SaaS outlook: No more castles in the cloud

Indian SaaS companies are focusing on delivering cost savings and improved efficiency to enterprise customers as the going gets tough

Growth in SaaS spending has also slowed, despite strong demand in areas such as IT service management, HCM, analytics and business intelligence

Illustration: Chaitanya Dinesh Surpur

Growth in SaaS spending has also slowed, despite strong demand in areas such as IT service management, HCM, analytics and business intelligence

Illustration: Chaitanya Dinesh Surpur

Zoho’s $1 billion revenue milestone has put the spotlight again on India’s software as a service (SaaS) sector, even as enterprises around the world are focusing more on cutting costs and improving efficiency.

So far so good. That’s the message from entrepreneurs and investors alike, on the outlook for India’s SaaS sector, while there are some slivers of hope that the war in Ukraine is a step closer to ending, or the global economy might turn around because some of the most recent US inflation data was better-than-expected.

“Fundamentals matter now more than ever, and our industry has to learn to lower the friction of technology, so that technology becomes far more affordable,” Zoho’s co-founder and CEO Sridhar Vembu said in a press release on November 8.

“Growth has slowed down quite a bit in 2022 over 2021,” Vembu says, but companies such as Zoho, offering diversified product portfolios and saving money for customers, are winning.

“The markets are speaking more loudly some of the fundamental truths about any market,” says Hemant Mohapatra, a partner in India at global venture capital firm Lightspeed.

Undifferentiated technologies in crowded categories are not attractive; inefficient scaling of SaaS/tech is not attractive—for example, paying one’s way into product-market-fit or scale with high-churn-low-retention and so on; and distracted founders are not ones who will inspire market confidence, he says.

Overall slowdown in cloud

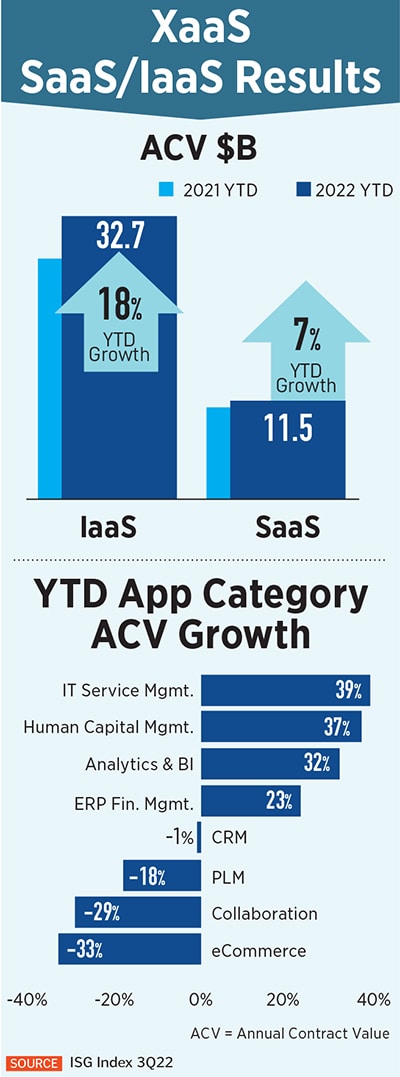

“Cloud-based x-as-a-service market saw its first down quarter since the beginning of 2015,” global outsourcing research and advisory company ISG noted in its latest quarterly index report, for the three months ended September 30. The ‘x’ comprises cloud infrastructure and SaaS.

Third-quarter annual contract value declined by 4 percent versus the prior year to $14.1 billion. Of that, at $10.5 billion, infrastructure-as-a-service was flat versus the prior year, while SaaS declined by 12 percent to $3.6 billion, according to ISG.

Third-quarter annual contract value declined by 4 percent versus the prior year to $14.1 billion. Of that, at $10.5 billion, infrastructure-as-a-service was flat versus the prior year, while SaaS declined by 12 percent to $3.6 billion, according to ISG.