How Purplle is solving beauty for women in tier 2 cities and beyond

One of the early movers in the beauty ecommerce space, Purplle is getting ready to take on the biggest in the business on its path to profitability and scale

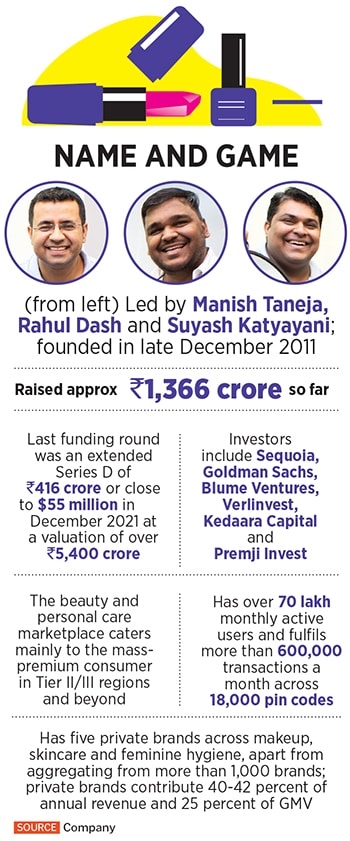

Manish Taneja (centre), Rahul Dash and Suyash Katyayani (left), co-founders of Purplle,

Image: Nayan Shah for Forbes India

Manish Taneja (centre), Rahul Dash and Suyash Katyayani (left), co-founders of Purplle,

Image: Nayan Shah for Forbes India

It was odd—three male engineers from IIT launching a beauty brand catering only to women.

But Arjun Anand, executive director at Belgium-based investment firm Verlinvest, decided to back Purplle anyway. He felt they had the maturity and vision to build a team around them that caters to their audience.

It was late 2019. Purplle, a beauty ecommerce platform, was raising its Series C funding round from a clutch of investors and Verlinvest decided to put in ₹56 crore ($8 million). A few things had piqued Anand’s interest. One was that the company founded in 2011 had gone eight years with just some $10 million of capital. “That capital efficiency in ecommerce is unheard of in startups these days,” he says.

Anand remembers that even at the Series C stage of funding, the founders of Purplle had the maturity and clarity to know exactly what they wanted and what they were not going after. “They asked me to look beyond the top 10 metros and were clear about building for women in smaller towns and cities.” At the time, he explains, that was an underserved and neglected segment, but was a large enough consumer set that would evolve over time.

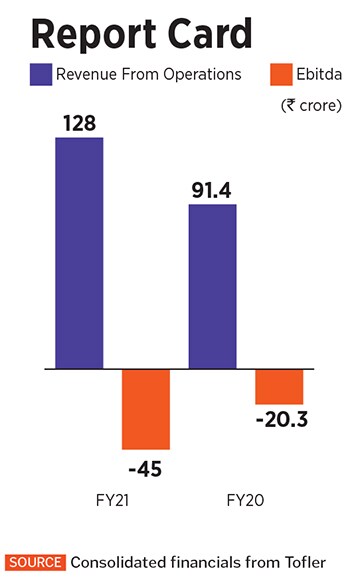

Operating revenue of Manash Lifestyle (the entity that operates Purplle.com) in FY21, as per data from intelligence platform Tofler, is about ₹128 crore, up from ₹91 crore in FY20. “My sense is, over the next two-three years, you will see us growing significantly more than the industry average,” claims Taneja, who is also the CEO, adding that the run-rate of gross merchandise value (GMV) is expected to be around ₹1,500 crore ($200 million).

Operating revenue of Manash Lifestyle (the entity that operates Purplle.com) in FY21, as per data from intelligence platform Tofler, is about ₹128 crore, up from ₹91 crore in FY20. “My sense is, over the next two-three years, you will see us growing significantly more than the industry average,” claims Taneja, who is also the CEO, adding that the run-rate of gross merchandise value (GMV) is expected to be around ₹1,500 crore ($200 million).

Bisen of Technopak says cracking the value market can be challenging due to high price sensitivity. “We are also confronting a high inflation environment and economic uncertainty, which plays out a lot more adversely in the segment that Purplle is catering to,” he says. “Therefore product-price relationships and products made available at the right cost become a big factor.” Purplle will also need a multi-channel approach to target the value-sensitive consumer, he adds.

Bisen of Technopak says cracking the value market can be challenging due to high price sensitivity. “We are also confronting a high inflation environment and economic uncertainty, which plays out a lot more adversely in the segment that Purplle is catering to,” he says. “Therefore product-price relationships and products made available at the right cost become a big factor.” Purplle will also need a multi-channel approach to target the value-sensitive consumer, he adds.