Superstar, Villain and Freshworks: How Girish Mathrubootham is fighting the brutal tech meltdown

With stock down over 65 percent, the SaaS poster boy from India is keeping his head down and planning a comeback, just as his favourite superstar, Rajinikanth, does in films

“We have been dealt with the first three cards of poker,” Girish Mathrubootham tries to explain the situation by coming up with an analogy. Image: Madhu Kapparath

“We have been dealt with the first three cards of poker,” Girish Mathrubootham tries to explain the situation by coming up with an analogy. Image: Madhu Kapparath

September 21, 2021

It was the night before the ‘wedding’. The mood was festive, guests from Chennai, San Mateo in California and Europe had camped in New York, US, and the ‘bachelor party’ was in full swing. The ‘groom’ was trying hard to mask his jitters. Girish Mathrubootham was sitting subdued in a park with his long-time friends Mohit Bhatnagar of Sequoia and Shekhar Kirani of Accel. An enchanting open restaurant, soft touch of cool breeze blowing across the public park and soothing music played by a live band were perfect setting to push the ‘groom’ into a retrospective zone. “Staying a venture capital-backed private company is like being a bachelor,” said Mathrubootham, who started Freshdesk in a 700-square foot warehouse in Chennai in 2010.

The friends raised a toast and the ‘bachelor’ continued with his rumination. “You can party hard, you can have a lot of fun and no questions are asked,” reckoned Mathrubootham, who rebranded the software as a service (SaaS) company as Freshworks in June 2017. Now, after four years, Freshworks was about to go public, making it the first SaaS company from India to get listed on Nasdaq in the US. His friend Bhatnagar popped up the clichéd question. “How are you feeling,” asked the managing director of Sequoia. Accel’s Kirani, who pumped in $1 million as seed capital in 2011 was also curious to find what different hues of emotion the first-time founder from Chennai was feeling.

Mathrubootham stayed mum for a few seconds. “I feel good today,” he murmured. The lines are firmly etched on one of the walls of the corporate office of Freshworks in Chennai. Back in New York’s public park, Mathrubootham’s first emotion was of happiness. And it’s natural. After all, an initial public offering (IPO) is once-in-a lifetime opportunity.

Mathrubootham was understandably delighted. “Going public,” he underlined, “is like getting married.” The second emotion overlapped with the first one. Freshworks’ IPO was marking the creation of a currency for everybody—employees, investors, shareholders, and was a moment of pride for an Indian company. The third emotion, though, was most perplexing. “It was one of responsibility and maybe the fear of the unknown,” he says in a candid conversation with Forbes India. “One didn’t know what one is getting into,” he underlined in an exclusive interview in March this year.

Mathrubootham was understandably delighted. “Going public,” he underlined, “is like getting married.” The second emotion overlapped with the first one. Freshworks’ IPO was marking the creation of a currency for everybody—employees, investors, shareholders, and was a moment of pride for an Indian company. The third emotion, though, was most perplexing. “It was one of responsibility and maybe the fear of the unknown,” he says in a candid conversation with Forbes India. “One didn’t know what one is getting into,” he underlined in an exclusive interview in March this year.

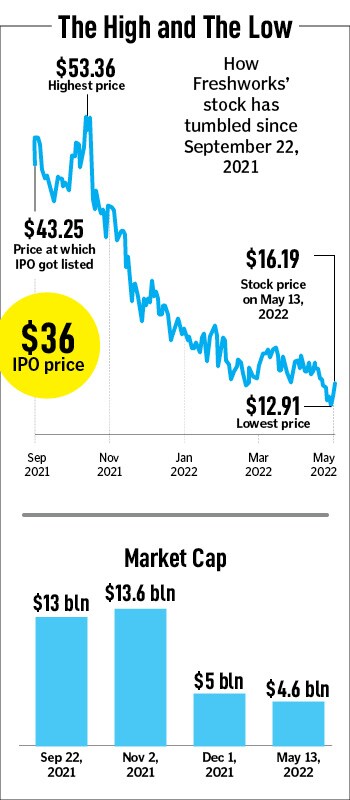

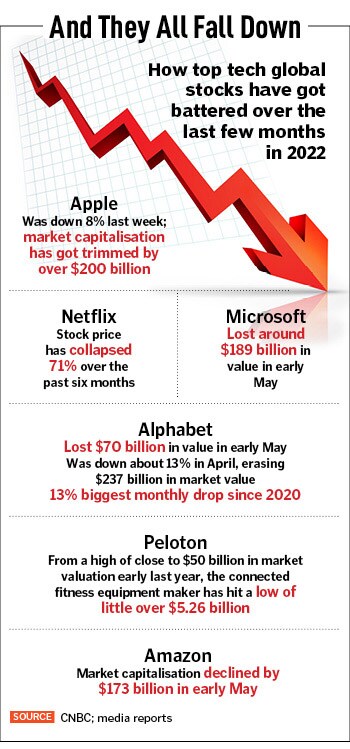

How does the ‘groom’ feel now? Mathrubootham smiles. “I know how to separate passion and emotion,” he says. Globally, stock markets have got battered over the last few months on the back of rising inflation, the US Fed’s interest rate hike, geo-political uncertainty over the

How does the ‘groom’ feel now? Mathrubootham smiles. “I know how to separate passion and emotion,” he says. Globally, stock markets have got battered over the last few months on the back of rising inflation, the US Fed’s interest rate hike, geo-political uncertainty over the

"My happiness," the founder qualified his statement, "is also to ensure that the coconut chutney is well-made." His cousin looked bemused. And to all his rattled employees, who might be worried about the stock performance, he reassures them in his inimitable style. “This is like an interval scene in a Rajini movie,” he says. And everybody knows what happens next. “When everything looks down, the hero stages a comeback,” he smiles.

"My happiness," the founder qualified his statement, "is also to ensure that the coconut chutney is well-made." His cousin looked bemused. And to all his rattled employees, who might be worried about the stock performance, he reassures them in his inimitable style. “This is like an interval scene in a Rajini movie,” he says. And everybody knows what happens next. “When everything looks down, the hero stages a comeback,” he smiles.