Banking: What's next for loans?

Sluggish credit growth continues to hurt bank finances and will delay economic recovery. Retail lending will improve by March 2022, after the impact of a potential third Covid-19 wave

Lending activity from the banks—a key indicator of economic activity—in the form of credit to corporates, small businesses or individuals is still sluggish

Lending activity from the banks—a key indicator of economic activity—in the form of credit to corporates, small businesses or individuals is still sluggish

Illustration: Chaitanya Dinesh Surpur

For several months in the current financial year, India’s economic data—statistically speaking—is likely to lie or will not reveal the complete truth. The country, on August 31, reported a jump of 20.1 percent GDP growth for the three months to June—its best ever fiscal quarter numbers—against the 24 percent economic contraction in the same period last year due to the shutting down of manufacturing activity and corporate business between March and May 2020.

With Nomura India’s Business Resumption Index rising above 100 (101.2) in the week ending August 15, for the first time since the pandemic began, experts are starting to debate about how quickly the economy will normalise to pre-pandemic levels. This index level supports the general positive outlook that the economy is picking up pace sharply from the impact of the crippling second wave of the pandemic, as mobility and workplace, retail and recreation activity improves.

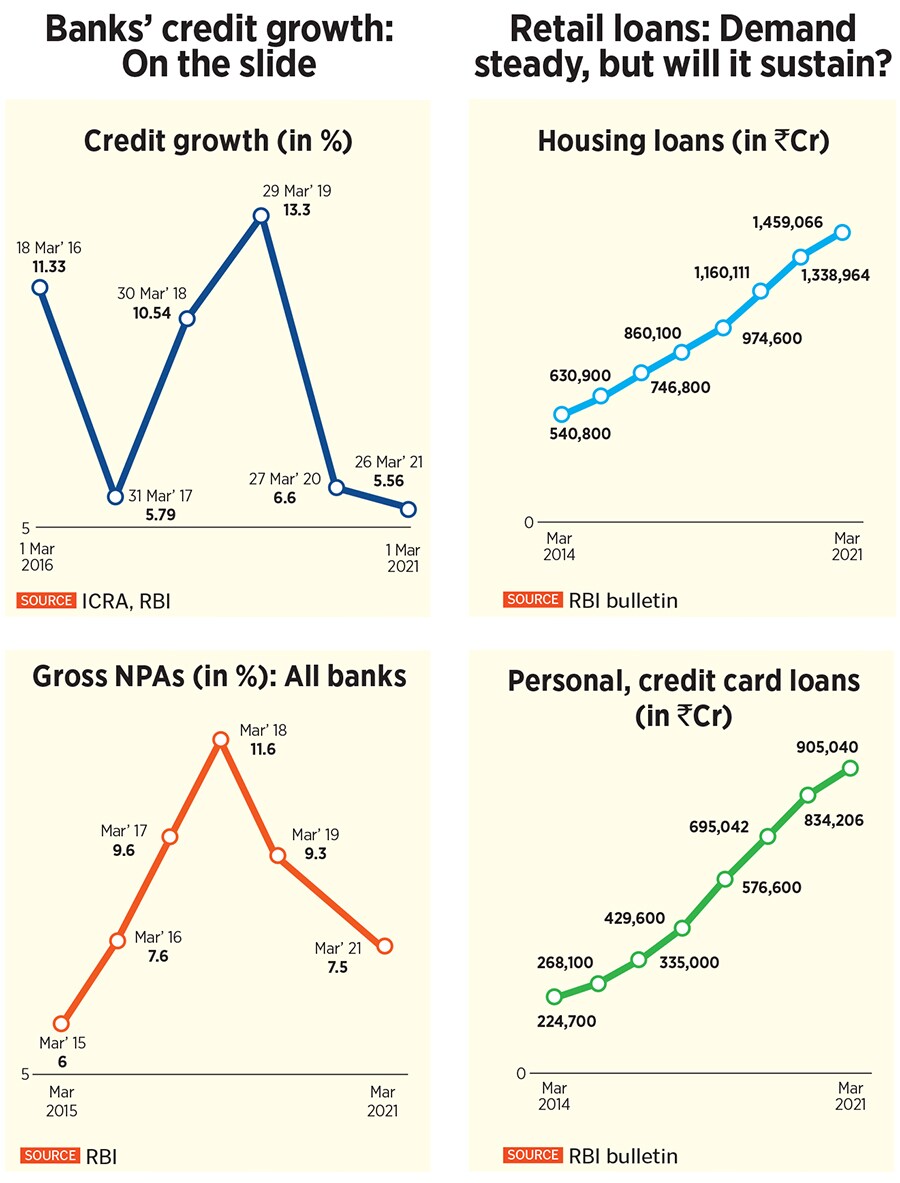

Sluggish credit growth

But lending activity from the banks—a key indicator of economic activity—in the form of credit to corporates, small businesses or individuals is still sluggish. It touched a 59-year low of 5.56 percent in the fiscal year ended March 2021 (see chart). Most private sector, public sector and small finance banks have shown weak credit growth in the June-ended quarter compared to the successive previous quarters of this year. Currently, most of the demand for loans is in the form of working capital but there is little in the form of term loans for expansion or longer-term credit for larger projects.Low demand and the wariness of banks to lend due to continuing concerns of asset quality have kept banks risk averse. “The risk appetite among corporates has reduced. Expansion from large corporate groups also has been calibrated. The capital requirement to fund greenfield projects or brownfield expansion is very limited, either in the form of equity or debt,” says Anil Gupta, ICRA’s financial sector ratings head. And all this while interest rates are at a seven-year low.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)