- Home

- UpFront

- Take One: Big story of the day

- Entrepreneur at 49, billionaire at 58: How Falguni Nayar built success with Nykaa

Entrepreneur at 49, billionaire at 58: How Falguni Nayar built success with Nykaa

Investment banker Falguni Nayar launched beauty and fashion ecommerce platform Nykaa from her father's office when she was 49. Almost a decade later, after her IPO was oversubscribed nearly 82.5 times, India's richest self-made woman billionaire says she is only getting started

Naini is a writer at Forbes India, who likes to dabble in storytelling across all forms of media. She writes on various topics ranging from innovation and startups to cryptocurrency and agricultureâanything and everything that makes for an interesting story. Before her stint at Forbes India, she worked for close to a year at Outlook Business. With five years of work experience, she co-produces Forbes Indiaâs video series âFrom The Fieldâ and hosts the podcast âTeenpreneursâ. She also emcees at events and moderates panel discussions from time-to-time. Naini is a part of Forbes Indiaâs digital team, also handles Forbes Indiaâs Instagram account and helps plan events. An avid learner, she has completed her PGDM in Journalism from Xavier Institute of Communication and Bachelorâs of Mass Media from Sophia College for Women in Mumbai. Be it at work or home, you will not find her working without her headphones and work playlist. She loves trekking and travelling, experimenting in the kitchen, watching films and reading.

- EXCLUSIVE: How William Lauder built Estée Lauder Companies into a global beauty giant

- India has what it takes to become a global semiconductor powerhouse: Qualcomm's Rahul Patel

- Is study abroad turning burden from boon?

- Serena Williams and The Good Glamm Group form a joint venture to launch 'Wyn Beauty' for the US market

- Celebrating self-made women: W-Power list 2024

Entrepreneurship is an adventure that needs courage. Age and experience are not liabilities: Falguni Nayar, executive chairperson, managing director and CEO, Nykaa

Entrepreneurship is an adventure that needs courage. Age and experience are not liabilities: Falguni Nayar, executive chairperson, managing director and CEO, Nykaa

Image: Mexy Xavier

The Nykaa headquarters on the fourth floor of Cynergy IT Park in Mumbai’s Prabhadevi is packed with vivacious faces on a Thursday morning. I walk in and check my watch—it is only 9.30 am. While the collaborative open spaces, glass walls, stand-sit desks are all textbook ‘startup office’, there is something that stands out. A majority of Nykaa’s staffers are young women, dressed up to the nines with flawless make-up, shirts tucked into A-line skirts or high-waisted pants to go with high heels. Leading the pack is investment banker-turned-entrepreneur and now India’s second female self-made billionaire Falguni Nayar.

Related stories

The click-clack of the high heels echoes, as these young faces walk, rather, bolt past each other, with cups of coffee. The entire floor is oozing with energy, thanks to the Pink Friday Sale. The IPO buzz is also inevitably in the air. For someone who has been working from home for the past year-and-a-half, watching these heads buried into laptops on their desks and hearing the constant chatter came as a breath of fresh air.

Look out for more stories on entrepreneurs and their ‘Roaring 50s’ in our new special, releasing on 6th December, Monday

As I walk into Nayar’s cabin, her eyes are fixed on the laptop screen as she monitors Nykaa’s statistics. She greets me and then her eyes go back to the screen, even for the minute I take to settle down. I am immediately reminded of what her son Anchit, chairman and CEO of beauty ecommerce, told me a day earlier, “FN [Nayar] is extremely hardworking and barely sleeps. She sends emails at 4 am.”

The pattern follows throughout our 45-minute conversation; it is almost as if her eyes are craving to get back to work. Clearly, Nykaa [meaning ‘heroine’ in Sanskrit] is her passion and the enthusiastic workforce is proof that she leads by example.

Nayar then turns the screen toward me and says, “See, I am just looking at the funnel chart, where we track unique customer visits. It is an art to convert them to paying customers… it is not a simple button that you press, and customers aa jaate hai (people will come to you).” The upper funnel includes customers who visit the website, but may or may not have an intention to buy; the middle funnel includes repeat visitors, but not paying customers; the bottom is where they may have added to the cart, but are waiting for an opportunity to buy. “Since day one, I have been looking at the statistics,” she says, adding that it is something she picked up as an investment banker. “That is the secret sauce.”

