have shown interest include Faering Capital of Aditya Parekh and Unity Small Finance Bank. The bank can operate only in five states—Uttarakhand, Delhi NCR, Uttar Pradesh, Haryana and Rajasthan.(BusinessLine)

55 million taxpayers may have opted for new regime

Fifty-five million taxpayers with a taxable income of up to Rs7 lakh have opted for the new tax regime this assessment year. The new regime eliminates deductions, but offers a low tax rate. A total of 380,000 tax filers have an income of Rs50,00,000 to Rs100,00,000 and 260,000 filers had an income of over Rs100,00,000. The tax regime was revamped in the 2023 Budget and its true popularity would only be known next financial year.

X