Domestic investors hold the fort as FIIs flock out

The looming threat of the US Fed hiking interest rates and the worsening outlook for global macroeconomic stability have pushed FIIs to exit India investments to the tune of $12 billion since October last year

Illustration: Chaitanya Dinesh Surpur FIIs have sold stocks to the tune of $8 billion in the current year so far, perplexing fund managers given the outperformance of Indian equities

FIIs have sold stocks to the tune of $8 billion in the current year so far, perplexing fund managers given the outperformance of Indian equities

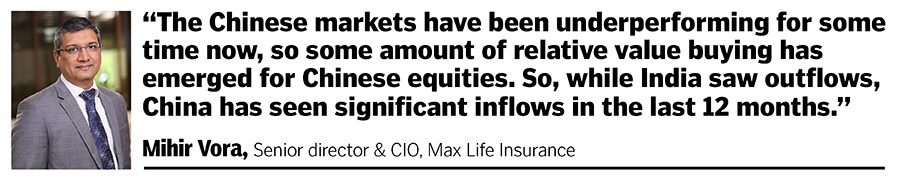

Foreign institutional investors (FIIs) are exiting Indian markets in large droves. Surely, the reason can’t be pinned to underperformance of India equities. Rather, it is mainly a rub-off effect of shaky global macros in the backdrop of rising uncertainty and volatility. FIIs have sold stocks to the tune of $8 billion in the current year so far, perplexing fund managers given the outperformance of Indian equities.

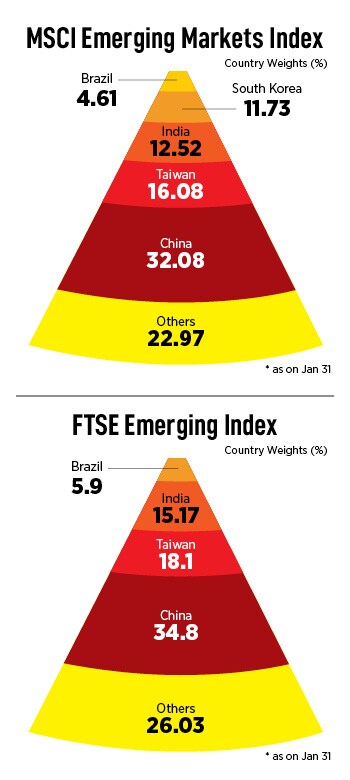

“I cannot explain (the FII outflows). In fact, if I didn’t know and you asked me to guess, I would have said FIIs were buyers. It is possible passive emerging market ETFs were a large part of the selling, as people have soured on China. It’s worth pointing out that the FII numbers alone don’t paint a complete picture. Some foreign investors use options and structured products to access the Indian market. Also, some of the money could be Indians managing their funds offshore,” says Mark Matthews, managing director and head of Asia research at Julius Baer.

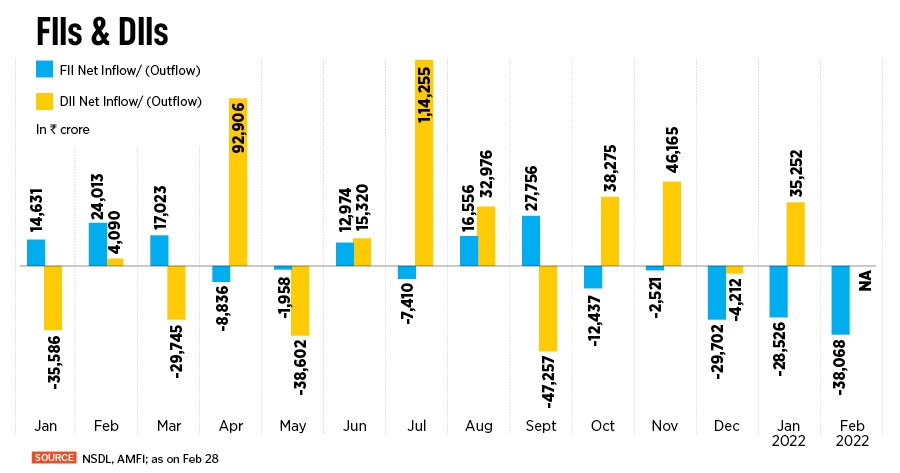

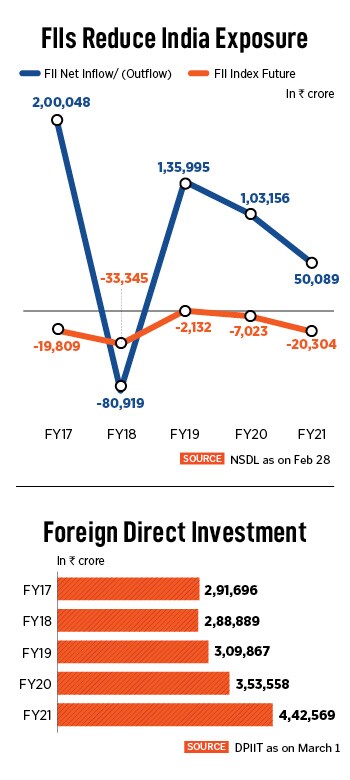

This is not a sudden change of heart, or a bolt from the blue. FIIs have been net sellers in India since October last year (see chart) in response to the changing monetary policy stance of most global central banks, and more specifically the US Federal Reserve.

“Foreign investors started to grapple with the fact that inflation wasn’t transitory and interest rates, at some point in 2022, would have to rise,” says Andrew Holland, chief executive officer, Avendus Capital Alternate Strategies.

A rate hike in the US can potentially drain out liquidity and stem inflows into financial markets. Also, higher rates in the US may skew the risk-reward ratio against most emerging markets, making them relatively less attractive for FIIs as they increase investments in developed markets.

A rate hike in the US can potentially drain out liquidity and stem inflows into financial markets. Also, higher rates in the US may skew the risk-reward ratio against most emerging markets, making them relatively less attractive for FIIs as they increase investments in developed markets.

Though FIIs own one-fifth of the shares of companies listed on the NSE, they seem to have less sway over Dalal Street now than in the past, given the hectic activity of domestic investors.

Though FIIs own one-fifth of the shares of companies listed on the NSE, they seem to have less sway over Dalal Street now than in the past, given the hectic activity of domestic investors.