Can Papa Johns take on big daddy Domino's?

A slow start, a cheesy first innings and an abrupt ending. Can Papa Johns be second-time lucky and get a bigger slice as it gets ready to reopen its Indian account with a new partner and a revamped strategy?

Tapan Vaidya, Group CEO of PJP Investments

Tapan Vaidya, Group CEO of PJP Investments

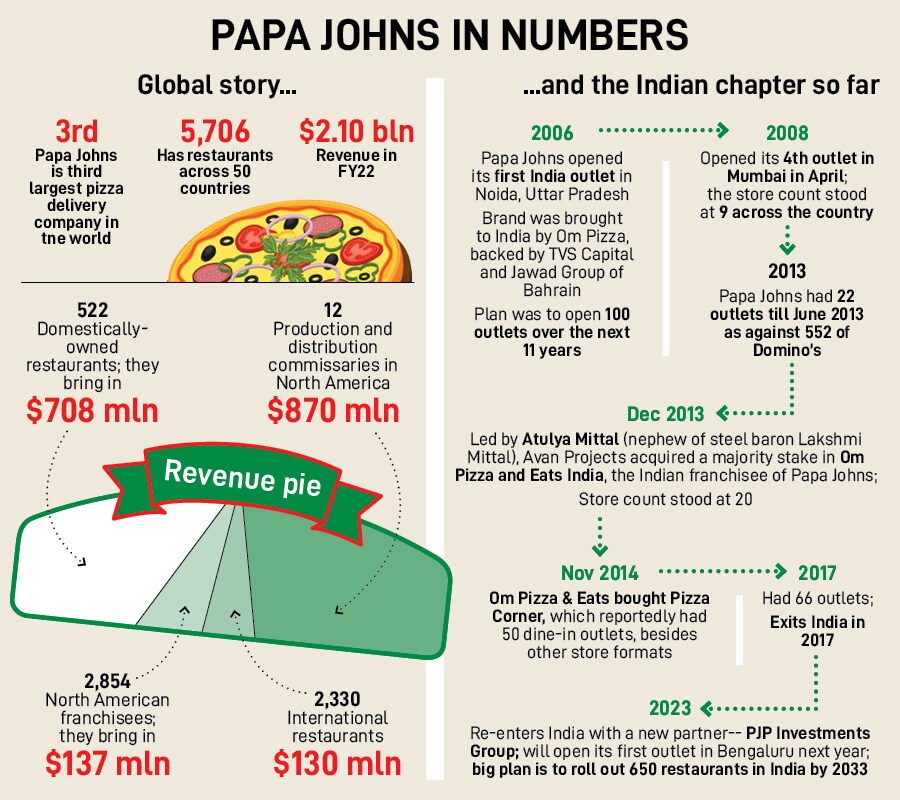

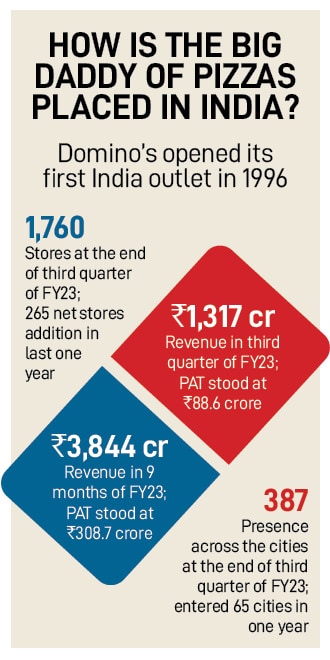

June 2006, Noida, Uttar Pradesh. Let’s look at four easy-peasy steps to make a pizza. First, place each dough ball on a heavily floured surface. Second, use fingers to stretch it. Third, use your hands to shape it into a square, round or whatever shape you want. And last, top and bake it. Simple. Isn’t it? It is indeed for the rookies. But for experts like Papa Johns—the third-biggest pizza player in the world, which has a brand topping aka tagline of ‘Better ingredients, better pizza’—making a debut in India was not all that simple. It was 2006, the American pizza giant was a decade late in opening its account, and rival Domino’s had a massive head start by rolling out its first store in New Delhi way back in 1996. The odds were heavily stacked against the challenger brand, which trailed Domino’s and Pizza Hut.

