Niren Shah, Norwest India, and the art of slow and meaningful VC investing

In the era of spraying bullets, Niren Shah and Norwest India believe in dodging bullets when it comes to investing money in startups. Its picky and contrarian strategy has led to a lean and mean portfolio for the American VC firm in India. Will it continue?

Niren Shah, Managing director and head, Norwest India

Image: Mexy Xavier

Niren Shah, Managing director and head, Norwest India

Image: Mexy Xavier

July 2016, Mumbai. The first meeting lasted for just two minutes. “No. He was not having Maggi,” giggles Asish Mohapatra as he recounts his maiden pitch with Niren Shah. “He was too engrossed in having lunch,” says the venture capitalist (VC)-turned-entrepreneur who co-founded OfBusiness with Bhuvan Gupta, Nitin Jain, Ruchi Kalra and Vasant Sridhar in 2015. It was well past noon on a wet Friday. The city was under a thick cloud blanket and a gloomy encounter was the last thing on the mind of the first-time founder who had raised $5 million in February. Mohapatra expected quick funding dollars.

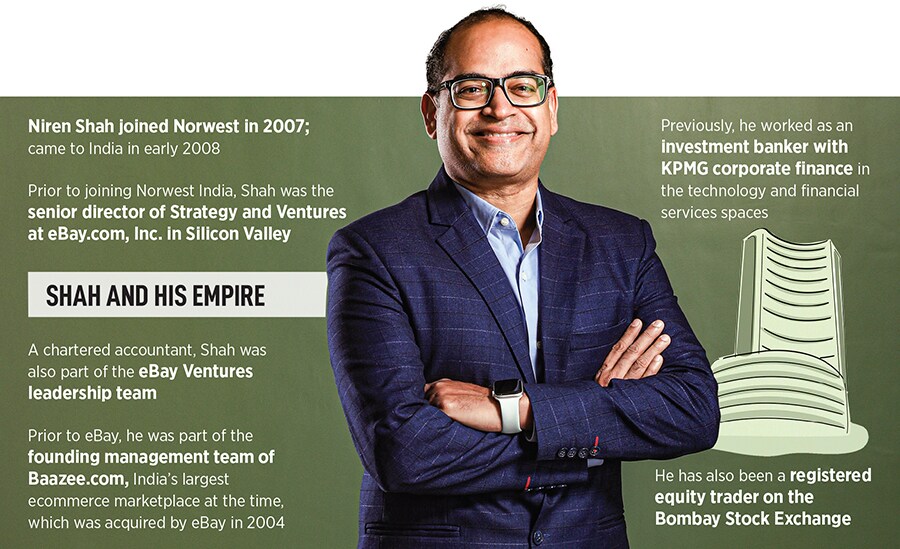

Shah indeed was quick. “Kitna revenue hai, kitna profit hai and management kaun hai (how much is the revenue, profit and who all are in the management)?” he asked in one go. A chartered accountant and investment banker, Shah joined American investment firm Norwest Venture Partners (NVP) in 2007 and came to India in early 2008. Mohapatra was equally brisk in his reply. “We will start posting revenue from next month. So there is no question of profit,” he underlined. Shah paused for a while, glanced at the rookie founder and continued munching. The meeting ended. Shah passed on the opportunity.

