Will Reserve Bank of India's Quantitative Easing approach stimulate economic recovery?

India's central bank is following a Quantitative Easing programme of its own device called GSAP 1.0. Here are the nuances of the technique

Image: Shutterstock

Image: Shutterstock

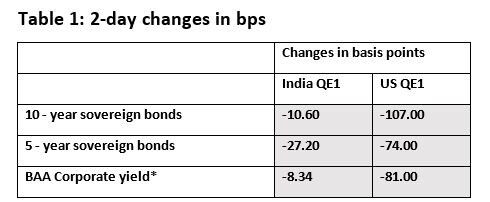

The recent announcements of G-SAP 1.0 and 2.0, where the RBI has committed to buying government bonds from the secondary market has led many analysts to draw parallels with the Quantitative Easing programs rolled out by the Federal Reserve of the US in the aftermath of the 2008 crisis. Prior to 2008, the monetary policy followed by most advanced economies was best summarized by the Taylor Rule—lower interest rates when growth is weak and raise it to counter inflation when growth is strong. However, post-2008—with short term interest rates down to nearly zero and the economy still anaemic—the Federal Reserve launched the controversial Quantitative Easing (QE) program. The QE policy involved the purchase of long-term securities in an attempt to directly lower the long-term rates and stimulate economic activity.

The term ‘Quantitative Easing’ was coined by German economist Richard Werner in the mid-1990s. He defined it as ‘credit creation for GDP transactions. He advocated such a program to help stimulate economic recovery in Japan after the 1990s asset price bubble collapse. The Bank of Japan (BOJ) was the first to implement QE in March 2001. The central bank targeted to increase the banks’ current account balances (CABs) by increasing outright purchases of long-term Japanese Government Bonds (JGBs). Since then, QE has been loosely used to refer to any central bank policies that aim to increase central bank balance sheets.

QE VS Credit Easing

Ben Bernanke, chief of the Federal Reserve in 2009, however, argued that the QE program carried out by the Japanese was fundamentally different from the Fed’s actions. The Japanese approach was primarily focused on the liability side of the central bank’s balance sheet and its goal was to increase the monetary base and the reserves held by the banking system. The rationale was that this increased liquidity would in turn translate into greater lending by banks, higher money supply and asset prices all of which would stimulate the economy and foster recovery.

In contrast, he termed the Federal Reserve’s actions as a credit easing program that focused on the asset side of the balance sheet. Unlike the Japanese approach which involved the purchase of risk-free government securities to increase bank reserves, the Feds approach involved the purchase of defaultable private securities to support private credit markets. The objective here was to impact credit conditions for households and businesses by changing the size and composition of central bank assets. Crucially, the rise in bank reserves under this program was the by-product and not the objective of policy.

[This article has been published with permission from IIM Bangalore. www.iimb.ac.in Views expressed are personal.]