- Home

- UpFront

- Take One: Big story of the day

- Inside Paytm 3.0: Vijay Shekhar Sharma's vision for a one-stop finance shop for India

Inside Paytm 3.0: Vijay Shekhar Sharma's vision for a one-stop finance shop for India

As of 2020, the billionaire's super app for financial services had run up losses in thousands of crores. Now, as digital payments gets yet another boost courtesy of Covid-19, he's hopeful of reaching near breakeven in two years

I'm the Technology Editor at Forbes India and I love writing about all things tech. Explaining the big picture, where tech meets business and society, is what drives me. I don't get to do that every day, but I live for those well-crafted stories, written simply, sans jargon.

- Zoho: Busting the myth that great software can only be written in Silicon Valley

- Ashok Leyland: From tradition to transition

- Solving for India: Five startups tackling social problems

- How Larsen & Toubro Infotech came into its own

- Dhruvil Sanghvi is working to make LogiNext the Google of supply-chain logistics

Vijay Shekhar Sharma

Vijay Shekhar Sharma

Image: Francis Mascarenhas / Reuters

Vijay Shekhar Sharma was trying to import a batch of oxygen concentrators from China when he sat down for the interview for this story. At some point, in between, he also left a voice note for his assistant to let everyone know he would participate in the week’s ‘Friday Final’ hangout, on a Zoom conference call, of course — once these weekly get-togethers would have helped executives and staff to hang out with Sharma just to unwind and talk about “what’s happening in life,” he says.

Today, there are staff on Zoom calls wearing masks, because someone in the family has Covid, or an urgent piece of work necessitated calling in a technician, Sharma says. “In 2020, it was in an apartment complex or a colony, and we knew it was there. In 2021, it has walked into everyone’s homes. I never thought it would be so harsh,” he says. The five-day holiday stretch for Labour Day in China has delayed the fulfilment of the order for oxygen concentrators as well, as Paytm is trying to help staff and others.

“Entrepreneurs who believed that they owned the destiny of their life, that they could do what they aspired to do, they are all struggling to accept the harsh reality,” he says, speaking online from his home in Delhi.

And yet, perhaps even more than demonetisation, when India banned two high-value currency notes overnight in November 2016, the coronavirus has come as a shot in the arm for not just Paytm, India’s most valued startup and digital payments leader, but for multiple internet-led ventures around the world.

Sharma says he would rather have done without the boost which is coming at such a cost. “When demonetisation happened, I was proud to call out that this single event will put India on the fast track to digital payments. With Covid, even though it is seen as benefitting online payments, I feel the pain.”

India is going through its next big wave of financial digitalisation because of Covid, “but it’s painful for me to send more people out into the field” because it makes them vulnerable to the virus. Or “if we run an ad with a celebrity, it’s a worry now that it’s inappropriate”.

