Underdog, animal instinct and top dog: Puma's giant leap into the Rs 2,000-crore club

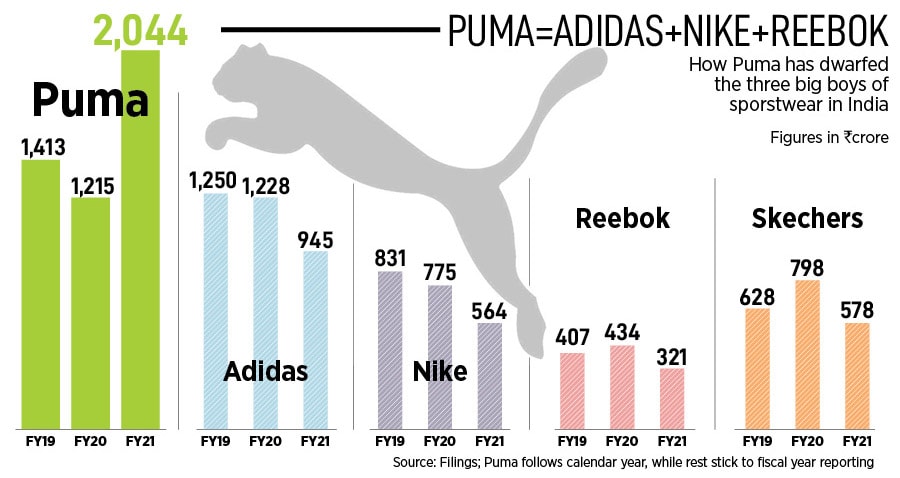

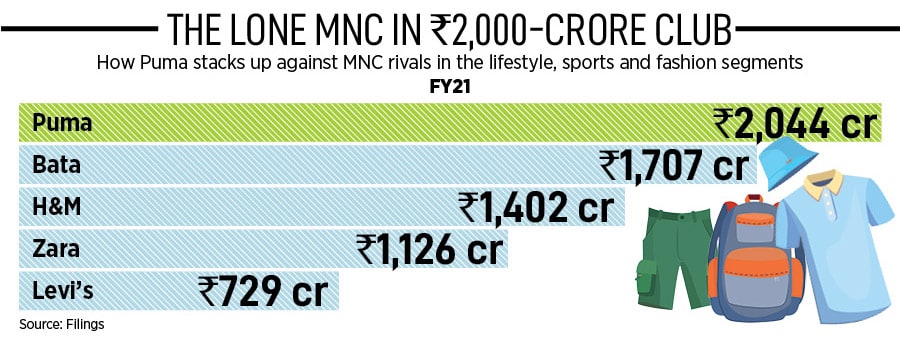

The last big sportswear maker to enter India, Puma is now bigger than rivals Adidas, Nike and Reebok combined. Can the Big Cat continue to roar?

Abhishek Ganguly, managing director, Puma India and Southeast Asia, reckons the underdog tag stoked fire in his belly. It made him perpetually hungry, and relentless.

Abhishek Ganguly, managing director, Puma India and Southeast Asia, reckons the underdog tag stoked fire in his belly. It made him perpetually hungry, and relentless.

The intention was to forewarn. ‘The shoe will pinch’ is how Abhishek Ganguly’s colleagues and friends reacted when they got to know that the regional manager is quitting Reebok. After a three-year stint, Ganguly was set to join rival Puma as director of sales and marketing in November 2005. The concern was valid. Puma, which was the last among the big global sportswear makers to enter India in 2005, closed the first year with a puny revenue of Rs 22 crore. Compare this with the big boys: Nike posted FY06 sales of Rs 99 crore; Adidas was sitting pretty with Rs 186 crore; and Reebok was on the top of the heap with a staggering Rs 354 crore.

‘Who knows Puma’ was how Ganguly’s bosses mocked and pricked the enthusiasm of their soldier who was about to snap the buckles and put on new marching shoes. The cockiness of the biggest brand permeated into the behaviour of the top bosses. “There was a lot of doubt, which could have led to self-doubt,” recalls Ganguly. The questions asked, though, had serious merit. Was there space for one more sports brand in India? Did Puma actually stand a chance in its fight against the big boys? After all, Puma’s underdog status in India was a grim reality.

Ganguly’s intention was to stay firm. The new recruit had lived a life of the underdog, and a series of déjà vu moments only made him more dogmatic.

Five years ago, in 2000, when Ganguly made it to IIM-Lucknow, the maths grad from Bhagalpur University in Bihar encountered one such ‘who are you’ moment. “What is TNB college”, some of his batch mates took a dig, alluding to the institution from where Ganguly graduated. Later on, when he stepped into the professional world, he realised that he didn’t have the ‘ABC’ of management on his resume. IIM-Lucknow was perceived to be fourth on the pecking order of IIMs—Ahmedabad, Bangalore and Calcutta were the top three.

Showcasing the success of PUMA’s Motorsport category in India, the brand’s experiential store at Cyber Hub in Gurgaon features professional-grade Formula 1 racing simulators for shoppers to enjoy a virtual race on multi-country tracks. The simulators installed at the store are exactly the same as used by F1 racing professionals worldwide

Showcasing the success of PUMA’s Motorsport category in India, the brand’s experiential store at Cyber Hub in Gurgaon features professional-grade Formula 1 racing simulators for shoppers to enjoy a virtual race on multi-country tracks. The simulators installed at the store are exactly the same as used by F1 racing professionals worldwide