Jet Airways, Akasa plan to fly next year. Then there's everything at Air India. Is it getting better for Indian airlines?

Amidst all the action, India's aviation sector is expected to see debt levels rise to Rs 1.2 lakh crore in FY22, requiring additional funding of Rs 45,000 crore in the next two years even as passenger traffic will take longer to return to pre-pandemic levels

Indian aviation: A renewed fight for the skies. Representational Image (Shutterstock)

Indian aviation: A renewed fight for the skies. Representational Image (Shutterstock)

There is a rather strange paradox playing out in India’s aviation sector.

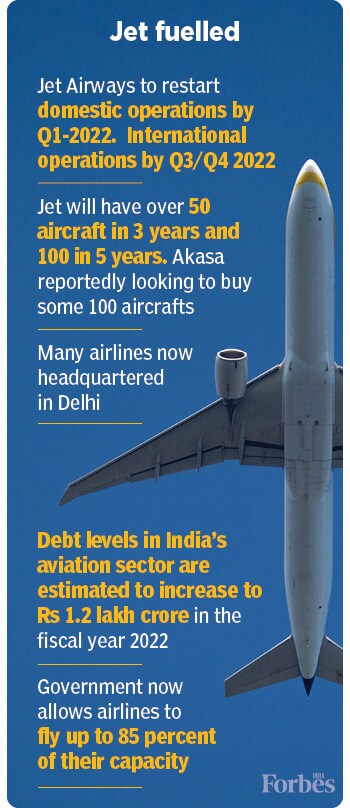

To begin with, India’s oldest private airline will make a comeback into Indian skies next year. Around the same time, a new entrant, backed by a billionaire businessman and a few aviation veterans will also take to the skies. Yet another, backed by one of India’s oldest business groups, will tap the bourses to raise money and have already received approvals for it.

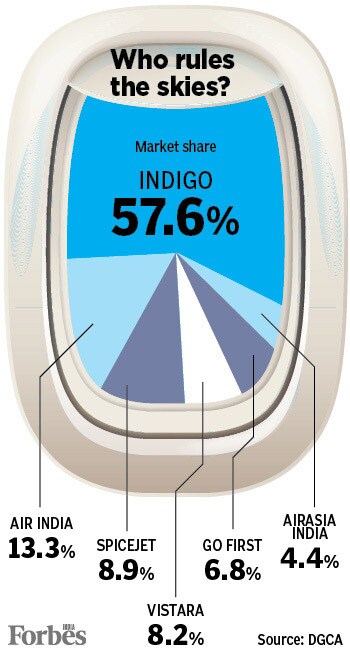

While all this plays out, India’s oldest airline and its national carrier, Air India, will have a new owner for the first time in more than 70 years. One of the suitors is an airline whose promoter has close ties to the government, but one who has seen its fortunes dwindle over the past few years, raising concerns about its viability. If all this isn’t enough, India also has a two-year-old player emerging as its largest airport operator and accounting for one in four passengers passing through its airports.

Amid this churn, India’s aviation sector is expected to see debt levels rise to Rs 1.2 lakh crore in FY22, requiring additional funding of Rs 45,000 crore in the next two years. Over the past few years, many, including Jet Airways, had fallen prey to high debt levels, making operations unsustainable. Beleaguered airline owner Vijay Mallya had to flee the country after his airline, Kingfisher Airlines, had mopped up massive debts during its decade-long journey.

“Lurching from crisis to crisis has become a familiar story since 2004 because the industry has chosen to pursue profitless growth, resulting in chronic losses for many years,” said airline consultancy firm Centre for Asia-Pacific Aviation (CAPA) in its India aviation outlook for 2022. “Two major airlines have failed in the last 10 years, leaving a trail of $7 billion of liabilities. Yet nothing has changed. The twin waves and sudden impact of Covid-19 have resulted in a high level of solvency risk for most airlines, which could impact the entire industry, including airports.”