Praveer Sinha: Charting aggressive renewables strategy for Tata Power

Under Praveer Sinha, winner of the Forbes India Leadership Award for CEO of the Year, Tata Power aims to significantly enhance its renewables capacity by 2030 and position itself for a net-zero world

Praveer Sinha, CEO and MD, Tata Power

Image: Mexy Xavier

Praveer Sinha, CEO and MD, Tata Power

Image: Mexy Xavier

In 2020, a year or so before sustainability became a buzzword, Tata Power had already taken its bold step. The company targeted to become net zero by 2050. Importantly, it decided not to add any more conventional [read coal-based] power capacity.

To understand the significance of this, keep in mind that the COP-26 Summit had not taken place in Glasgow. Sustainability [and the many announcements that followed] had yet to come into vogue. ESG [environmental, social and governance] investing was still in its infancy.

Later, Tata Power went one up on its previous announcement. “We stepped up and then advanced our net zero timeline to 2045,” says Praveer Sinha, CEO and managing director of Tata Power.

It’s not just net zero. Sinha points out that Tata Power has, through its 108-year history, always been at the forefront of trying new technologies. This sets up a culture of experimentation in the company and makes for a business that is not necessarily wedded to old ways of making money. Over a 100 years ago, in 1915, it set up India’s first hydroelectric plant. More recently at the Indian Energy Exchange, an electronic power trading exchange, Tata Power was an initial shareholder and promoter. These were both pioneering concepts at their time and this early-adopter spirit is what has held the company in good stead. “At any given time, we have half a dozen pilots that may or may not work out,” points out Sinha.

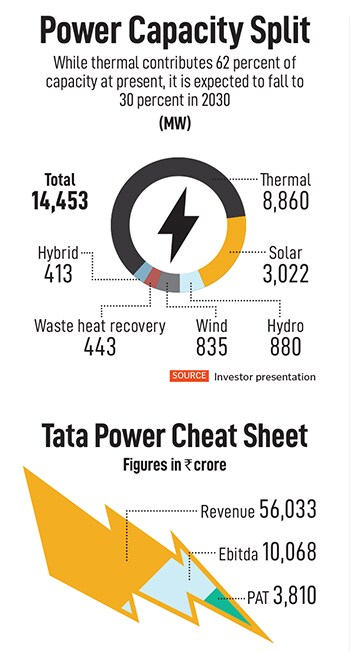

Trying new technologies comes with a solid core of power generation, distribution and transmission that has propelled Tata Power to a business that is valued at ₹117,000 crore in February. Its market cap has seen a rapid climb post pandemic when power demand surged. In FY22 and FY23, demand rose by 8.2 percent and 9.6 percent respectively—far above the 5 percent growth seen in the last decade. A heatwave in the summer of 2022 led to a 19 percent year-on-year increase in demand, while 2023 saw demand up by 11 percent year-on-year on account of rainfall uncertainty.

Trying new technologies comes with a solid core of power generation, distribution and transmission that has propelled Tata Power to a business that is valued at ₹117,000 crore in February. Its market cap has seen a rapid climb post pandemic when power demand surged. In FY22 and FY23, demand rose by 8.2 percent and 9.6 percent respectively—far above the 5 percent growth seen in the last decade. A heatwave in the summer of 2022 led to a 19 percent year-on-year increase in demand, while 2023 saw demand up by 11 percent year-on-year on account of rainfall uncertainty.

Or the solar rooftop business [which consists of a mix of projects for the Tata group as well as third-party projects] where last year, its revenue has risen from ₹535 crore to ₹952 crore in Q3FY24. These point to a clear sign of new businesses scaling rapidly with the latest being a cell and module manufacturing plant that will scale up to 4.3 GW of manufacturing capacity by Q1FY25. A recent announcement by the government christened PM Surya Dhar Muft Bijli Yojana has received a ₹75,000 crore allocation and this means that Tata Power should have enough demand on its hands.

Or the solar rooftop business [which consists of a mix of projects for the Tata group as well as third-party projects] where last year, its revenue has risen from ₹535 crore to ₹952 crore in Q3FY24. These point to a clear sign of new businesses scaling rapidly with the latest being a cell and module manufacturing plant that will scale up to 4.3 GW of manufacturing capacity by Q1FY25. A recent announcement by the government christened PM Surya Dhar Muft Bijli Yojana has received a ₹75,000 crore allocation and this means that Tata Power should have enough demand on its hands.