BharatPe redefined India's payment ecosystem. The unicorn now wants to challenge India's banks

In just three years, Ashneer Grover-led BharatPe has become one of India's biggest fintech startups. And it's only getting started

(From Left) Ashneer Grover, MD & Co-Founder; Suhail Sameer, CEO; Shashvat Nakrani, Co-Founder; BharatPe.

(From Left) Ashneer Grover, MD & Co-Founder; Suhail Sameer, CEO; Shashvat Nakrani, Co-Founder; BharatPe.

Image: Madhu Kaparath

Ashneer Grover has one fundamental rule in life. “If you have to do something, do it big,” the 39-year-old co-founder of BharatPe says. “Because, if you must do something smaller, it takes an equal amount of effort.”

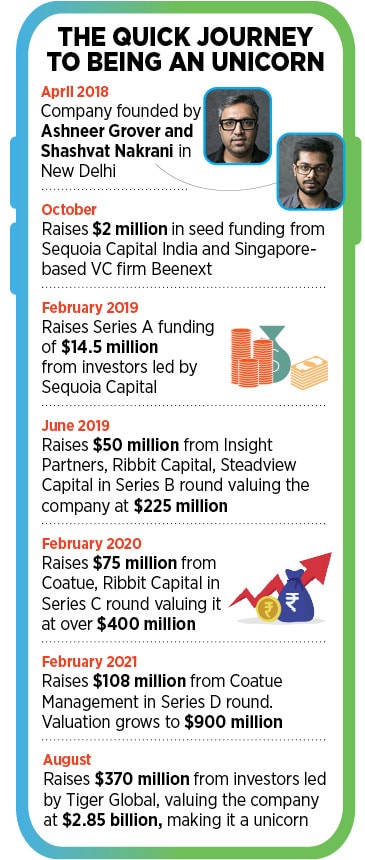

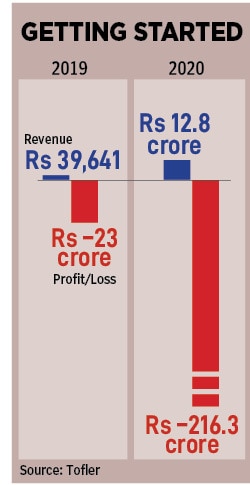

There is a certain merit in that argument, particularly since Grover and BharatPe have made it a habit of making it big. In just three years, Grover has built BharatPe, founded in April 2018, into one of India’s biggest fintech startups, commanding a staggering valuation of $2.85 billion after its latest round of funding. This August, BharatPe raised $370 million from investors including Tiger Global, Sequoia Growth, and Dragoneer Investment Group, among others.

In June, the company’s joint venture with Mumbai-based Centrum Group received an in-principal approval from the Reserve Bank of India (RBI) to take over the troubled cooperative lender PMC Bank and re-launch it as a small finance bank. The consortium will become the first small finance bank in nearly six years to be permitted by the RBI to do this.

“Even today, I don't care about these valuations,” Grover says nonchalantly in a video interview. “I absolutely don’t give a damn about it. For me, the question is whether I am a leader or not. If I’m the leader, money will follow. If I’m not, then I will be following the money. I am in no mood to follow the money.”

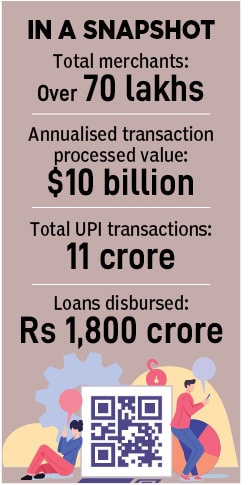

BharatPe, the financial services platform that Grover founded along with Shashvat Nakrani, an IIT-Delhi dropout, processes payments and provides credit or loans to merchants and shopkeepers across the country after building up India’s first UPI interoperable QR code. The company is also India’s first zero MDR payment acceptance service with over 70 lakh merchants across 140 cities, processing some 12 crore UPI transactions per month with an annualised transaction value of $10 billion. MDR is the cost paid by a merchant to a bank for accepting payment from their customers via digital means.