Will Zomato's audacious grocery bet with Grofers pay off?

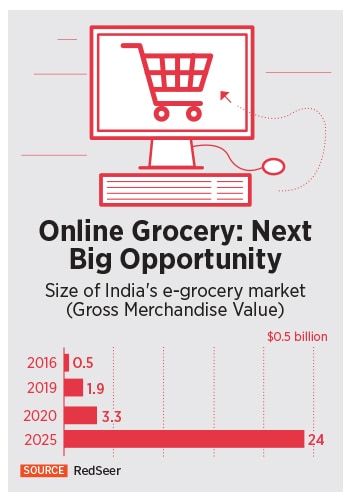

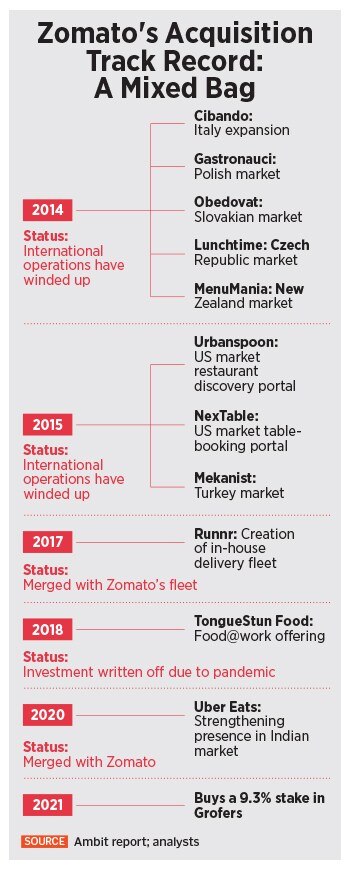

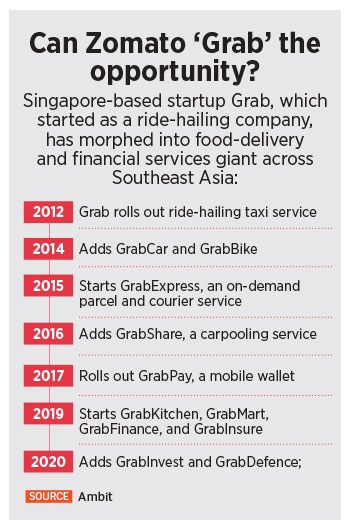

Despite grocery being a high-risk play with wafer-thin margins and dynamics that are different from food delivery, IPO-bound Zomato perhaps has little option but to take the plunge with a stake in Grofers, viewing it as a fighting chance to keep its growth story intact

Deepinder Goyal, founder and CEO of Zomato. Photo by Amit Verma

Deepinder Goyal, founder and CEO of Zomato. Photo by Amit Verma

Last April, it was not a question of choice for Zomato.

The country shut down, restaurants shuttered and food business got hammered. To keep the home fire burning, the online food delivery and restaurant discovery platform started delivering grocery with ‘Zomato Market.’ Though getting into grocery and essentials was the need of the hour, as demand for food delivery suddenly evaporated, the bigger question was: Who would buy grocery from Zomato?

Five months down the line, the food delivery giant got the answer. By September 2020, Zomato had delivered 1.1 million grocery orders across 185 cities, points out CLSA in its brokerage report in April this year. “Thank you for giving us the opportunity to serve you during the lockdown,” Zomato wrote in a blog last September, announcing the ‘signing off’ of Zomato Market. With a gradual lifting of the lockdown curbs, the company was getting back to its core business and focus: Food delivery. Though the company flirted with grocery delivery for half a dozen months, there were signs of a promising future.

Back in 2018, Zomato was committing itself a serious relationship by getting into B2B grocery business. It bought Bengaluru-based company WOTU, rebranded it as Hyperpure, and started supplying restaurants everything they needed: Vegetables, fruits, poultry, groceries, spices and dairy beverages. “We are trying to transform Zomato into a foods company, much on the lines of a farm-to-fork model,” Deepinder Goyal said in an interview to Forbes India in July 2018. The co-founder explained the evolution of the company. In July 2008, Zomato was born as a food discovery and ratings platform. “In July 2013, we started walking. Now in July [2018] we will start running,” he then stressed.