Meet the women of Dalal Street

Despite challenges of culture and access to capital, female participation in trading and investing is increasing albeit cautiously, and they are vying to be taken seriously

Mahek Shah

Mahek Shah

Do you even know what volumes mean in the stock market?” Mahek Shah was asked this question in 2017. She had just started trading a year earlier, as a 19-year-old, and was asked this question by a man who found it difficult to take her, or women in general, seriously when it came to trading on Dalal Street. But Shah let her work speak for itself.

Intrigued by the stock market, Shah first tried her hand at intraday trading in 2016 while she was still in college, armed with savings of Rs 20,000. She was fascinated by the thrill of it all: The dynamic price movements right in front of her eyes, the constant tracking and monitoring of stocks, the determination to understand technical terms, and the rush of earning good profits when she made the right decisions. Shah gradually started trading with Rs 1 lakh or Rs 2 lakh, and the highest profit she has made in a day’s trade went as high as Rs 77,000. She started day trading full-time after graduating in 2018, her eyes glued to her laptop screen between 9 am and 4 pm, five days a week.

There were losses too: Three months into her trading in 2016, Mumbai-based Shah lost Rs 10,000, while trading with a capital of Rs 40,000. Later, she lost Rs 40,000 while taking up multiple trades to cover up for the loss made in one trade on a single day. “That disheartened me, but I decided to learn from my mistakes. That way, no day will be wasted and eventually, my money will grow,” she says. Shah learnt how to be more cautious, how to implement stop-loss limits to trades every day, how to be calm and focussed even when the markets are volatile, and how to tirelessly keep learning.

Shah is now pursuing a postgraduate degree in finance and investment banking in the UK. Even after a 25 percent scholarship, the tuition fee came to Rs 12 lakh, half of which she paid from the profits she made as a day trader. The rest was sponsored by her family, which she intends to repay soon. She has just moved to the UK for her year-long course, but has no intention of quitting intraday trading. “Once a stock trader, always a stock trader. I want to trade in the foreign market here by putting into practice what I’ve learnt in India,” says Shah, 23. “I have seen the power of trading and value investing now, and I know that if done correctly, it can give you high profits and quick financial independence in a couple of years.”

Pandemic Push?

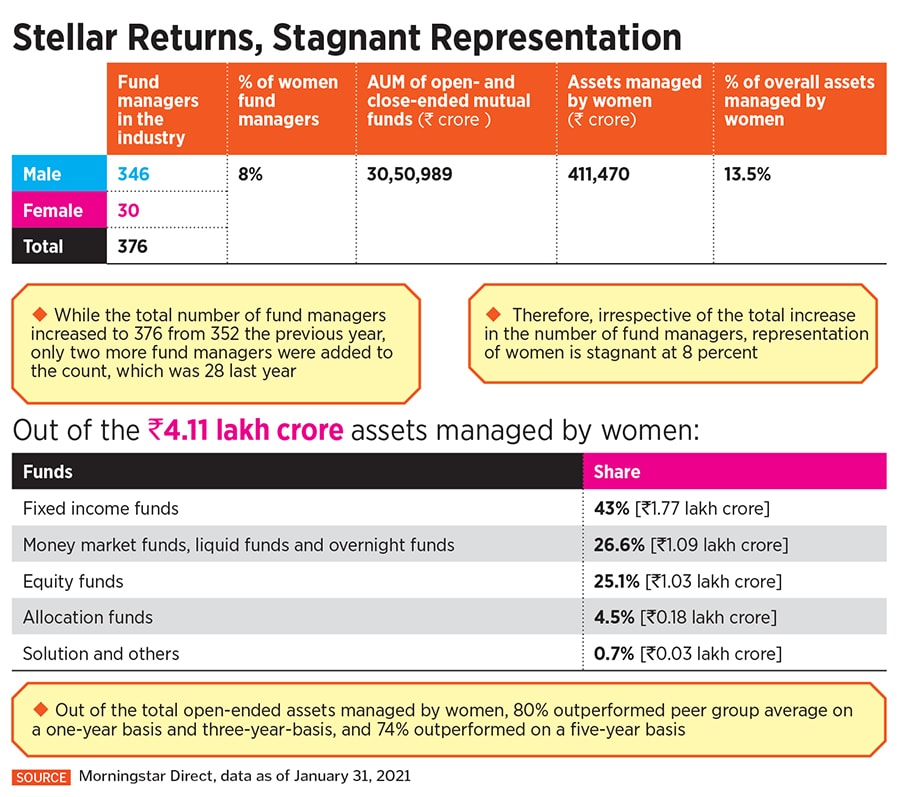

The stock market, with all its number-crunching, technicalities, risk and volatility, has traditionally been a male domain. It continues to be largely so, but more women in the country are gradually participating in trading and investing, particularly in equity, with the upsides being money, financial independence and a flexible career. The widening reach of the internet, the freedom to work remotely, low initial investments, access to training resources and inspiration from other successful women are encouraging them to take this up.

The number of women on brokerage firm Zerodha’s online trading platform, for instance, has increased to 7.2 lakh, up from 3.5 lakh last year, and they form 16 percent of the total traders on the platform. The average age is 30, says co-founder Nikhil Kamath, and the average ticket size women invest is about Rs 80,000. “A lot of them have bought into the corrections that the pandemic got with it. Hopefully, this is a precursor of increased participation and more women coming on board,” he says.