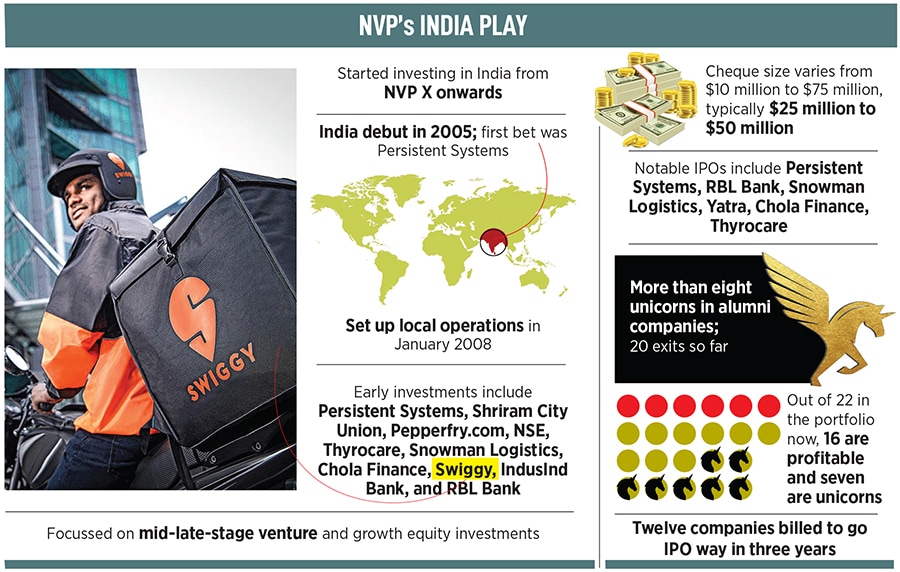

Back in 2008, Shah was camping in one of the villages around Alibaug, around 95 km from Mumbai. It was an age of microfinance, which had fast emerged as the darling of investors. “Back then, it wasn’t cool if you didn’t have exposure in microfinance,” recalls Shah, who decided to test the waters. The VC was taking tentative steps in his formative days at Norwest, which made its first investment in India when it backed Persistent Systems, a leading offshore product development company based out of Pune, in December 2005. Three years later, in January 2008, the American firm set up its India team, and now Shah was scouting for his maiden bet. The herd instinct in the market was strong, the temptation to pluck a low-lying fruit was equally compelling and Shah was busy testing his own investment thesis.

Fast forward to 2012. The funder, along with his young team, was standing outside a huge garbage dump. There was an opportunity to invest in a waste management company which had grown at an amazing clip and had ticked all the boxes in terms of revenue, profit and cash flow. A comforting barometer for any firm looking to invest was the fact that the company had borrowed money from a bunch of reputed banks. What this meant was the business was clean. “We were counting the number of garbage trucks visiting the site every day,” recounts Shah, who was in the midst of his regular due-diligence exercise. “The numbers were not adding up,” he says, alluding to an expected mismatch in revenue quoted and reality. “Where are the trucks? They were missing. Looked like something was fishy,” he adds.

Meanwhile, six years later, in 2018, Shah was close to hitting a jackpot. An opportunity came knocking at one of the top-valued startups in the country—Shah refuses to divulge the details—which was raising its umpteen round of growth capital. Shah’s eyes lit up, and he decided to pursue the opportunity. The entrepreneur, though, hurled a weird requisite. Shah was not allowed to do the due diligence. “But why?” asked an inquisitive VC. “People bigger than you have not done it. So you too can’t,” was the reply. “Either follow them and enter, or be out,” came the parting remark.

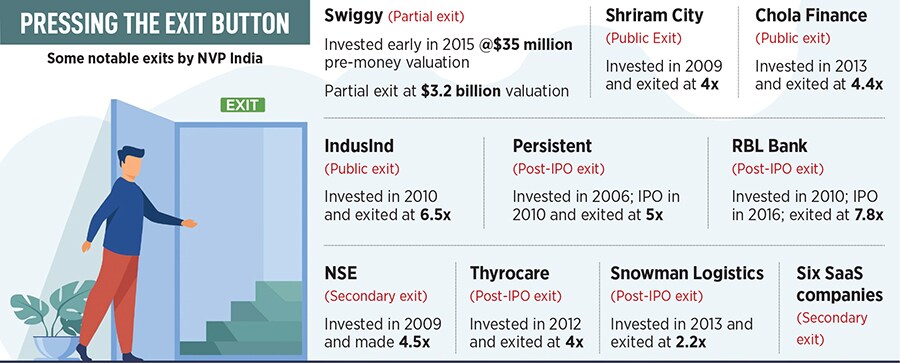

So what’s the secret sauce? Shah explains. “You have to dodge a lot of bullets,” he reckons. The first seven years of the fund’s operations in India, he underlines, was all about dodging as many bullets as possible. “We only did the deals which were so compelling that we could not say no,” he says. “And that has really worked for us,” he stresses, adding that the investment in Sriram City was his first deal with a cheque size of $28-30 million.

So what’s the secret sauce? Shah explains. “You have to dodge a lot of bullets,” he reckons. The first seven years of the fund’s operations in India, he underlines, was all about dodging as many bullets as possible. “We only did the deals which were so compelling that we could not say no,” he says. “And that has really worked for us,” he stresses, adding that the investment in Sriram City was his first deal with a cheque size of $28-30 million.

When asked to select a single quality which sets Norwest apart in a cluttered VC space, the entrepreneur talks about the freedom that the fund brings in. “They will get involved only when you want them to,” he says. What also clicked between Shah and the founder was the common belief in building a sustainable business. “After my Myntra and Medlife experience, I wanted to build a business for the long term,” he says. “This resonated with Norwest. They are very thoughtful investors,” he adds.

When asked to select a single quality which sets Norwest apart in a cluttered VC space, the entrepreneur talks about the freedom that the fund brings in. “They will get involved only when you want them to,” he says. What also clicked between Shah and the founder was the common belief in building a sustainable business. “After my Myntra and Medlife experience, I wanted to build a business for the long term,” he says. “This resonated with Norwest. They are very thoughtful investors,” he adds.