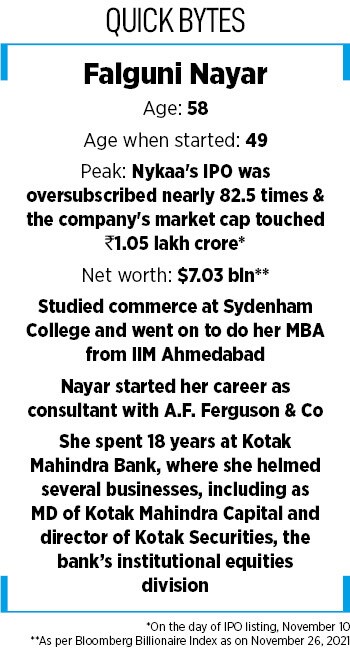

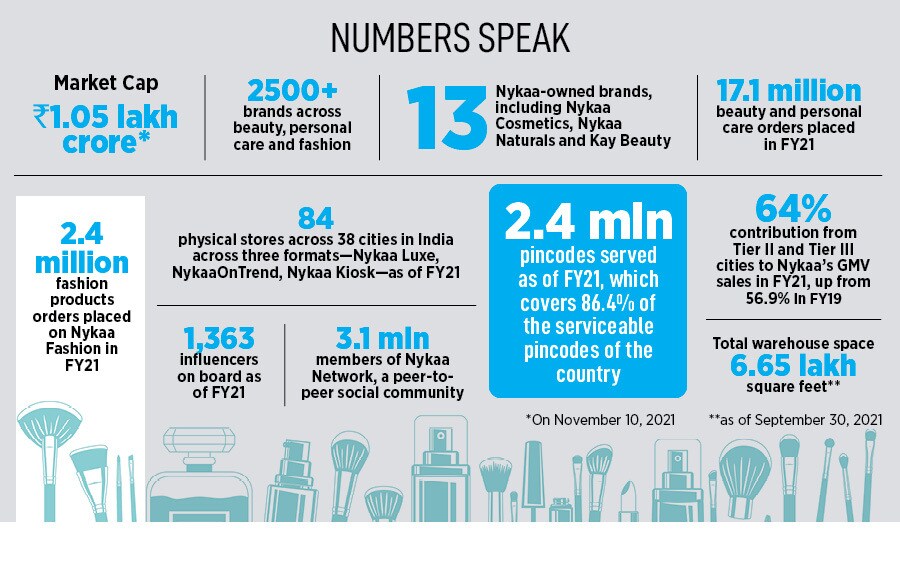

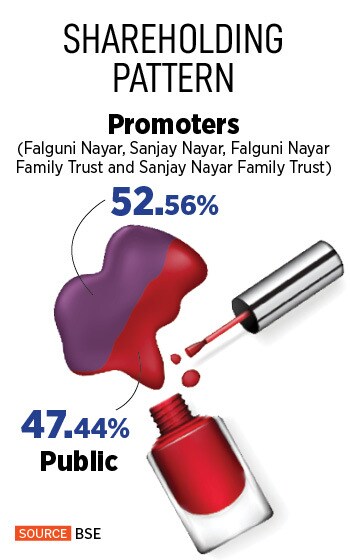

Nayar, 58, has been the talk of town since the company’s blockbuster initial public offering (IPO) on November 10. The ₹5,352-crore IPO of Nayar’s FSN E-Commerce Ventures Ltd was oversubscribed nearly 82.5 times. On the same day, the company’s market capitalisation touched the ₹1 lakh crore mark. Nayar, who owns 52.56 percent stake in the company, became India’s richest self-made woman billionaire, with a net worth of $7.03billion (₹52,794 crore) as of November 26, according to the Bloomberg Billionaires Index.

Nayar, 58, has been the talk of town since the company’s blockbuster initial public offering (IPO) on November 10. The ₹5,352-crore IPO of Nayar’s FSN E-Commerce Ventures Ltd was oversubscribed nearly 82.5 times. On the same day, the company’s market capitalisation touched the ₹1 lakh crore mark. Nayar, who owns 52.56 percent stake in the company, became India’s richest self-made woman billionaire, with a net worth of $7.03billion (₹52,794 crore) as of November 26, according to the Bloomberg Billionaires Index.

