Online trading and the Karvy effect

Elaborate workarounds are being designed to safeguarding authority over stocks traded online

Image: Shutterstock

Image: ShutterstockPrasun Johari, the owner of an educational institute, remembers hearing a couple of years ago how stock brokers could misuse the powers of attorney (PoA) that investors and traders sign for various online trading requirements.

To trade online on behalf of clients, brokers need PoAs from them so that every trade does not need individual authorisation, as was the process with physical share certificates. Hence traders often, unknowingly, forfeit their right to be the sole authority on what their securities can be used for.

Recently, when Sebi announced that Karvy, a financial services firm, had pledged clients’ securities worth more than ₹600 crore to make good margin calls, it confirmed what Johari had heard.

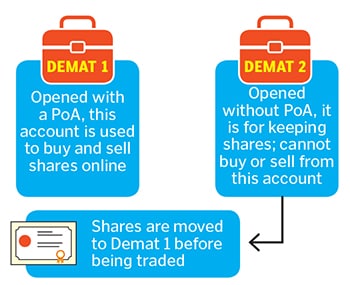

Thankfully Johari, who is a buy-and-hold investor, was not caught napping. A year ago he had devised an elaborate workaround. He’d been buying and selling stocks through a Zerodha demat account, for which he had signed a PoA. He then got a demat account with HDFC Bank for which he did not sign a PoA. (Demat accounts can be opened in banks without a PoA, but clients need to give authorisations for every transaction.) “There was some resistance on their [bank’s] part in opening such an account but I was firm,” Johri says.

Shares that Johari buys through Zerodha move automatically to his HDFC account. When he has to sell shares, it takes him a day to transfer them from HDFC to Zerodha, via delivery slips deposited at a bank branch, or online using a digital signature. “Either way it requires a day to process, but at least it gives me peace of mind,” he says, adding that he knows that legally he now has the sole authority over his securities.