From Ranchi to Tashkent via Dubai: The mysterious man gearing up to fly Jet Airways

Not much is known of Murari Lal Jalan, who leads the consortium that has won the bid for India's oldest private airline. Will he be able to turn around the company in a pandemic-ravaged sector?

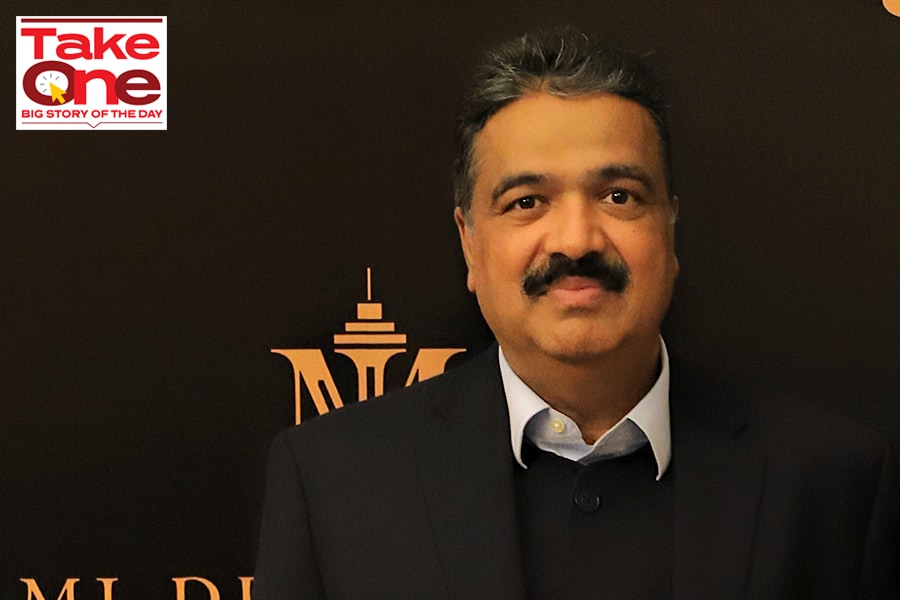

Murali Lal Jalan, set to become the newest owner of Jet Airways, along with Kalrock Capital. Photo courtesy: NRI Achievers

Murali Lal Jalan, set to become the newest owner of Jet Airways, along with Kalrock Capital. Photo courtesy: NRI Achievers

Within India’s corporate echelons, Murari Lal Jalan remains something of an enigma. Not much is known about the greying and moustached millionaire who, along with London-based financial advisory firm Kalrock Capital, became the newest owner of India’s oldest private airline, Jet Airways. Jet, previously owned by billionaire businessman Naresh Goyal and Etihad Airways, had shut in April 2019 after its debt spiralled out of control.

“The resolution plan submitted by Murari Lal Jalan and Florian Fritsch has been duly approved by the CoC (committee of creditors) as the successful resolution plan,” Ashish Chhawchharia, the resolution professional appointed by the lenders of the airline, said in a stock exchange filing on October 17. The consortium will now have to wait for clearance from the National Company Law Tribunal (NCLT) before the new owners can officially take over the reins. In July last year, the NCLT had approved bankruptcy proceedings against Jet.

While Kalrock Capital is part of the Fritsch Group, an investment group founded by serial real estate and tech entrepreneur Florian Fritsch, 56-year-old Murari Lal Jalan remains a mystery. A casual search on Jalan on the internet is almost certain to land one on the website of a commercial and residential project being developed in Uzbekistan by the MJ Group, which envisages Jalan as “a man who has a global vision”. MJ Group, as the initials suggest, is owned by Jalan.

“Traditional wisdom says ‘don’t put all your eggs in one basket’ and it perfectly applies on Mr Murari Lal Jalan,” says his profile on the website of Namangan Square, a residential complex being developed by the group in Uzbekistan’s eastern city of Namangan. The complex is spread over 18 hectares, featuring 1,500-odd luxury apartments.

“An eminent figure in the business fraternity, Jalan is a veteran who has invested in diverse sectors like real estate, mining, trading, construction, fast-moving consumer goods, dairy, travel and tourism, and industrial works globally to name a few, minimising the risk factor,” the website adds.

Aakash Jahajgariah, who is married to Vega Gupta, the niece of the South Africa based Gupta brothers, along with Ankit Jalan and Murari Lal Jalan

Aakash Jahajgariah, who is married to Vega Gupta, the niece of the South Africa based Gupta brothers, along with Ankit Jalan and Murari Lal Jalan Ropeway in Auli, a small ski resort near Joshimath in the Himalayan state of Uttarakhand in Northern India.

Ropeway in Auli, a small ski resort near Joshimath in the Himalayan state of Uttarakhand in Northern India.