Heart, Brain & Endiya: Pumping impact, left, right & centre

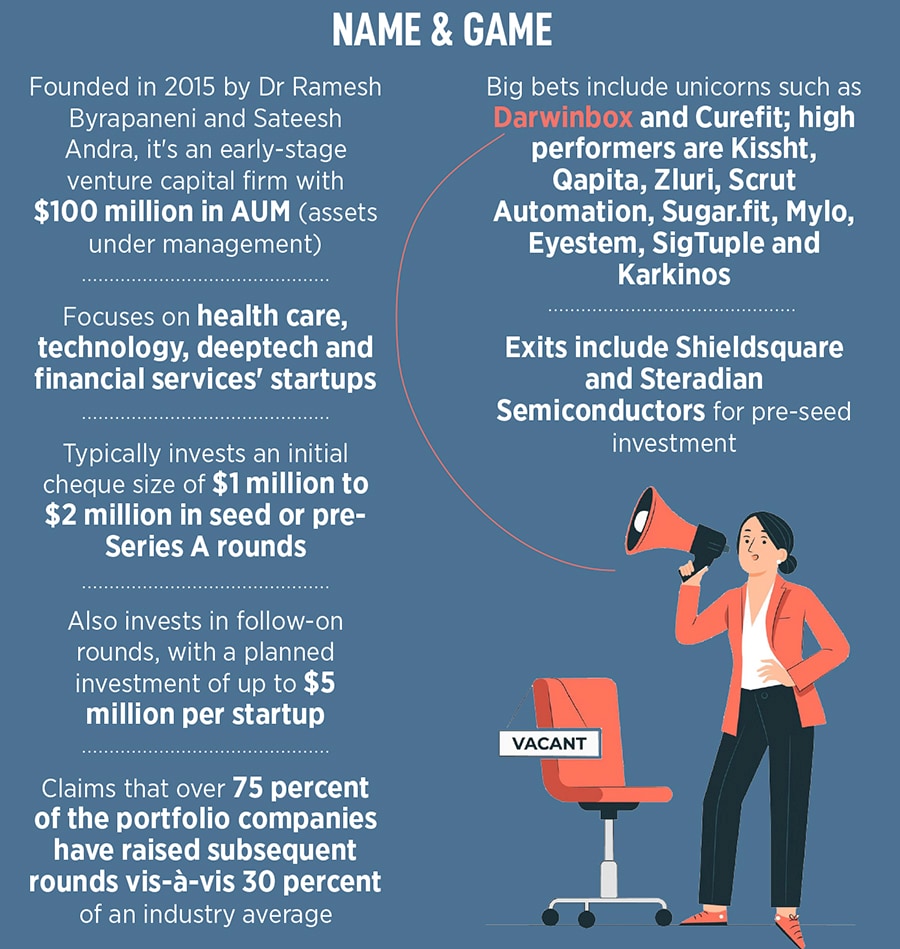

A cardiologist and an electrical engineer are trying to change the physics, chemistry and biology of investing. Can Endiya rewire the venture rules?

Image: Vikas Chandra Pureti for Forbes India Sateesh Andra, MD, Endiya (left) and Ramesh Byrapaneni, MD, Endiya

Sateesh Andra, MD, Endiya (left) and Ramesh Byrapaneni, MD, Endiya

The interview starts with a hypothetical question. Much like electricity that either flows in alternating current (AC) or direct current (DC), if there are two types of entrepreneurs—the ones who are wired to play the game of high valuation whenever it’s on offer, and the ones who know the difference between real and reel but are hyper-possessive in nature—which trait would be more damaging for a founder?

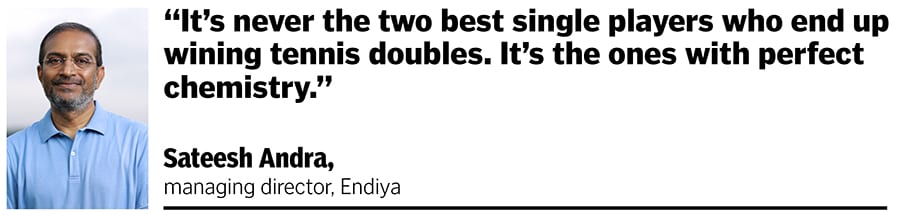

Sateesh Andra, a seasoned entrepreneur and investor for over two decades, doesn’t take a nano-second to reply. “The latter,” reckons the managing director of Endiya, an early-stage venture capital firm with a focus on healthcare, technology, deeptech and fintech sectors. “But is not hyper valuation more dangerous,” is the natural follow-on question. “Nope,” he reckons.