Return to the roots

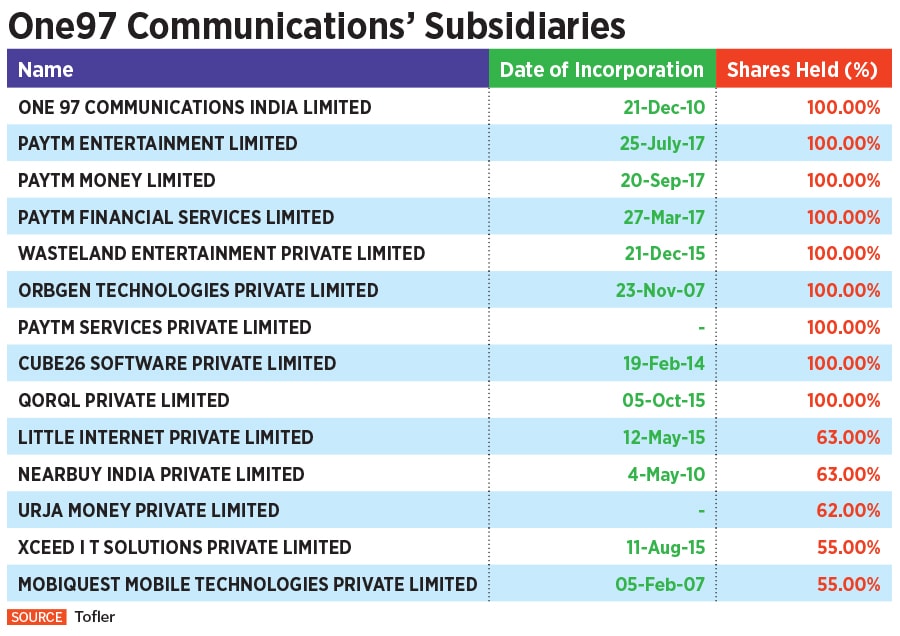

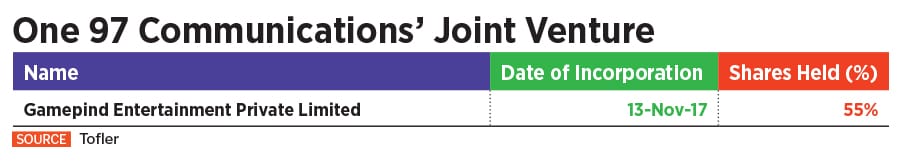

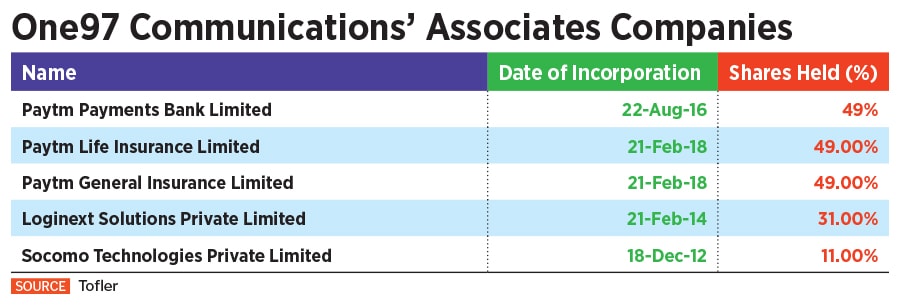

Sharma’s venture started out as One97 Communications Limited, in 2010 offering people a chance to ‘pay through mobile,’ and hence Paytm, and top up their phone plans and pay utility bills and so on. He then offered a mobile wallet and expanded the number of things that people could pay for, using their phones — from train ticketing to hospitality. Backed by venture capital funding, Sharma is today at the head of a company that has some 14 fully or partly owned subsidiaries, a joint venture, and multiple associates companies. One97 and Paytm’s operations include an ecommerce marketplace, insurance, lending, stock broking, a payments bank, online gaming and events and entertainment.

The ecommerce bet was a big one, but it didn’t pan out the way Sharma had hoped — he had wanted to make it the third big online commerce ecosystem in India, alongside Flipkart and Amazon India — and most of the other forays are yet to mature to the point where they can make money. And when India launched the Unified Payments Interface, Paytm failed to capitalise on it, and today lags in terms of UPI volume market share, behind Flipkart’s PhonePe unit and Google Pay. Sharma has a different view on this, and more on that later.

Especially over the last two years, the 42-year old billionaire has attempted to go back to basics, to the strengths of the payments business, after pulling the plug on a cashback-led strategy to add customers at Paytm Mall, the ecommerce marketplace, and moving that operation to Bengaluru.

Paytm has been trying to make its wallet experience better than ever. For example, its executives say it has the least failures, or declined payments due to technical reasons, than even Paytm UPI, which in turn has the lowest failure rate among all the banks providing UPI services — based on data independently released periodically by National Payments Corporation of India.

On the merchant front, it is incrementally adding more tools and technologies to not only make it easier for them to accept payments but also to send money to their vendors, pay salaries and so on. And third, Paytm’s financial services businesses — lending, wealth management and stock broking — are small but growing rapidly, naturally tapping the large base of consumers and merchants that Paytm has amassed.

The wallet user base also helped Paytm add a large number of customers to its payments bank. That network effect helped make Paytm Payments Bank a rare entity — a payments bank that is actually profitable, while other payments banks either just stopped or are running at a loss.

Paytm’s return to its roots has been long and arduous, and it hasn’t been without its share of senior level exits. And it is far from being done. However, it might have reached a point from where cash burn is set to continue to come down and breakeven is realistically in sight, Sharma and top executives tell Forbes India. Beyond that, even an IPO may be on the cards.

One other factor that is helping is that people no longer need to be taught about the convenience and benefits of going digital. It means they have to be incentivised a lot less as well. “Reconciliations, systems, banks, things have aligned. The last decade has given this country digital payments at scale,” he says.

And Paytm can claim its share of credit for that. Five years ago, Paytm was still a young startup with big dreams of changing how people transacted with money. Payments with phones and QR codes were new possibilities and while Paytm set out to make such options more mainstream, “we were also not sure whether these things would work or not,” he says.

