Paytm shares sink, take investors along

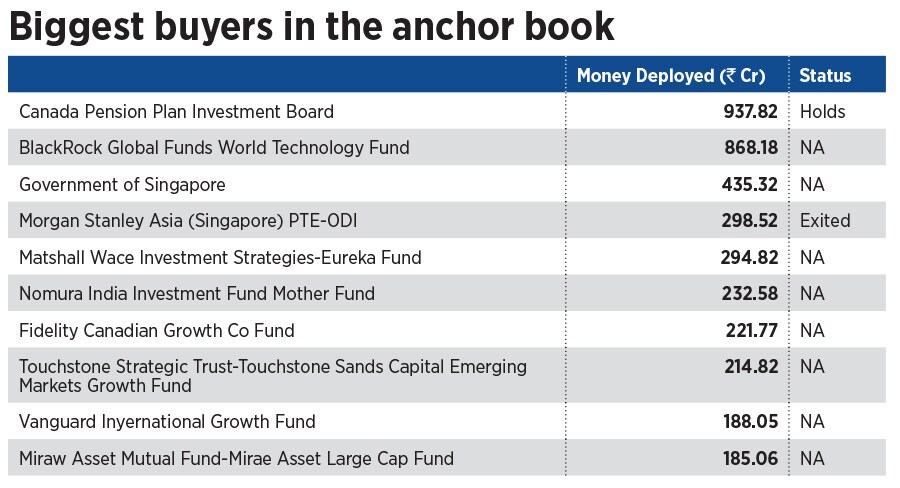

In the Paytm market rout, anchor investors are the biggest losers

Vijay Shekhar Sharma led-Paytm’s shares closed at Rs 592.40 per share, down 12.28 percent from today’s opening Image: Dhiraj Sing/Bloomberg via Getty Images

Vijay Shekhar Sharma led-Paytm’s shares closed at Rs 592.40 per share, down 12.28 percent from today’s opening Image: Dhiraj Sing/Bloomberg via Getty Images

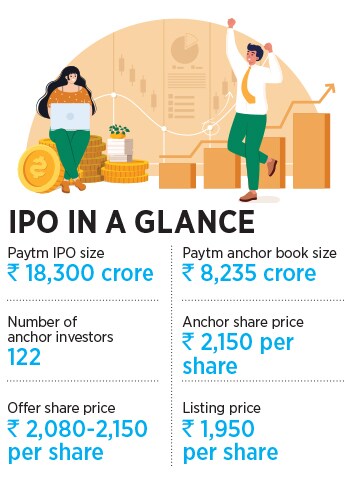

If you are an anchor investor, or you have subscribed to the largest public offering of 2021—in payments firm Paytm—then today (March 15) you must have lost 72.44 percent of your investment. That’s a big loss. At today’s closing on the Bombay Stock Exchange, Vijay Shekhar Sharma led-Paytm’s shares closed at Rs 592.40 per share, down 12.28 percent from today’s opening.

But what about those investors who came in before the IPO? The ones who have been investing in the company over the years?

But what about those investors who came in before the IPO? The ones who have been investing in the company over the years?

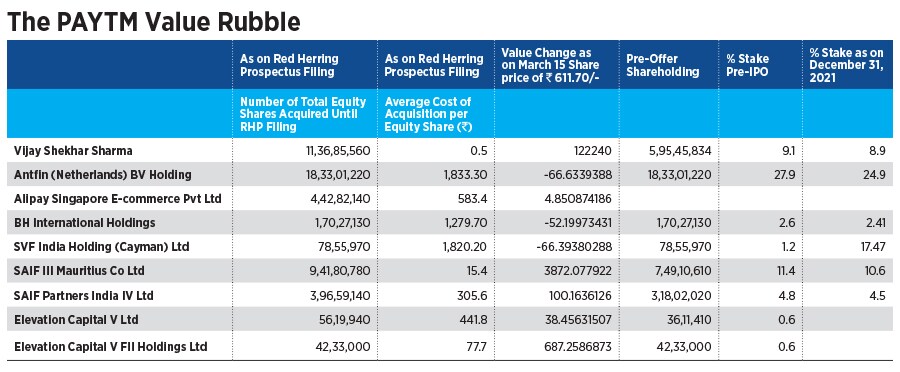

A look at Paytm’s red herring prospectus shows that Sharma’s average cost of acquiring each share stands at Rs 0.50 per share, or as much as you would pay to buy a toffee. But what about others? Jack Ma’s Ant Financial, which still owns 24.9 percent through Antfin (Netherlands) BV Holding in the company, had paid an average of Rs 1,833 per share to acquire shares in the company, which, in today’s market rout, stands at a loss of 68 percent.

It’s other large investor Softbank India, which today stepped down from the board of the company, a process they had initiated a month back, said people directly familiar with the matter, had acquired shares at an average cost of Rs 1,820.20. The only investor that has still managed to protect its capital is one of its oldest investors, the erstwhile SAIF Partners, which has rebranded itself as Elevation Capital. Elevation, across various funds, continues to own shares in Paytm, but has paid between Rs 15.40 and Rs 441.80 per share to buy them.