Andra explains his point. “Froth is something you should take advantage of,” he smiles. In a connected world, a smart entrepreneur, contends the electrical engineer, will ideate and build a product wherever she gets the talent, will raise capital from the one offering highest valuation, will sell to somebody who gives highest margin, and will take the startup public or exit when she gets highest multiple. “Why not,” he adds. “A founder must take advantage of froth,” he maintains, alluding to unrealistic valuations on the table due to the glut of capital in the market. He, though, adds a caveat. A smart founder, Andra reckons, would know that the sky-rocketing valuation is an aberration. “It’s not real. So the founder knows how to use the capital to protect her turf,” he adds.

Also read: Niren Shah, Norwest India, and the art of slow and meaningful VC investing

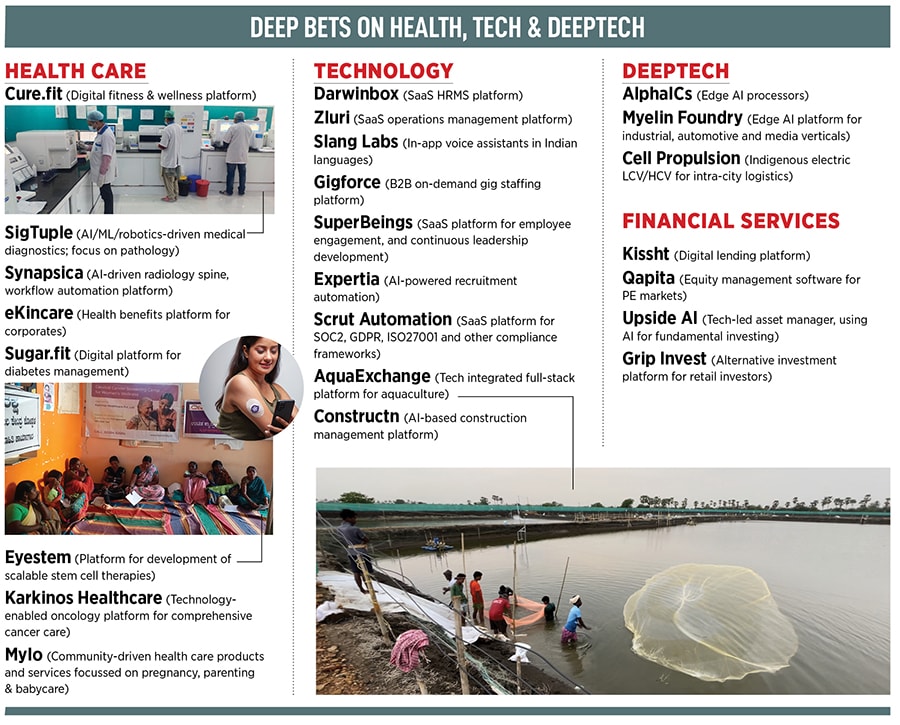

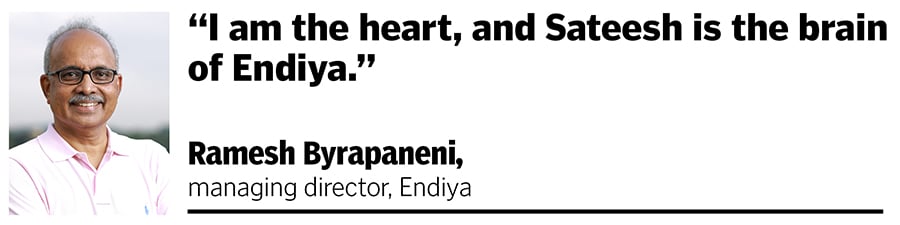

Byrapaneni and Andra, for sure, agree on the core DNA of Endiya. “Its impact over everything else,” says Andra, adding that the mission of the fund is to back startups who can create a lasting impact. That's why, he lets on, Endiya is selective and anal about the whole process in terms of the kind of investors getting into the fund, the types of entrepreneurs who are picked and the amount of money deployed.

Byrapaneni and Andra, for sure, agree on the core DNA of Endiya. “Its impact over everything else,” says Andra, adding that the mission of the fund is to back startups who can create a lasting impact. That's why, he lets on, Endiya is selective and anal about the whole process in terms of the kind of investors getting into the fund, the types of entrepreneurs who are picked and the amount of money deployed.