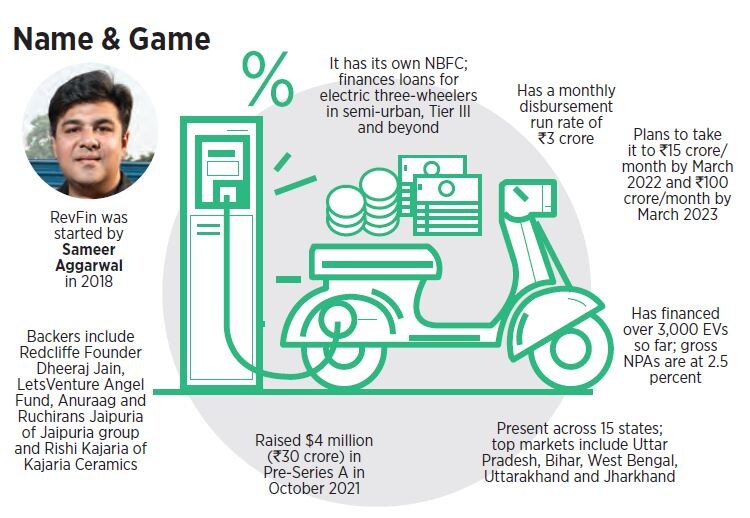

How banker-turned-investor Sameer Aggarwal is financing the EV revolution

Former HSBC banker Sameer Aggarwal has been a prime mover in financing electric rickshaws with RevFin. Will the gambit pay off?

Sameer Aggarwal has financed over 3,000 EVs since 2018

Sameer Aggarwal has financed over 3,000 EVs since 2018

Image: Madhu Kapparath

Sameer Aggarwal’s tryst with ‘prime’ started early. He graduated from IIT Kharagpur—one of the top engineering colleges—in 2006; his maiden job was with HSBC, and after a few years, the Delhi lad relocated to London and continued to work with one of the world’s largest financial and banking organisations. His almost-decade-long stint was dotted with prime roles such as managing £20-billion portfolio comprising credit cards, personal loans and overdrafts, handling credit risk for retail assets globally, and working across six continents in 15 countries.

In 2015, he quit his job. Though keen to start his own venture, Aggarwal wanted to check his appetite for a startup life full of hustle. “I wanted to check whether I am still a corporate guy or do I have it in me to take a solo plunge,” he recalls.

The second innings started on a ‘subprime’ note. Aggarwal joined London-based subprime lending startup Oakam. As head of risk and analytics for two years, he gained rich insights into the financial lives of the underbanked, the ones without any credit history and the ones having a broken track record of repayments. “From prime I moved into subprime, and it was an enriching experience,” he recounts. The stint also prepared him to start his entrepreneurial journey. “It was clear that I wanted to do something in the financial segment,” he says. “But I didn’t know what. There was a lot to explore.” Towards the end of 2017, he came back to India.

After a few months of brainstorming, Aggarwal bumped into an electric vehicle (EV) manufacturer. “It was serendipity,” he recalls. It was October, Delhi was gradually getting chocked due to the annual ritual of stubble burning by farmers across Delhi-NCR, Haryana and Punjab, and the air was already oppressive due to heavy vehicular emissions. “Why don’t you start financing electric three-wheelers?” the visitor nudged Aggarwal, who was sitting in his one-room office in Central Delhi. “They cost around ₹1.5 lakh, and the headroom for growth is massive,” he underlined.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)