The IPO routes for India's internet unicorns

Will Sebi's new recommendations make public listings easier for India's internet-based startups?

Image: Deepak Turbhekar for Forbes India

Image: Deepak Turbhekar for Forbes India

On February 22, Zomato announced its latest—and potentially last—round of funding of $250 million from five investors, including Tiger Global Management and Kora Management. The online food delivery unicorn is now valued at $5.4 billion, a 1.4x jump from its valuation of $3.9 billion in January 2020, when it raised $660 million. The company is reportedly gearing up for an IPO this June.

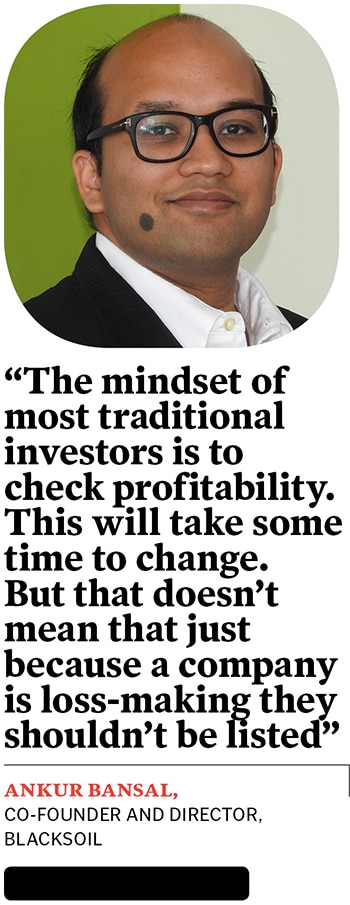

“The fundraise adds to the war chest for acquisitions and price wars as the company readies for its initial public offering [IPO],” says Ankur Bansal, co-founder and director at BlackSoil, a credit platform for startups. “It has recently restructured its capital base to create 8.8 billion new shares and tripled its paid-up capital, indicating its intent in the near term.” Plans for the public listing seem to have been advanced due to Zomato’s better-than-expected performance during the Covid-19 pandemic. Zomato, however, reported a 160.6 percent increase in its FY20 losses, to Rs 2,451 crore from Rs 940 crore in FY19, while revenue increased from Rs 1,255 crore in FY19 to Rs 2,485 crore in FY20.

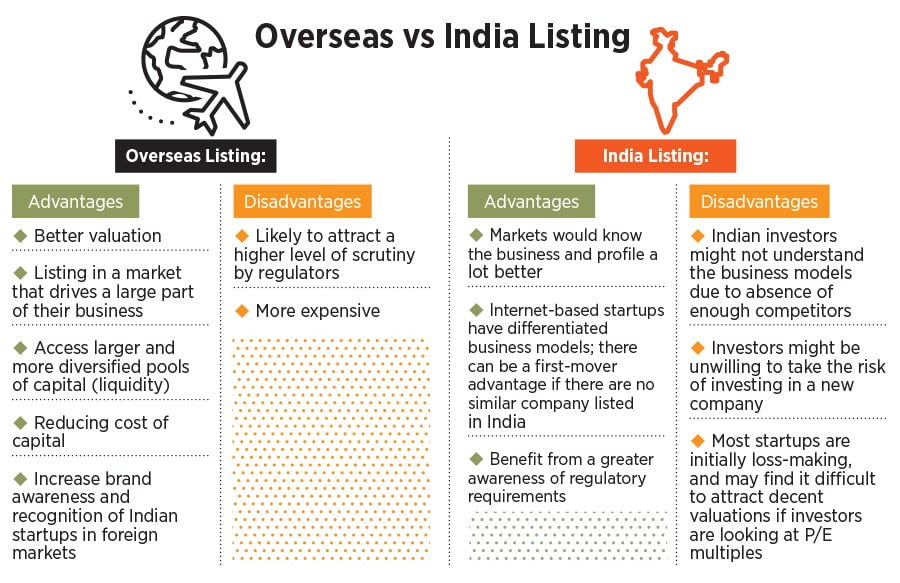

Zomato is part of a crop of internet-based companies, including Flipkart, Nykaa, PolicyBazaar and Paytm, which are planning their IPOs in the coming year or two. According to a report by HSBC Global Research, more than $60 billion has been invested in India’s internet-based startups over the past five years, with around $12 billion in 2020 alone. However, unlike traditional profit-making companies that list on Indian exchanges, these startups continue to be loss-making ventures. The Securities and Exchange Board of India (Sebi) keeps a close watch on pricing and valuations of IPOs, and the kind of companies coming into the market, with profitability being a key factor. But with the emergence of internet-based ventures over the last 10 years, things are changing.

Pranav Haldea, managing director of Prime Database, says, “These companies, which are funded by private equity [PE] and venture capital [VC] investors, require a huge amount of capital investment before they turn profitable. In line with that, Sebi has been modifying its regulations to encourage such companies to get listed in India.”

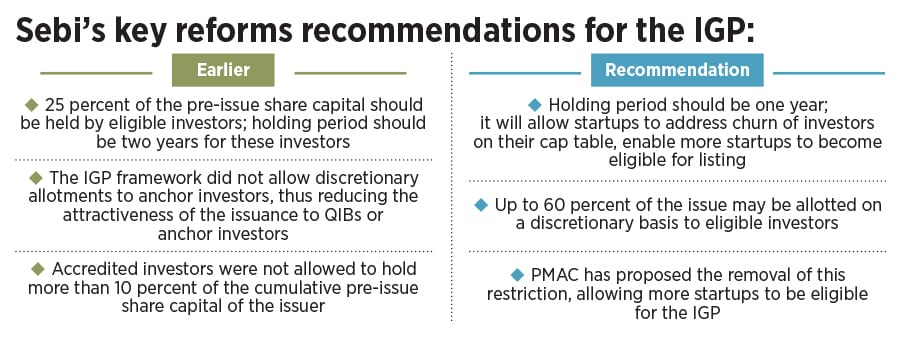

Last December, Sebi released a consultation paper on 'Review of Framework of Innovators Growth Platform (IGP)', with recommendations from the Primary Market Advisory Committee (PMAC). In 2015, Sebi had introduced a similar segment called Institutional Trading Platform (ITP), but it failed to get any interest from startups. The current reforms in the IGP framework, when implemented, are expected to find far more interest among Indian startups and technology companies.“

The IGP framework is likely to benefit startups—both large and small—and is therefore seen as a step in the right direction to change the startup landscape in India. “There is a lot of frenzy around this on both the startups’ and investors’ sides,” says Bansal of BlackSoil. Clearly, the investor appetite for a platform like this is huge, especially since the IGP is advocating for technology and innovation-led companies.

The IGP framework is likely to benefit startups—both large and small—and is therefore seen as a step in the right direction to change the startup landscape in India. “There is a lot of frenzy around this on both the startups’ and investors’ sides,” says Bansal of BlackSoil. Clearly, the investor appetite for a platform like this is huge, especially since the IGP is advocating for technology and innovation-led companies.