Modest to a fault despite the blockbluster listing, Nayar says there has been no high point in her career. “I do not think I have one,” she says. Not even the IPO? Nayar admits it is a “big milestone”. “During our roadshow, we met some global investors who are called ‘Champions of Investing’ and run big tech funds. They gave attention to our business model, understood it, asked some tough questions and told us that we have something unique and built the right business. That gave me a lot of satisfaction. So, if you consider that a high point…”

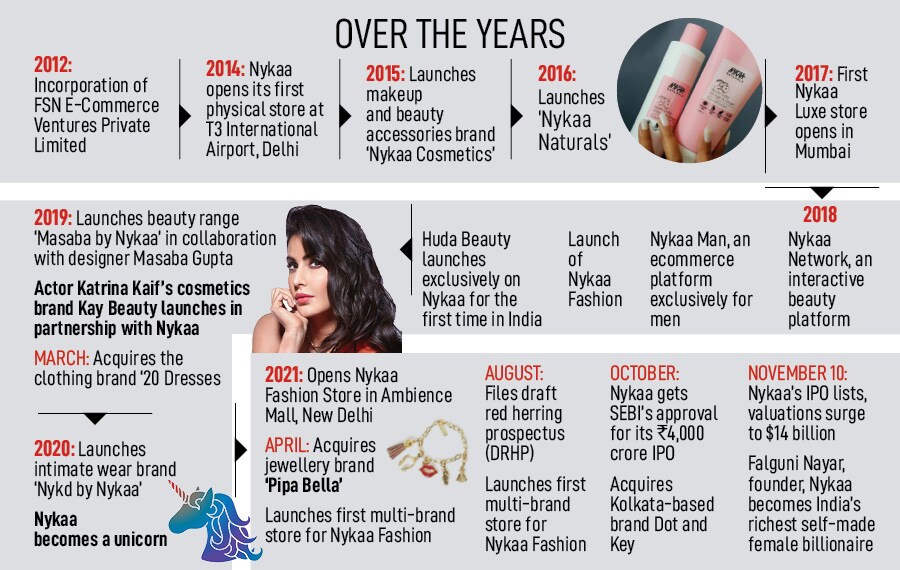

It was around 2009 that Nayar, then managing director at Kotak Mahindra Capital, started considering a second innings as an entrepreneur. By 2011, she had a couple of ideas, one of them was being a multi-brand retailer in the beauty segment. She was 49 when quit her job in March 2012 and launched Nykaa.

On April 1, Nayar started working on Nykaa and by April 21, she registered her company FSN E-Commerce Ventures Private Ltd. By May 1, she had three employees. She started out of her father’s small office—which could seat 10-15 people—at Vasan Udyog Bhavan in Lower Parel, Mumbai. Nykaa’s website went live on October 1. “I often joke,” says Nayar, “that it was like taking a bride to the mandap when she was not ready. The website was fully operational by January 2013.”

It was around the same time that her daughter Adwaita started helping at Nykaa. “After I graduated, I spent some time with mom in India, helping her decide what the wireframes would look like from my bedroom. But like a good Indian mother, she said you should go work in the US for a bit,” recalls Adwaita. In a couple of months, she quit her job at Bain & Company as an associated consultant, and came back to Nykaa.

It was around the same time that her daughter Adwaita started helping at Nykaa. “After I graduated, I spent some time with mom in India, helping her decide what the wireframes would look like from my bedroom. But like a good Indian mother, she said you should go work in the US for a bit,” recalls Adwaita. In a couple of months, she quit her job at Bain & Company as an associated consultant, and came back to Nykaa.

Adwaita admits the early days were challenging. “Our founding team quit within a year of launch. The website would keep crashing. Our CTOs kept quitting. We had no enterprise resource planning (ERP) system in place, which meant that the minute we hit 100 orders, the whole system crumbled. Mom and I would be at the warehouse packing boxes,” she recalls. Once they started investing in marketing, by August 2013, around Raksha Bandhan, demand picked up. They started getting 60-65 orders a day. When Nykaa participated in the second edition of the Google Online Shopping Festival in December that year, that number shot up to approximately 1,000 orders a day.

“Back then, I was so young… I realised entrepreneurship is so hard and such a roller-coaster—there are so many highs and lows. Particularly the lows… it was hard for me to be thick-skinned,” says Adwaita, who spent about two-and-a-half years at Nykaa before pursuing her MBA at Harvard Business School. Two years later, in 2017, she rejoined Nykaa as head of retail business.

