Markets refuse to sell off. What is driving this?

Indian markets have proven resilient over the last six months. Declines have been shallow and short-lived since the collapse in March 2020

Indian companies are facing rising challenges on account of slowing demand, supply chain bottlenecks and rising costs. What then explains the resilience of Indian markets?

Image: Shutterstock

Indian companies are facing rising challenges on account of slowing demand, supply chain bottlenecks and rising costs. What then explains the resilience of Indian markets?

Image: Shutterstock

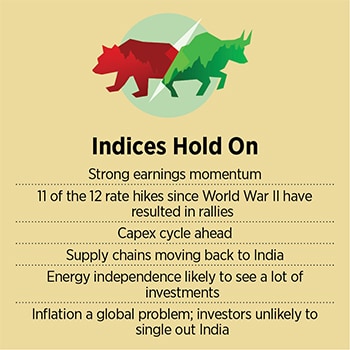

Over the past six months, going short on the Indian market has been a fool’s errand. Rising interest rates, higher inflation numbers and peak valuations have proved insufficient to dent the index rally that started after the collapse in March 2020. Since then, market declines have been shallow and short-lived. Buyers have been waiting on the sidelines.

As things stand, the Nifty 50 quotes as a price multiple of 22 times while its midcap counterpart the Nifty Midcap 100 is at a 26 multiple. Both are the highest valuation numbers seen in the last decade and look set to sustain.

These numbers come at a time when Indian companies are facing rising challenges on account of slowing demand, supply chain bottlenecks and rising costs. What then explains the resilience of Indian markets?

“Earnings have been strong,” says Gautam Duggad, head of research, institutional equities at Motilal Oswal. The brokerage has put an FY22 Nifty earnings target of Rs730, which has been led in large part by an increase in earnings from metals companies. If this number is achieved, this would make it the best earnings year for the Nifty since FY11. Other sectors like IT, oil and gas, banking have also picked up the slack left by slowing earnings in consumer companies. Motilal is targeting Rs870 Nifty earnings for FY23.

In addition, there are opportunities for earnings to continue to grow as companies shift production back home and energy independence becomes a theme for the current decade. With an investment cycle moribund for much of the last decade, Kenneth Andrade, chief investment officer at Old Bridge Capital Management, sees ample room for growth in spending on new capacities over the next decade but cautions that this is likely to be the decade when inflation takes off.

Rising inflation has taken Indian bond yields to 7.1 percent, and while there is still a 400 bps difference between Indian and US yields it remains to be seen how much those yields narrow. If

Rising inflation has taken Indian bond yields to 7.1 percent, and while there is still a 400 bps difference between Indian and US yields it remains to be seen how much those yields narrow. If