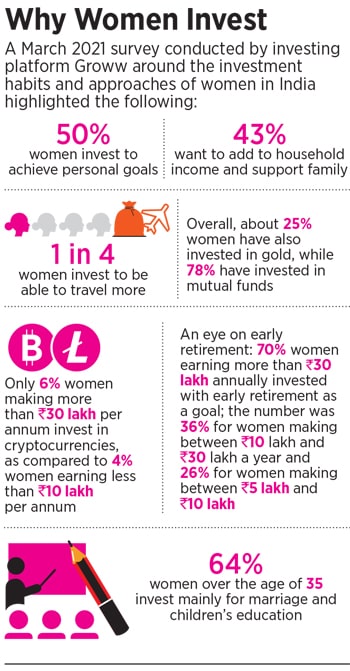

A survey conducted by online investment platform Groww among 28,000 women investors in March indicated that more of them are emerging as primary decision-makers for their wealth, as opposed to turning to the men in their family. In the 18 to 25 age group, almost 60 percent women say they take their own financial decisions.

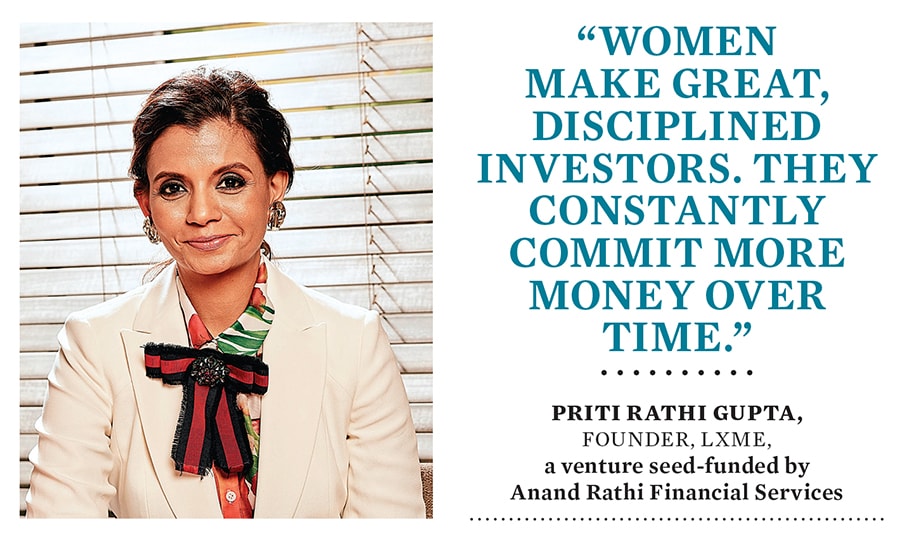

Close to 10 percent of Groww’s one crore-odd customers are women. “We have seen a significant growth in the number of women investors on our platform in the past year compared to previous years,” says Lalit Keshre, co-founder, Groww. “The pandemic-induced lockdowns and work-from-home conditions have given them more time to research about investing in stocks and mutual funds,” he says. According to a September 2020 report in The Hindu, stock broking fintech startup Fyers acquired 20,000 new customers between last May and September, 10 percent of whom were women. Overall, women form around 15 to 20 percent of the platform’s customer base. Lxme, a financial platform dedicated to women, conducted several bootcamps to improve financial literacy last year, which saw participation from over 25,000 women. The transaction platform was launched in 2018, an online community in 2020, and currently, Lxme has over 15,000 women investors. The 6,400-odd women on its members-only Facebook page will be onboarded on the app by April. “Women make great investors. They understand what they are investing for, they are disciplined and not fickle-minded, and constantly commit more money over time, depending on their financial goals,” says Priti Rathi Gupta, founder of Lxme, a venture seed-funded by Anand Rathi Financial Services.

Gupta believes women are increasing their participation despite market conventions being stacked against them. “First, manufacturers and distributors of financial products have a ‘communication by men, for men’ approach, reinforcing that men take charge of money better,” she explains. Second, markets are often projected as a zero-sum game. “From The Wolf of Wall Street to Scam 1992, the narrative is that either you make vulgar amounts of money, or you lose it all. Women, being cautious investors, want to protect what they have instead of taking huge amounts of risk. So they are put off by the perception that they should enter the markets only if they are willing to lose all their money.”

Third, she adds, while men build trust by way of immediate transactions, women try to discover products and instruments—particularly big-ticket purchases—by reading, talking to people and taking advice from experts and the community. “That’s a long journey. Typically, a financial firm does not have the patience for that,” Gupta says.

Most of the previous generation stuck to investment options like fixed deposits or gold, thus nurturing the mindset that markets are not for everyone. “We do what our parents do. So either many women do not have the time or inclination to get into trading, or many of them still turn to the men of their family to make financial decisions for them,” says Apeksha, 35, who mainly does intraday trading, apart from positional index and stocks trading.

She started trading three years ago without a mentor, poring through books, online resources and social media, where she found other helpful traders who introduced her to different trading methods and strategies like technical analysis, market profile, options trading etc. “You just have to keep trading, test what you’re reading, and implement it in live markets,” says Apeksha, who primarily follows the Nifty index for intraday trades. She believes she’s just a beginner who has not seen her share of bull and bear runs, and has not experienced “life-changing” profits or losses so far.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)