Such a long journey

Nayar was one of the few ‘professional entrepreneurs’ at Kotak, as she took up roles that included setting up offices in new locations, including New York and London. “At Kotak, we were encouraged to do new things. The bank was fairly small then, so a bunch of us got to take up entrepreneurial roles, where the path of how you have to do things is not well laid out… you have learn to find innovative solutions,” she says.

It helped Nayar understand that return on equity and long-term sustainability of the business matter, which is what she tried to implement at Nykaa. “As an investment banker, I have seen companies go up and down. Only companies that create long-term sustainable value for shareholders, customers and everyone in the ecosystem survive and thrive.”

The investment banker in her was aware that raising capital immediately would lead to questions such as: ‘Why do you think you will get this margin?’ and ‘How will you acquire customers at this cost?’ “I did not want to be questioned on assumptions. I chose to make it [the business model] work and only then raise capital,” she says.

Some of Nykaa’s early investors included Smita Parekh, wife of HDFC Ltd Chairman Deepak Parekh; corporate lawyer Zia Mody of AZB; Hong Kong-based billionaire Harindarpal Banga of Caravel Group and Sharrp Ventures, which manages the Mariwala Family Office.

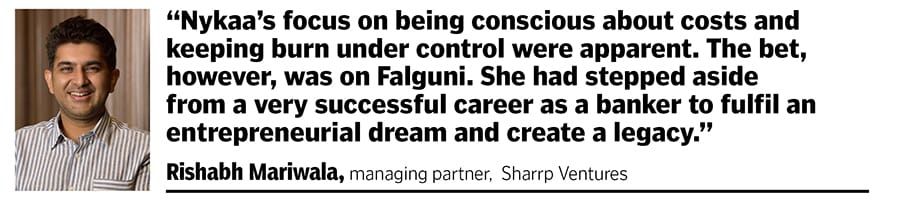

Rishabh Mariwala, managing partner at Sharrp Ventures, says, “Nykaa had shown some traction on the marketplace vertical. Its focus on being conscious about costs and keeping burn under control were apparent. The bet, however, was on Falguni. She had stepped aside from a very successful career as a banker to fulfil an entrepreneurial dream and create a legacy.”

He strongly believes that Nayar is a risk-taker. “Without taking reasonably high risk, it is impossible to build the business that she has. It is not merely about diving into high risk initiatives. It is about making a proper assessment, experimenting, and having a risk mitigation plan,” he explains. Some of Nayar’s biggest bets have been on people. Her initial top management comprised members who were not from the beauty and personal care industry, “Sometimes you have to give people a chance. I bet on myself and everyone,” says Nayar.

Off-the-beaten path

In the first five years of Nykaa’s journey, people would ask Nayar, “How will you Amazon-proof your business… with Amazon coming in, giving discounts and killing your business?” These questions are asked even today. But Nayar was clear from day one that she wanted to do the ‘right business’. “We did not have an ambition that was driven by a need for a certain GMV (gross merchandise value) or valuation,” she explains. “We wanted happy customers. So, we went down that path.”

There were certain trends and models that Nayar chose not to follow. One of them being an inventory-based model over a marketplace, something most ecommerce players follow.

Adwaita says the team was clear from the beginning that beauty had to be run as an inventory-based model. “Beauty has a lot of variety, and customers know exactly what they want. One of the pain points in the market was that they wanted shade XYZ, but it was never available. We felt the way to deliver on availability was by holding stock,” she says. Another reason was that they can have superior delivery timelines and customer experience.

The second was the concept of brand-funded sales. “We respect the brands that our partners are building. A lot of horizontal platforms want to acquire customers and hence they discount or they see brand discounts as a way to build GMV. We did not look at it that way,” says Nayar. The strategy at Nykaa was that if brands wish to discount, they pass it on to consumers. Some luxury brands do not do that and instead offer free products.

The second was the concept of brand-funded sales. “We respect the brands that our partners are building. A lot of horizontal platforms want to acquire customers and hence they discount or they see brand discounts as a way to build GMV. We did not look at it that way,” says Nayar. The strategy at Nykaa was that if brands wish to discount, they pass it on to consumers. Some luxury brands do not do that and instead offer free products.