The late comer, though, was confident of making a dent. "The middle-class here is growing at a fast rate, and this is the right time for us to enter the Indian market," the then chief executive Nigel Travis reportedly remarked in 2006. The brand was brought to India by Om Pizza & Eats, backed by TVS Capital and Jawad Group of Bahrain, and the idea was to scale up at a feverish pace. The ambition, in fact, was to open 100 stores in a decade.

A year later, Domino’s had become the biggest pizza player in the country and had close to 160 outlets. In 2008, in contrast, Papa Johns opened its fourth outlet in Mumbai in June, taking the overall Indian store count to nine. Though the pizza maker was painfully slow in kneading the dough, it remained hyper bullish in its intent, and planned to open 100 stores over the next four years.

Cut to April 2023. Papa Johns decides to try its luck for the second time by joining hands with a new partner: PJP Investments Group. Owned by Dubai-based private equity investment firm Levant Capital, PJP operates over 100 Papa Johns restaurants across the United Arab Emirates, Saudi Arabia and Jordan. In an exclusive interview to Forbes India, Tapan Vaidya, Group CEO of PJP Investments, reckons why Papa Johns stands a good chance of making a comeback. “This time the brand will do what India needs rather than what it does in the US,” he underlines, alluding to the unanimous diagnosis by the marketing, branding and QSR experts about the failure of the brand in its first innings. The brand, they point out, was too purist in its approach, didn’t do much to Indianise and appeal to the local palate like a Domino’s or a McDonald’s, and was too premium in its appeal and positioning. “Now we are entering pretty much with a clean slate, and it’s a fresh start,” says Vaidya, adding that the brand will roll out its first outlet in Bengaluru in 2024.

Cut to April 2023. Papa Johns decides to try its luck for the second time by joining hands with a new partner: PJP Investments Group. Owned by Dubai-based private equity investment firm Levant Capital, PJP operates over 100 Papa Johns restaurants across the United Arab Emirates, Saudi Arabia and Jordan. In an exclusive interview to Forbes India, Tapan Vaidya, Group CEO of PJP Investments, reckons why Papa Johns stands a good chance of making a comeback. “This time the brand will do what India needs rather than what it does in the US,” he underlines, alluding to the unanimous diagnosis by the marketing, branding and QSR experts about the failure of the brand in its first innings. The brand, they point out, was too purist in its approach, didn’t do much to Indianise and appeal to the local palate like a Domino’s or a McDonald’s, and was too premium in its appeal and positioning. “Now we are entering pretty much with a clean slate, and it’s a fresh start,” says Vaidya, adding that the brand will roll out its first outlet in Bengaluru in 2024.

But is the task, and the ambitious target of opening 650 outlets by 2033, going to be a cakewalk? Experts are sceptical. “The markets, and the pizza category, have evolved in India,” says KS Narayanan, a food and beverage expert. Today there is much more competition across the mass and the premium ends. “The markets are far more segmented and consumers more discerning,” he reckons, adding that for any new player, which already is making a late entry into India, making it to the top three would be extremely challenging. “This will require sustained management effort and focus to build the brand,” he says.

But is the task, and the ambitious target of opening 650 outlets by 2033, going to be a cakewalk? Experts are sceptical. “The markets, and the pizza category, have evolved in India,” says KS Narayanan, a food and beverage expert. Today there is much more competition across the mass and the premium ends. “The markets are far more segmented and consumers more discerning,” he reckons, adding that for any new player, which already is making a late entry into India, making it to the top three would be extremely challenging. “This will require sustained management effort and focus to build the brand,” he says.