Mad Over Donuts: Lord of the glazed rings

A decade of frenzied euphoria, an intense scramble for a bigger bite, and recoiling of a flurry of doughnut brands have paved the way for an unlikely winner. Interestingly, the maddest about doughnuts has managed to survive, flourish, and make money

Tarak Bhattacharya, Executive Director & CEO at Mad Over Donuts.

Image: Mexy Xavier

Tarak Bhattacharya, Executive Director & CEO at Mad Over Donuts.

Image: Mexy Xavier

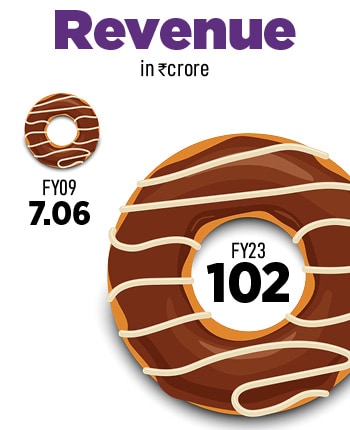

Mumbai, August 2013. Tarak Bhattacharya was a bit edgy. It had been a little over five years since the doughnut brand from Singapore—Mad Over Donuts (MOD)—opened its account in India. The first store came up in March 2008 at Noida, some 25 kilometres from Connaught Place, the heart of Delhi, and by the first half of 2013, the brand had plodded along to two dozen outlets across Delhi-NCR, Mumbai, Pune and Bengaluru. Though sedate, the journey was commendable for a raft of reasons.

First, doughnuts were an alien product in India in 2008. Being the first mover in the segment, MOD had to do most of the heavy lifting in terms of spreading awareness, developing a palette and creating a market. Second, unlike the American consumers who devoured the glazed ring with a steaming cuppa during their daily morning ritual, the Indians still loved their dosa, idli and upma for breakfast. For them, doughnut was a sweet snack, it didn’t have enough dough to graduate as a meal, and Indians were still gingerly flirting with the product. Though there was consumer love, stickiness—call it commitment—was an issue.

Third, doughnut had too many desi competitors in mithai, desserts and yes, chocolates. Given the not-so-sweet market realities, Bhattacharya should have had a glazing look on his face. Back in August 2013, he was looking a bit pale. “I was just anxious,” recounts the chief executive officer who joined MOD in 2011. “I was not scared.”

Well, Bhattacharya had all the reasons to be worried, and scared. The big daddy of doughnuts—Dunkin Donuts—did something unthinkable in India. Over a year into the country, the Indian master franchise of Dunkin Donuts—Jubilant FoodWorks—rolled out burgers: Classic and smoked chicken, potato hash brown burger and spicy veg. A brand globally known for doughnuts was about to sell burgers! What this meant for rivals was one simple thing: More footfalls, more stickiness and more business for Dunkin, which bared its aggressive intent by racing to 14 outlets in Delhi-NCR and Chandigarh in just a little over 12 months.

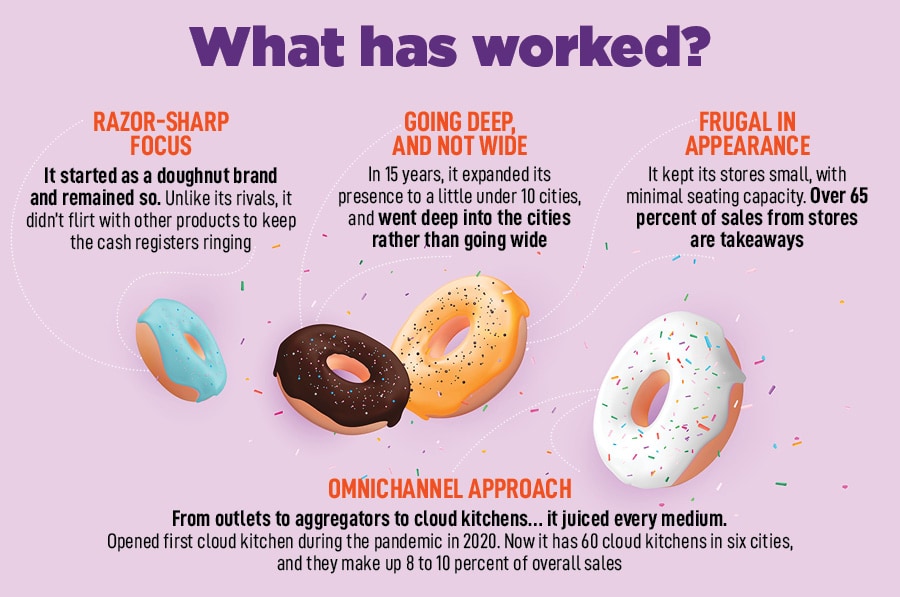

The performance of MOD, reckon branding and marketing experts, has to be evaluated against the context of how it stayed away from the mad scramble to open outposts across scores of cities in a short span of time. “Doughnut is not dosa or idli or samosa,” says Ashita Aggarwal, professor of marketing at SP Jain Institute of Management and Research. It will always have its consumers, but the frequency would be restricted. Anybody opening a doughnut shop in India and thinking that it can make quick and big money is unrealistic. “You can’t just sell burgers or fries or pizzas under the doughnut brand to make money,” she says, adding that the business of doughnuts is only meant for those who have loads of patience and stay true to the product. “The fact that MOD realised the folly of matching the firepower of its rivals shows the maturity of the brand in accepting its limitations,” she says. “It played to its strength.”

The performance of MOD, reckon branding and marketing experts, has to be evaluated against the context of how it stayed away from the mad scramble to open outposts across scores of cities in a short span of time. “Doughnut is not dosa or idli or samosa,” says Ashita Aggarwal, professor of marketing at SP Jain Institute of Management and Research. It will always have its consumers, but the frequency would be restricted. Anybody opening a doughnut shop in India and thinking that it can make quick and big money is unrealistic. “You can’t just sell burgers or fries or pizzas under the doughnut brand to make money,” she says, adding that the business of doughnuts is only meant for those who have loads of patience and stay true to the product. “The fact that MOD realised the folly of matching the firepower of its rivals shows the maturity of the brand in accepting its limitations,” she says. “It played to its strength.”