Another popular trend they did not follow was the ‘beauty box’—a concept that was becoming popular not only in India, but also the US. Customers subscribe to these, and every month, the company sends four to five beauty products. After sampling them, the customers decide to buy it. Nykaa decided not to launch beauty boxes. “We made our own choices, and did what we thought was the right choice for us. We did not try to copy others,” says Nayar, an IIM-Ahmedabad graduate, who met her husband, KKR India CEO Sanjay Nayar, in college.

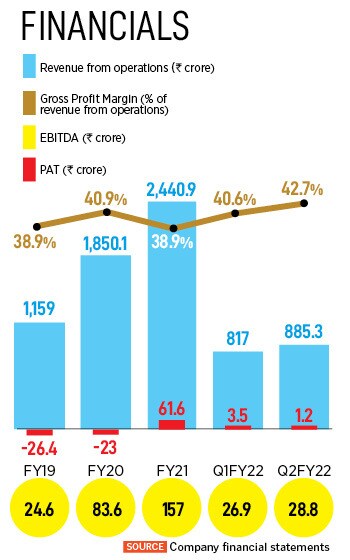

The company’s revenue model works majorly on the margins it earns by selling every product. “We enjoy about 30 to 40 percent gross margins, which is very healthy. This is because we give a full bouquet of services to brands. New brands are launching on Nykaa for the first time, since they get access to 15 million customers from day one,” says Arvind Agarwal, group chief financial officer, Nykaa. Once a brand is a part of the platform, complete end-to-end marketing, including digital ads, influencer marketing, educational content creation, is done by Nykaa. Based on the kind of deal it has with each brand, Nykaa gets a margin for every product sold on the platform, which covers all costs—storage, overheads and shipping. Its order value is almost double that of the industry average—₹1,800-1,900 for beauty and ₹3,200 for fashion, claims Agarwal, who has worked with ecommerce giant Amazon in the past.

From the early days, Nykaa has had a mix of experienced professionals and young team members. “Our generation lived on social media, so we understood the power of social media and digital. Very early on, we realised that it was working well, and we kept following that strategy,” says Adwaita, co-founder of Nykaa, and now CEO, Nykaa Fashion. Educating the audience was an important marketing strategy, which is why the company bet on influencer marketing. “From day one, we have had disproportionately large teams focusing on content creation and education. Once you start seeing that the slightly more complicated products are selling, you have the validation that education works in pushing sales,” Adwaita says.

Different verticals

By 2015, Nykaa launched its beauty brand, with products in areas where it saw certain market gaps in terms of price points. First came nail enamels, and then some bath and body products. After launching a few products, the company roped in Reena Chhabra, who was COO at Colorbar, to head Nykaa’s private label for beauty. The company realised it was a specialised segment that needed a lot of attention to detail—from labelling and colours to production. Even now, manufacturing is not outsourced completely. “The packaging comes from somewhere, inner packaging from elsewhere, the perfume from France or Switzerland, caps and bottle from somewhere. It is quite a complicated supply chain in putting these products together,” Nayar explains.

Launching Nykaa’s private label was a risk too, says Mariwala. “New brands do not have very high success rates. However, her strategy with the private label vertical was to improve margins,” he says. After nail enamels, lipsticks, kajal sticks and body mists in beauty, Nayar in 2017 took the plunge into a new segment: Fashion.

“Mom often comes to me with a glint in her eyes, saying, ‘Let us look at a new business’. It happens all the time… she is a huge risk-taker, always dreaming up new businesses. On the other side, I am like, ‘Are we ready? Can we really do it?’,” says Adwaita. This happened first when they moved from online beauty to offline retail stores and then with fashion. She laughs, “I am just put at the end of starting new things.”

Nayar was sure of entering the fashion market given that the estimated size of the industry was 5-6x the size of the beauty industry. According to Statista, the Indian fashion industry is expected to show compound annual growth rate (CAGR) of 10.14 percent, resulting in a projected market volume of $25,743 million (approx ₹1.93 lakh crore) by 2025.

