Should you invest in REITs?

The listing of a third REIT in India provides further scope for retail investors, allowing them to invest in real estate with small amounts, while bringing in greater corporate governance

A night view of a tech park in Bengaluru. Photo: Reuters

Canadian alternative investment firm Brookfield Asset Management is expected to launch its Indian real estate investment trust (REIT) by the second week of December, say three people familiar with the matter. Brookfield had filed its papers with the markets regulator in October, and while soft commitments have started rolling in from global investors, the official anchor book is expected to be closed by the middle of December. This is the third REIT in India, and opens up the market even more for investors, and it raises the question: Should Indians start investing in REITs?

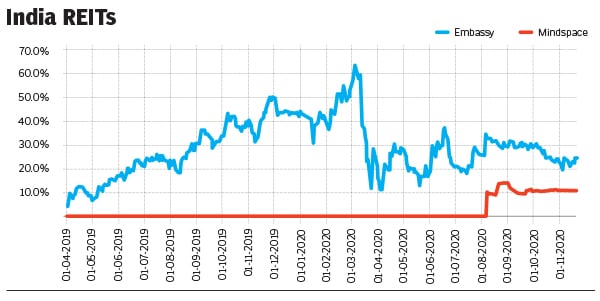

While this is Brookfield’s first listing of any asset in India—it declined to participate in this story citing market regulations—and its second REIT listing globally, it has a listed portfolio that trades at the New York Stock Exchange (NYSE). Global private equity (PE) firm Blackstone Group-backed Embassy Office Parks REIT (Embassy) had launched India’s first REIT in April 2019. The shares had listed with gains of 4.7 percent at Rs 314.10 apiece, they peaked at Rs 479.79 apiece on March 5, 2020, and have dropped to Rs 340.45 apiece (as of November 24, 2020). In November, Embassy was included in the S&P Global Property Index and S&P Global REIT index, which gives them further exposure to global investors.

“REITs are increasingly becoming an attractive investment vehicle, providing investors a stable cash flow and favourable dividend yields. They offer diversification and an opportunity to invest beyond traditional assets, which is especially critical in an environment of ultra-low interest rates. Blackstone is proud to have played a role in the creation of both of the REITs that are currently listed in India,” says Vikram Garg, managing director at Blackstone India.

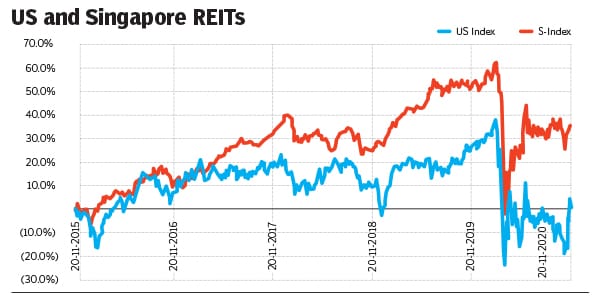

Although REITs have been available in the US for the past four decades, they have taken a while to enter India. While there are two types of REITs—commercial and mortgage—in India, only commercial REITs are available now.