Lighthouse Canton: Day late but not a dollar short

Singapore's Lighthouse Canton may have entered India only in 2020 but it is zeroing in on the latecomer's advantage—a steady vantage point. Can the global investment firm make its bets count?

Shilpi Chowdhary, Group chief executive officer and co-founder of Lighthouse Canton

Image: Madhu Kapparath

Shilpi Chowdhary, Group chief executive officer and co-founder of Lighthouse Canton

Image: Madhu Kapparath

A lighthouse primarily serves two purposes. First, the powerful flashing light mounted on the top of the soaring tower is used to guide ships. The intent is to help them navigate. Second, the blazing light warns captains of an impending danger. Shilpi Chowdhary points out an obvious third aspect which only a latecomer can spot. “It’s a good vantage point,” says the group chief executive officer and co-founder of Lighthouse Canton. When the Singapore-headquartered global investment firm opened its India account in 2020, it definitely didn’t have a first-mover advantage. “There is enough room for multiple players,” he says, dismissing any notion about carrying the baggage of being late. “We know what we have,” he underlines confidently.

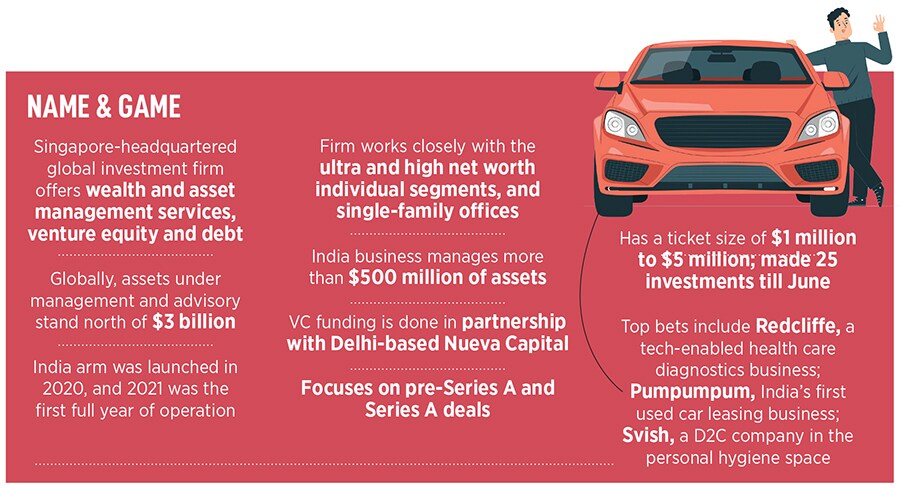

What Lighthouse Canton does have is an edge that not many in the investing world possess. The firm offers wealth and asset management services, and doubles up as a venture equity and debt fund. “We want to capture the whole lifecycle of a startup,” says Chowdhary, who has had stints as managing director of Credit Suisse Private Bank and Citibank in India. “That’s the big opportunity we are chasing,” he says, explaining the dynamics of the fund which tied up with Nueva Capital to roll out LC Nueva Capital, the entity making venture investments.

The fund, Chowdhary explains, comes at pre-Series A stage, has a ticket size of $1 million to $5 million, and later in the growth stages—Series B, C and D onwards—offers venture debt. Most of the companies at the growth stage, he points out, are not too keen to dilute equity. So venture debt becomes a great lever to help them grow. Coming late also meant playing a differentiated game. Chowdhary reckons Lighthouse Canton has been trying to identify niches, look beyond top cities and back players who have the potential to make it big in these segments.

Also read: Stellaris Venture Partners' chosen path: Make contrarian bets, but with deep conviction

Take, for instance, its bet on electric vehicle financing platform Revfin. Started by Sameer Aggarwal in 2018, Revfin finances loans for electric three-wheelers in semi-urban, Tier III and beyond, has its own NBFC, and has set an ambitious target of financing two million electric vehicles over the next five years. The company claims to have so far financed over 10,000 electric three-wheelers across 14 states, is planning to widen its footprint, and diversify into two- and four-wheelers for the last mile and cargo deliveries and ride-sharing taxis.