More sure-footed

Today, according to Sharma, “we’ve become far more sure of ourselves”. Five years ago, talking about bringing digital finance to half a billion Indians was an aspirational statement. Today, it’s well on its way to becoming reality. Paytm has over 300 million consumers, who use its wallet, and 20 million merchants on its network.

“Today we can say that we know how (to do this) and we have the resources and we now have a business plan and a business model.” That means Paytm is becoming an increasingly revenue-centric company and not just one that spread out and acquired customers, he says.

Sharma has invested over Rs20,000 crore ($2.73 billion) in his venture from investors including China’s Alibaba Group and its affiliate ANT Group, Japan’s SoftBank Group and America’s Berkshire Hathaway. The last significant funding round, announced in November 2019, saw Paytm being valued at $16 billion. Overall, Paytm has raised about $3.5 billion in funding.

And now the network effect of consumers, financial services and technology for merchants has matured to a scale that it is a revenue earning company, he says. And while individual opportunities, like an insurer that Paytm is in the process of acquiring, might need money, the group won’t need any more equity funding either, he says.

“In financial year 2021-22, we are expecting ourselves to reach breakeven or near breakeven. Not at the financial-year level, but in one of the months, towards the end of it.” The intention is not to invest less, but to continue to expand the market. “In 2021, we are expecting a business, which is not requiring any more equity capital,” Sharma says.

That might be just as well, with China cracking down on its biggest tech giants, including Alibaba and ANT Financial, two of the biggest investors in Paytm. For now, Sharma doesn’t see any immediate impact on Paytm. “They are commercial equity stakeholders and beyond that Paytm runs on its own blood, sweat and hard work, and we are run, operated and managed by our Indian management and the board that is completely independent of that.” He isn’t aware of ANT facing any obligation to divest its foreign investments including those in Paytm, he says.

Madhur Deora, president, Paytm

Madhur Deora, president, Paytm

Image : Courtesy Paytm

With 300 million plus wallet users, about 60 million bank customers, and about 20 million merchants on its network, cost of customer acquisition, especially for the financial services businesses, will be very low, Paytm’s top executives say. “The network is now big enough where you don’t need to keep incentivising users to keep making transactions,” Madhur Deora, president and group CFO of Paytm, tells Forbes India.

“For sure,” Paytm will hit breakeven over the next two years, Deora says, and the former investment banker is a bit more conservative than his boss: “Our trajectory suggests that burn will continue to come down and we should aim to hit breakeven perhaps not this year (2021-22) but the next. That should be our aim.”

From time to time there are opportunities like the insurance business that Paytm acquired, which will need money, but “for the organic business that we do we don’t really need more money,” he explains. And “the existing funding, excluding any large acquisitions, should last us till breakeven.”

One a standalone basis, One97 Communications’s operational revenue for the year ended March 31, 2020 rose to Rs3,115 crore from Rs3,050 crore for the previous year, according to data from business intelligence provider Tofler. Losses came down to Rs2,833 crore from Rs3,954 crore. At Paytm, revenue was Rs3,629 crore and losses were at Rs4,217 crore for FY20.

Payments business

Paytm today offers payments services, consumer internet services, provides technology to merchants, and financial services. Payments helps the company acquire users and build engagement. Consumers pay very little or nothing for using most Paytm’s payments products and the company makes money from the merchants. All the rest of the services build stickiness and help make more money via cross-selling and up-selling opportunities.

Compared to two or three years ago, the payments business has become more nuanced, Deora says. Even some years down the line, when he expects to have more than doubled Paytm’s user base, “we will still be innovating on payments”.

About Paytm lagging PhonePe and Google Pay on number of UPI transactions, it’s a commoditised low-hanging service in which there isn’t any money, Deora says. UPI payments are free, under India’s rules. That said, UPI payments too are gradually growing at Paytm. For example, from about 250 million transactions in January to 320 million in April, according to NPCI data. PhonePe facilitated nearly 1.2 billion UPI transactions in April. NPCI data shows, however, that Paytm Payments Bank leads as a destination—or beneficiary bank—when people send money using UPI, with 470 million such transactions in March 2021, ahead of even State Bank of India.

The differentiation will happen at the wallet end, Deora says. It’s harder to maintain the wallet than it is to maintain UPI because Paytm will have to ensure that its wallet works with every single merchant. It will also have to do the KYC with every single wallet user.

