Why are brands warming up to non-cricket sports?

Sponsorships and brand investments are no longer limited to cricket as more and more marketers take up an inclusive approach when it comes to sports marketing. Sports like badminton, kabaddi, kho kho, handball, and even yoga are grabbing the marketers' attention

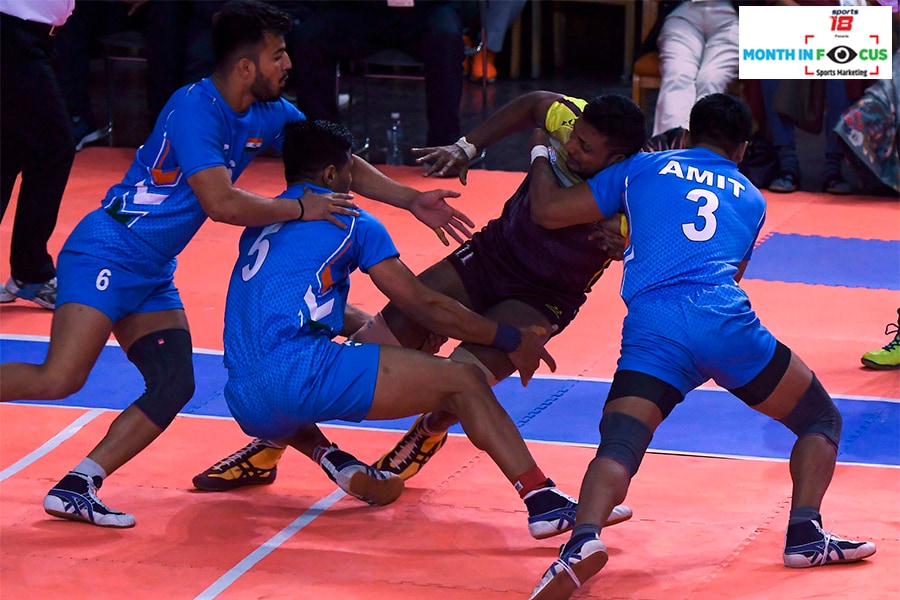

India's players tussle with Sri Lanka's Y.D. Sanjaya (C) during the Kabaddi final at the 13th South Asian Games (SAG) in Kathmandu on December 9, 2019. Image: PRAKASH MATHEMA/AFP via Getty Images

India's players tussle with Sri Lanka's Y.D. Sanjaya (C) during the Kabaddi final at the 13th South Asian Games (SAG) in Kathmandu on December 9, 2019. Image: PRAKASH MATHEMA/AFP via Getty Images

Marketers are warming up to badminton, wrestling, kabaddi, boxing, and other non-cricket sports as players shine in big leagues. Brands across sectors like fashion, fintech, edtech, F&B, FMCG, electronics, and others are increasing investments in media spends, ground sponsorships, team sponsorships, and endorsements in a wide variety of sports. While cricket still leads the charts, it is no longer the only sport in the marketing playbook of both new age and legacy brands.

“While investing money in cricket ensures immediate prominence and overnight appreciation for any brand, associating with indigenous and emerging sports provide brands a more economical option to engage with thousands of new young fans in a particular sports discipline,” says Tenzing Niyogi, chief executive officer at the soon to be launched league, Ultimate Kho Kho.

Overall surge

Overall, the space saw a surge in the year gone by, leading to brands taking notice of emerging categories and athletes. As per a recent GroupM ESP report, 2021 saw an echoing comeback for sports sponsorships and media deals as compared to 2020.

The space saw a 62 percent growth over 2020, with India’s performance at the Tokyo Olympics being a major morale booster for budding sports talent in the country. There was also a significant growth in Sport AdEx that stood at Rs 6,018 crore in 2021. The spending on sports celebrity endorsement grew by 11 percent year-on-year in 2021.