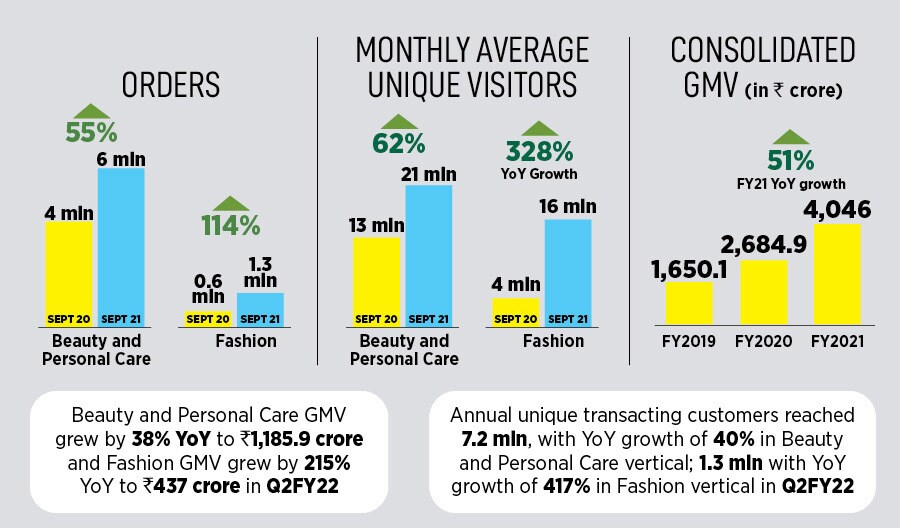

“She has an uncanny knack of recognising that these are large opportunities. So I did not push back too much,” says Adwaita. Two-and-a-half years later, fashion’s GMV grew by 256 percent year-on-year (YoY) to reach ₹665.6 crore in FY21. Its annual unique transacting customers reached 1.3 million with YoY growth of 417 percent at the end of Q2FY22. Nykaa turned into a lifestyle brand with Nykaa Fashion enterting the kids, men and home segments too.

Currently, Nykaa Fashion is a multi-brand platform with close to 1,500 brands—five of these are its own brands, two it has acquired and three it has built from scratch. Nykaa Beauty and Nykaa Fashion are separate businesses. “Beauty and Fashion are completely distinctive markets and we run them differently—beauty is inventory-based, fashion is a marketplace model,” says Adwaita.

When Nykaa first decided to move into the retail space, Adwaita travelled all over India—from Jalandhar and Ludhiana to Chennai and Guwahati. This helped her gauge consumer insights, which have helped her with Nykaa Fashion as well. “The general assumption is that the metros are the trend setters,” says Adwaita. “But when you see women dressed in Guwahati, Jalandhar and Ludhiana, they put the Mumbai girls to shame in terms of how well-dressed and aspirational they are.” According to her, there is not much difference between Tier I and II cities. From the beginning, Nykaa Fashion has seen equal demand from Tier I, II and III cities.

Son steps in

After spending close to seven years in the media and telecom banking, high yield, and equities departments at Morgan Stanley, New York, Anchit moved back to India. Around 2018, he joined Nykaa to run the retail side of the business. “I wanted to help out given how much the business was expanding… it was a phenomenal learning experience and a once-in-a-lifetime chance to build the business,” he says.

Online was booming, and Adwaita had just started the offline business by setting up close to 20 stores across India. Anchit took over the retail business then, and grew it to 60-70 stores in about two years. “FN [Falguni Nayar] always wanted us [Adwaita and me] to join the retail business first because of how challenging it is...if you just do ecommerce, you do not meet the customer base, and our success depends entirely on what the consumer thinks,” he explains. The offline business has grown to 84 physical stores across 38 cities over three formats—Nykaa Luxe, NykaaOnTrend, Nykaa Kiosk—as of September 30.

Around 2013, Nayar found out that customers preferred an assortment of products over discounts. Hence, Nykaa made an effort to onboard various international brands from Korea, Japan etc. “Today,” says Anchit, chairman and CEO, beauty ecommerce, “there are big brands like Huda Beauty and Charlotte Tilbury selling on Nykaa without having a single employee in India. We manage everything for them— from imports and pricing to storing in warehouses and marketing.” Not only does Nykaa reach out to brands to be a part of the platform, but often new brands reach out to them. Earlier, it was only the legacy brands in the beauty and personal care space that people knew about. That has changed. “Nykaa has democratised access not only for consumers but also for brands,” says Anchit.

Nykaa as a platform is majorly focussed on women and thus came the decision to set up a different platform for men: Nykaa Man. The male grooming market in India stood at $643 million (₹4,828 crore) in 2018 and is projected to grow at a CAGR of over 11 percent, to cross $1.2 billion (₹9,010 crore) by 2024, according to Research and Markets. Explains Anchit: “We created a lifestyle platform for men, where they can shop for everything from personal care and grooming to tech accessories.”