On the other hand, Paytm has built its wallet product to the point where the user experience on it is superior to other payment options. A typical example would be paying for food delivery service. The wallet gets linked to the service with a one-time OTP, and from that point on, payment is quite literally one-click.

For those who are really keen on the extra security, one never need connect a bank account to the wallet and only just transfer money to it once in a while, although, as this reporter discovered, the best compromise there is to actually get a Paytm Payments Bank account. With the KYC already done for the wallet, getting an account with the payments bank is also a matter of only a few clicks on the Paytm app.

For Paytm, the motivation is that they expect the superior experience to add and retain even more customers over the long haul — and they are already at over 300 million wallet users — and every wallet-based transaction brings Paytm a fee from the merchant, from paying for food service and taxis to phone plan top-ups and other purchases on third-party apps.

At the top of the hierarchy of success rate is Paytm wallet, closely followed by Paytm UPI and further down are other UPI provider banks. Payments volume on Paytm’s network across its different products—wallet, UPI, QR code, and point-of-sale devices like sound box—have surged 50X, Deora says, over the last four-and-a-half years. In February, that was 1.2 billion transactions, and 1.4 billion each in March and April, according to Paytm—more than any competitor.

Now customers are veterans on the wallet. There are even some customers who do hundreds of transaction a year, he says. Month-on-month, Paytm is seeing higher transactions per second and its systems are built to handle the increase without giving on the failure rate.

FASTag, which Paytm started distributing some three years ago today, mean about 8.5 million four-wheelers can breeze through toll booths, with the human inside having to do nothing. As long as she has enough money in her Paytm wallet. Again, the Paytm experience is superior because the wallet automatically tops up the money reserved for FASTag without the user having to do anything.

Even if the user doesn’t have money in her wallet, Paytm has the tech today to provide credit on the fly, Deora says. Paytm has built the backend needed for this, and can integrate the top-up with its ‘pay later’ product as well. In five years, just as the RFID code is the token, “your face could become the token,” Deora says. There could be stores where people walk in and look at a camera and their payments go through. Five years from now, payments will almost become a subconscious activity, other than having to consent to payments, he says.

Another example of how Paytm keeps adding features is the Paytm Payouts solution, which allows merchants to send money as well, not just receive — pay bills, pay salaries, pay vendors, or even just park money in a wealth management account.

On the offline side, like your neighbourhood grocery store, Paytm started deploying QR codes some five years ago, in March 2016, and now has 20 million of them. Most are all-in-one codes, meaning they facilitate payments via any UPI-based service, not just Paytm UPI or wallet.

Devices like the Paytm Soundbox and all-in-one card-swipe machines, account for roughly half of the total value of transactions at offline merchants today. That makes money because the merchants pay rentals on the devices and charges on card swipes. The QR codes mean that people could make digital payments at offline merchant establishments without the need for a card machine. That is mainstream in India today.

“We have built our own tech stack to ensure that the strength of our products remains rock solid,” says Kumar Aditya, senior VP of Paytm’s offline payments business. Paytm started distributing its payments devices about two years ago, and today has a fairly strong network of these devices. Soundbox, which calls out a payment confirmation, is in its version 2 now and is 100 percent ‘Made in India’ technology. Aditya expects to have distributed 5 million devices in two years.

While Paytm is running several projects that all move the needle a little individually, “Payments growth is one of the biggest growth and revenue engines,” Deora says. Providing technologies to the merchants can have a revolutionary impact. So a modern card payments device that can be upgraded to many other features will be attractive to merchants.

Financial services engine

Top of that list of features would be the ability to provide credit to consumers on the fly. This already happens on the app, with a buy-now-pay-later product called Paytm Postpaid. On the merchants’ side, Paytm has a growing lending business via partnerships with multiple NBFCs.

"The lending business is growing at 25 percent month on month," says Bhavesh Gupta, CEO of Paytm’s lending business. The pay-later product now has a million users and Gupta expects to have 10 million users in two years. It helps drive consumption.

On the merchants’ front, Paytm has given credit to about 126,000 of them as of March. It wants to get to 400,000 this fiscal year and 1 million in two years. Typically, the average size of a loan to a merchant is Rs100,000, over 12 months. It is a daily repayment product, using the merchant’s daily settlement on the Paytm payments network. Covid put the brakes on, but the second half of the year saw a pickup with digital-led credit.

