Waves coming in and out: How to deal with market volatility, experts advise

A roller coaster ride is part and parcel of investing in the markets, highlighted especially since March 2020 when they have plummeted and reached all-time highs, only to tumble again thanks to Russia-Ukraine. Here are some ground rules you can follow

The current situation, where the Nifty corrected from its all-time high of 18,477 in October 2021 to 15,863 in early March and has remained volatile since, against the backdrop of fears of a rise in oil prices, hike in interest rates, high inflation and the Russia-Ukraine crisis, has been yet another in the line of events that markets are bound to react to, and which in fact provide an entry point to investors

Illustration: Chaitanya Dinesh Surpur

The current situation, where the Nifty corrected from its all-time high of 18,477 in October 2021 to 15,863 in early March and has remained volatile since, against the backdrop of fears of a rise in oil prices, hike in interest rates, high inflation and the Russia-Ukraine crisis, has been yet another in the line of events that markets are bound to react to, and which in fact provide an entry point to investors

Illustration: Chaitanya Dinesh Surpur

When a friend from Kolkata called up Nilesh Shah to ask why his portfolio had not generated the returns that the Kotak Emerging Equity Fund had, the latter first thought it was because the friend was comparing the returns of his diversified portfolio—which included gold, real estate and debt—to those of a mid-cap high-risk fund. When the friend said he was talking about his equity portfolio, Shah, managing director of Kotak Mahindra Asset Management Company, decided to take up the matter with the friend’s accountant. The accountant informed him that his friend had booked his losses in equity in March 2020, at the bottom of the market, so how could it deliver the SIP kind of returns the fund had generated?

“I immediately called up my friend and he said, ‘Covid-19 tha, there was so much gloom so humne bech diya (It was Covid-19, there was so much gloom, so I sold it off). This was an informed investor who did not need any money but because he panicked, he ended up converting a notional loss to a real loss.”

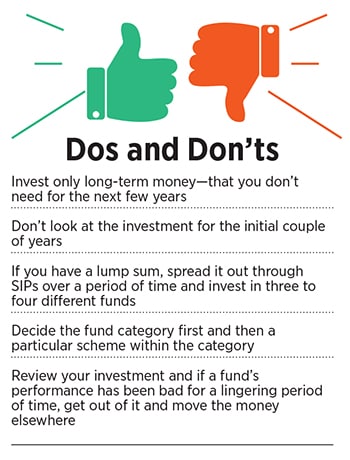

It is probably why financial advisers’ lists of dos and don’ts when dealing with the markets is mostly a list of don’ts—don’t invest money that you would need in the short term, don’t invest lump sums, don’t look at it every day, and since it is the nature of markets to be volatile, don’t panic. Instead, if you are invested for the long-term, just continue doing what you are doing, and do nothing. Or if you want to tweak your portfolio, think of what you can do to benefit from the situation.

The current situation, where the Nifty corrected from its all-time high of 18,477 in October 2021 to 15,863 in early March and has remained volatile since, against the backdrop of fears of a rise in oil prices, hike in interest rates, high inflation and the Russia-Ukraine crisis, has been yet another in the line of events that markets are bound to react to, and which in fact provide an entry point to investors.

Most people, says Shah, want certainty. “A market going down is a short-term phenomenon. How does that become uncertainty for you? If you are a child and you go to the sea, do you get worried about the waves coming in or going out? In fact, most kids will run to the sea and enjoy the waves coming in as well as going out. That is the innocence of kids which makes them accept waves naturally. Markets ka bhi utaar chadav hai (markets also fluctuate)… it is waves coming in and going out.” One needs to accept that, he adds, and make adjustments to portfolio allocations “where, by and large, one remains overweight in assets that are cheaper, and underweight in assets which are expensive”. This dharma, he adds, will ensure that you get your returns.

However, when it comes to fixed income investments, in a rising interest rate environment, one has to be careful about the type of bonds one buys and weigh the returns. If there is no major advantage, one should be in the lowest risk asset, points out Srikanth Bhagavat, managing director and principal advisor, Hexagon Wealth, an investment advisory firm.

However, when it comes to fixed income investments, in a rising interest rate environment, one has to be careful about the type of bonds one buys and weigh the returns. If there is no major advantage, one should be in the lowest risk asset, points out Srikanth Bhagavat, managing director and principal advisor, Hexagon Wealth, an investment advisory firm.