How Larsen & Toubro Infotech came into its own

With Sanjay Jalona at the helm, LTI is winning against bigger rivals, stepping out of its larger parent’s shadow, and forging an identity for itself

Sanjay Jalona, CEO & Managing Director, Larsen & Toubro Infotech

Sanjay Jalona, CEO & Managing Director, Larsen & Toubro Infotech

When Larsen & Toubro Infotech (LTI) listed on the stock exchanges in Mumbai in July 2016, it wasn’t the most auspicious of beginnings for Sanjay Jalona, who had quit Infosys to take over as CEO and MD of the company the previous year. The stock ended lower on debut, even though the issue had been subscribed 11 times over.

Reports from the time suggest that the fall had more to do with the overall lacklustre performance of the IT services sector at the time, and not anything specific to LTI. Not long after, Jalona proved that right as well, leading the company to the biggest order win in its history at the time—a $150 million contract to build much of the IT needed by a South African bank that was separating from its UK-based parent. At the time, LTI was not far from a billion dollars in annual revenue.

That large contract wasn’t a one-off either. The company has continued to win big contracts since then. During the three months ended December 31, 2020, LTI won two large contracts, including an enhanced partnership with Abu Dhabi-based cloud services provider Injazat, which could bring in $204 million in revenue over the next six years, and a net increase of $74 million over a five-year period from an existing global 500 customer.

“I like being an underdog,” says Jalona, speaking over a video call from his home in New Jersey, US. “I might not have the balance sheet to bid for a billion-dollar deal, but I have the capability to bid for a $200-300 million deal because now we are a $1.6 billion revenue company.”

Over the last four years, investors have bought into the LTI promise to the extent that the stock has become the most expensive among India’s IT services companies. It almost tripled from its debut to nearly Rs 2,000 by September 2018. Then, as it became apparent that the world would see a strong ‘up-cycle’ of technology spending in the post-Covid-19 recovery, LTI more than doubled from its Covid-19 low on April 3, 2020 to Rs 4,287.85 on January 15 this year. It was at Rs 4,118 at close of trading on the NSE in Mumbai on February 8.

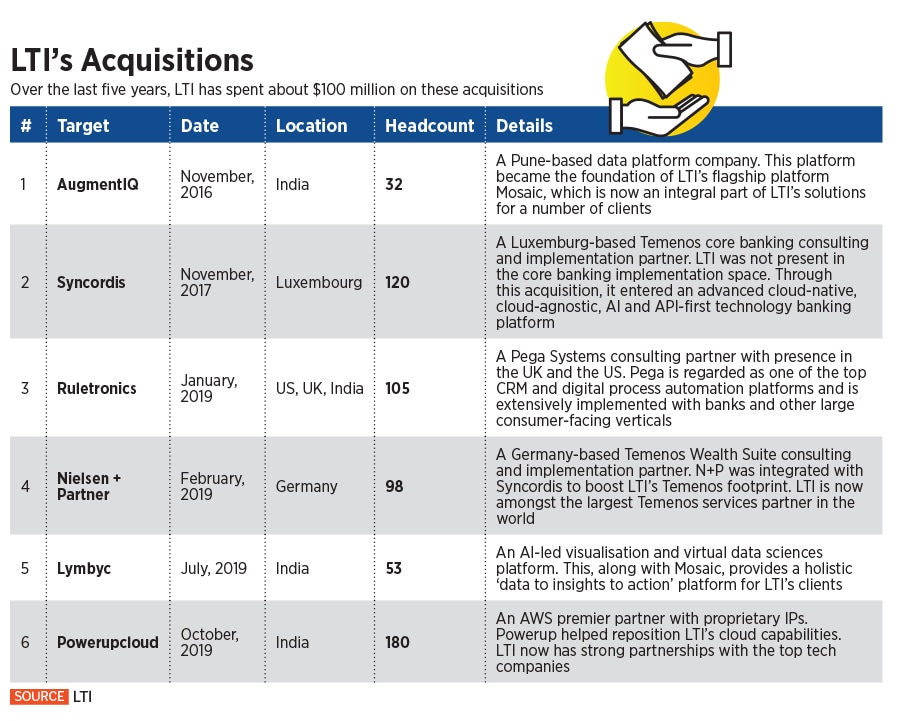

Acquisitions have also helped add some of these capabilities. Mosaic, for example, was built on intellectual property developed by a Pune-based company AugmentIQ that LTI acquired in November 2016. Syncordis, which LTI acquired a year down the line, opened up opportunities in banking software consulting and implementation—specifically, software from Switzerland-based Temenos AG. The acquisition also brought LTI the capabilities to provide banking software from Temenos in an as-a-service model and positioned LTI as a strong tech services provider around banking in the Nordic region, says CMO Dubey.

Acquisitions have also helped add some of these capabilities. Mosaic, for example, was built on intellectual property developed by a Pune-based company AugmentIQ that LTI acquired in November 2016. Syncordis, which LTI acquired a year down the line, opened up opportunities in banking software consulting and implementation—specifically, software from Switzerland-based Temenos AG. The acquisition also brought LTI the capabilities to provide banking software from Temenos in an as-a-service model and positioned LTI as a strong tech services provider around banking in the Nordic region, says CMO Dubey.