Paytm also has co-branded credit cards with SBI and Citibank. It expects to go from about 100,000 cards to a million in 18 months, getting customers from among those who otherwise would have found it difficult to get credit cards from traditional banks. But Paytm has their transactions data on its network.

The lending unit now offers slightly longer-duration personal loans to consumers as well. It is currently doing over 10,000 loans a month, but expects to get to 100,000 loans a month. Typically, these loans are for 18-month duration. The process is totally digital and round the clock. Open the app, apply for the loan and get the money in the bank in less than 10 minutes, Gupta says. Eventually, Paytm will tap higher-value customers as well.

Again, he stresses that a lot of this is possible because Paytm has built its own tech stacks for loan origination, management, collection and underwriting. “We aren’t a lead generator. We control the entire experience,” Gupta says.

That same philosophy also works at Paytm Money, the company’s wealth management unit, which offers one platform on which to buy mutual funds, gold, pension plans and get into stock trading.

“Paytm Money is growing like a hockey stick,” Deora says.

The mutual funds business has over 7 million users making between 1.2 million and 1.4 million direct mutual funds transactions every month. About 60 percent of customers are first-time investors and 99 percent of India’s PIN codes are represented in the user base, Varun Sridhar, CEO of Paytm Money says.

The digital gold business, in partnership with MMTC bank, allows people to invest just one rupee or Rs1 crore in gold. They can also take delivery. Some 60 million people have bought 6,000 kg of gold so far. The equity broking business started some 10 months ago and has over 200,000 customers, doing as many trades a day, with fees of Rs10 per trade and nothing for delivery, compared with Rs20 per trade at Zerodha, India’s biggest stock broker.

Sridhar’s team is also trying to teach customers about investment avenues like exchange traded funds, which are very big in advanced economies, but minuscule in India, Sridhar says. Today, the work is about ensuring that the app just works. Then there is education. For example, Paytm prepared an easy-to-understand document on IPOs, translated it to Hindi and Gujarati, and found great traction that helped capture a small but significant share of the IPO market.

In the future, the tech will track customer behaviour and build features that could help mitigate risks at individual customer’s level — a very simple example could be for the trading app to just prompt an intra-day trader to not forget to set a stop-loss, based on the user’s previous trading history.

“A lot of India comes to us,” Sridhar says. “We are slowly becoming a one-stop solution.”

With payments, banking, lending, and wealth management, Paytm will start becoming a super app for financial services, he says. A decade ago, there were probably 5 million people with disposable wealth in India. Today, it’s closer to 60 million and rapidly moving toward 100 million. In some years, it will get to 300 million alongside India’s growth into a five trillion dollar economy, he says.

People will look for do-it-yourself solutions that also offer strong technology-led user experience and transparency, Sridhar says. And Paytm wants to become the platform for every financial need of its customers. In the case of Paytm Money, that will mean offering everything from passive debt investments to very active high-frequency trading.

This will all happen on the mobile phone, for 99 percent of India, while Paytm will probably not be what the ultra-wealthy will look for. And through open APIs (application programme interfaces), Paytm will also partner with multiple startups, especially in the fintech area, to bring their products and services to its customers, which is an ‘everybody wins’ kind of model.

A still showing Paytm SoundBox deployed at a vegetable vendor. The SoundBox is a portable speaker that sounds an alert to the retailer when the payment is completed, instead of waiting for an SMS.

A still showing Paytm SoundBox deployed at a vegetable vendor. The SoundBox is a portable speaker that sounds an alert to the retailer when the payment is completed, instead of waiting for an SMS.

Image: Courtesy Paytm

India's pay pal

“Their dream was to become a commerce company powered by payments, but that’s not happening. Now the focus is firmly on payments,” Satish Meena, an independent senior industry analyst, tells Forbes India. They are also integrating their services—for example, they are allowing users to use Paytm to make purchases on Flipkart, which wasn’t the case earlier. And they are investing more in FASTag, he says.

Paytm is also becoming like a utility, to allow users to make payments wherever they want to make payments. We will see Paytm being much more aggressive in partnering with both online and offline merchants, and in adding users so they can use those customers to sell their other services.

Paytm’s business model is to offer payments services to consumers and merchants, aggregating various payments sources, and cross-selling and up-selling add-ons such as financial services, Sharma says. “It is tilting towards becoming like a PayPal,” he adds, with multiple partnerships to bring various financial products and services together.

Meena agrees: “Anything where a customer thinks of payments, they would want Paytm to be used in India. PayPal is used globally and Paytm wants to move in that direction in India and that’s the strength of Paytm also.”