Nykaa as a platform is majorly focussed on women and thus came the decision to set up a different platform for men: Nykaa Man. The male grooming market in India stood at $643 million (₹4,828 crore) in 2018 and is projected to grow at a CAGR of over 11 percent, to cross $1.2 billion (₹9,010 crore) by 2024, according to Research and Markets. Explains Anchit: “We created a lifestyle platform for men, where they can shop for everything from personal care and grooming to tech accessories.”

Nykaa’s next big bet is growing in the e-B2B space with its ‘Superstore’, which was launched in Q2FY22. This looks at small retailers who sell multi-brand products and deal with multiple distributors. “Now all shopkeepers get access to all brands sitting on our platform at wholesale prices—the assortment they get is massive and they can place orders online, based on the ratings and reviews customers give,” says Anchit. Once shopkeepers place an order, the supply chain is taken care of by Nykaa and products are delivered to them.

Covid-19 was a big learning and “taught us to be very agile”, emphasises Nayar. Around April 2020, the loss in a month was higher than the loss it had ever made in a year. Nykaa took the call to not let go of employees and moved into hyperlocal deliveries of essential goods.

After the initial setbacks, by July-September 2020, things started looking up. Around October-December 2020, the company had a strong quarter, though numbers did not reflect the same, because of continuing supply chain constraints. It was around that time that Nayar and team decided to start preparing for an IPO. The process took almost a year. “What was different for us is that FN was sure from day one that she wanted to run this company like a public company with the right corporate governance,” Anchit says.

About going for an IPO during a pandemic year, Agarwal says, “The great thing about our IPO was that Falguni was leading it from the front, and she has been an IPO banker herself. When I joined in June 2020, she told me that when our company is ₹80-100 crore in PAT (profit after tax), we should do the IPO. Last year, we became PAT positive… so we started the process.”

Nayar says that since Nykaa’s consumers are Indian, she did not even consider listing in US or other markets. “We did not even see what our valuation would be there. We are an Indian company and from the very beginning, we wanted to list in India,” says Nayar.

The IPO was oversubscribed nearly 82.5 times. Nykaa’s shares debuted at ₹2,001 on November 10 against the issue price of ₹1,125, nearly 80 percent premium. “A good listing was broadly expected… however, the magnitude of premium at which the listing took place was certainly not expected,” says Narendra Solanki, head-equity research (fundamental), Anand Rathi Shares & Stock Brokers. “We think the company’s current strategy is more than sufficient for mid-term growth prospects which includes store expansion, launch of new brands, increasing delivery efficiency and customer fulfilment.”

Post listing, however, the company saw a 95 percent decline in net profit at ₹1.2 crore for the September-ended quarter compared to ₹27 crore in the year-ago quarter. Nykaa attributes this to customer acquisition costs. “It was a conscious choice to step up marketing to 13.5 percent,” Agarwal explains. “If you look at other metrics like unique customer visits, beauty has gone up to 21 million and fashion to 16 million this quarter. Our upper funnel looks sound, and this is an opportunity for us to convert the visits to buyers, which will reflect in growth at some point.”

Additionally, he believes the investment in building capacities like new warehouses, eight new physical store in this quarter have also contributed to the drop in profits. “During the investor call, we warned our investors of a possible loss this quarter. However, we were just about profitable,” Agarwal adds.

Nayar explains the need to convert customers into buyers. “We can stop growing today if we stop spending on acquiring customers and turn highly profitable. But we have chosen this balanced business model, which to my mind is sustainable in the long-term,” she says.

Nayar says she never realised Nykaa was the ‘next big thing’ until listing day. “We did not anticipate this kind of a post-listing performance. I think the investors liked that we have a long-term orientation,” she says. In terms of the next big milestones, she adds, “Nothing, just keep going.”

Her critics frowned upon Nayar’s entry into the beauty segment, taking up entrepreneurship at 49, but her grit, determination and passion have kept her going. “Entrepreneurship is an adventure that needs courage. Age and experience are not liabilities. When you are young, it is easy because there is no downside. Typically, with age, you somehow put these constraints in your mind that you have enough to lose if you do not succeed,” says Nayar.