“Commerce was never their strength. This is a direction in which they can really succeed,” because they have the products that they pioneered, established differentiation with their partnerships and have a significant lead. “It’s good that they are going back to basics and focussing on what they do best,” Meena says.

If Paytm successfully turns its payments bank into a small finance bank, the bank could become a lender itself and play a larger role as well.

Paytm payments bank

Paytm Payments Bank opened for business in 2017. With the transfer of Paytm’s wallet business to the bank, about 200 million wallet users were making between 350 million and 400 million transactions every month, with the total value of money changing hands at between Rs12,000 crore and Rs13,000 crore every month, the bank’s MD and CEO Satish Kumar Gupta tells Forbes India.

The bank offers zero-balance savings accounts, UPI, Aadhaar-enabled payments, debit cards, and domestic money remittances. Today, there are between 750 million to 800 million transactions every month, with the volume at more than Rs65,000 crore per month, as of March 2021.

“We are present everywhere. In the last 40 years, the 25 biggest banks in the country have added about four million merchants as customers, whereas Paytm in the last five years has added 20 million merchants” of the estimated 70 million merchants in the country, Gupta says.

“We have created a full ecosystem. There are approximately 300 million wallet users (today) and 20 million merchants, and this ecosystem doesn’t cost us much.”

India’s central banker Reserve Bank is considering reducing the time needed for a payments bank to become a small finance bank to three years from the current five years. That makes Paytm Payments Bank, which is about four years old, eligible to upgrade itself. “The moment the guidelines come out, we will apply,” Gupta says.

From there, getting to a universal bank will take another five to six years as the bank will have to have been running for at least 10 years before it can become a universal bank.

Becoming a small finance bank would do away with the limit of capping daily end-of-day balances at Rs100,000. The small finance bank will also be able to offer fixed and recurring deposits, and loans to its customers — both consumers and merchants.

Payments banks are allowed to invest their money only in government securities, which means their sources of income are very limited. “Paytm Payments Bank, because of its homegrown technology, wide reach and large number of transactions, has been able to be profitable from the second year of its operations,” Gupta says.

“We are not a deposit-oriented bank, but a transaction-oriented bank,” he says, and that has helped the bank stay profitable. Revenues have been growing at 20-25 percent year-on-year and as a small finance bank the growth will be at a “much higher rate,” he says.

On the whole, Paytm’s financial services are another strong growth engine, Deora says.

Challenges

The first roadblock of his own making, Sharma says, because he saw opportunities in so many areas and decided to enter them. For example, at one point, Sharma and his top deputies were internally debating whether to enter the food delivery business in some way — perhaps with software to manage orders. They tried a wholesale business and learnt first-hand that the margins were too thin. On the other hand, diversification into businesses like wealth management is working very well.

The second challenge is that “we are a technology company that is learning regulated businesses that require traditional vertical domain knowledge”, Sharma says. And it’s not easy to get a technologist who also understands financial services at a senior level. So Paytm itself became the training ground for many people.

Sharma has also seen senior deputies leave in the last few years. Examples include Kiran Vasireddy, who was COO of Paytm, Amit Sinha, who was COO of Paytm Mall, senior VP Deepak Abbot, and Pravin Jadhav, who, as MD and CEO, is credited with initially building Paytm Money.

Getting the right talent at the right time will play a very important role in “how big we become or how small we remain”, Sharma says. Then, he also aspired to go global, but that would have been costly before much stronger growth in India. He did start a successful local payments service in Japan called PayPay, partnering with SoftBank and Yahoo!, which today serves 40 million customers and 3.5 million merchants.

One important cost is still that Paytm has multiple teams working on products that won’t make money in the near term, Deora adds. For example, Paytm has been working on lending for over 18 months and “it’s not a massive revenue earner for us (yet) compared to the investments that we have made to get the business right”. There are also many groups and teams within Paytm like this, working on very good products, but which won’t immediately make money.

In the meantime, Paytm will increasingly become a platform of choice for customers and merchants, and they won’t have to be added or retained by burning cash and providing incentives, Sharma says. Customers can pay using every payment choice that they have, and merchants can accept payment from every payment choice that a consumer is looking to use, he adds.

“That makes us the most compelling choice for consumers and merchants,” Sharma says. “And that is why whenever somebody compares us (with rivals) on the basis of one payments instrument, like UPI market share, they are missing the point.”

(With additional inputs by Rajiv Singh)