- Home

- UpFront

- Take One: Big story of the day

- Inside the shaken house of Adani

Inside the shaken house of Adani

Amid a massive stock sell-off and falling stock prices of its companies following the Hindenburg report, Adani Enterprises is looking for alternative options to raise funds so that its capex plans are not hit. Analysts say the task may not be easy and it will be difficult to justify the steep valuations

Gautam Adani, Chairman and founder of Adani Group

Image: Kobi Wolf/Bloomberg via Getty Images

Gautam Adani, Chairman and founder of Adani Group

Image: Kobi Wolf/Bloomberg via Getty Images

Even as the follow-on-offer (FPO) by Adani Enterprises was stalled due to massive stock sell-off triggered by a report by US-based Hindenburg Research, questioning its financial health and disclosures, the company is looking for alternative routes and options to raise funds so that its capex plans are not hit, and revenue targets are met.

Related stories

“After the FPO was withdrawn, the company will raise funds through other available instruments like QIP (qualified institutional placement) and preferential shares issue. Marquee investors are willing to invest further in Adani group companies. In due course of time, we will release those names too,” a company spokesperson tells Forbes India.

The person said the FPO withdrawal may delay capex plans, but not stall them entirely. “Growth expansion of Adani group companies will be met through internal accruals. Banks-led consortiums are willing to lend us further. Financing projects is not an issue as we have global marquee investors who have expressed keen interest to invest, given our project execution capabilities, strong business models and robust balance sheet,” adds the spokesperson.

However, the task may not be that easy for the Gautam Adani-led company.

“Valuations, valuations and valuations. Steep valuations that Adani companies trade at are quite difficult to justify. Now that the stock prices of its companies have also drastically fallen, it remains to be seen how new investors will value the company in any fundraising round,” says an analyst on condition of anonymity.

Though debt may be piling, the company’s business recovered in first nine months of FY23. Adani group’s flagship Adani Enterprises swung into profitability in the December quarter. It reported a consolidated net profit of Rs820 crore for October-December 2022 against a loss of Rs12 crore a year ago. Its total income jumped by 42 percent to Rs26,951 crore from Rs18,757.9 crore last year. Ebitda (earnings before interest, taxes, depreciation and amortisation) soared 101 percent to Rs1,968 crore.

Though debt may be piling, the company’s business recovered in first nine months of FY23. Adani group’s flagship Adani Enterprises swung into profitability in the December quarter. It reported a consolidated net profit of Rs820 crore for October-December 2022 against a loss of Rs12 crore a year ago. Its total income jumped by 42 percent to Rs26,951 crore from Rs18,757.9 crore last year. Ebitda (earnings before interest, taxes, depreciation and amortisation) soared 101 percent to Rs1,968 crore.

“Over the past three decades, as well as quarter after quarter and year after year, Adani Enterprises has not only validated its standing as India’s most successful infrastructure incubator but has also demonstrated a track record of building core infrastructure business,” said Gautam Adani, chairman, Adani Group, after the December quarter results.

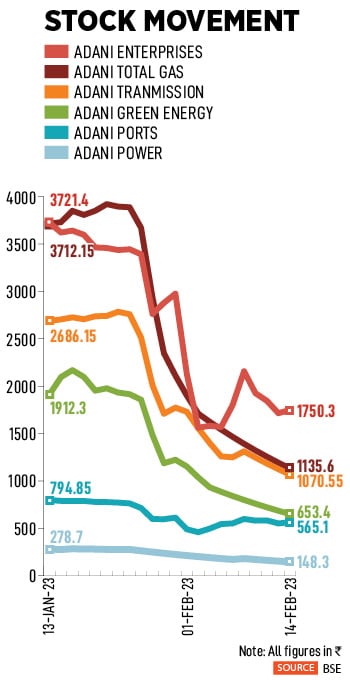

Share prices of Adani Enterprises jumped around 10 percent on the day of declaring the December quarter results but recovering the lost investor wealth from January-end will take time.

On January 24, Hindenburg Research, a US-based research firm, released a report levying various allegations on the Adani group encompassing multiple litigations, related party transactions, shareholding ownership by few overseas investors in non-promoter group entities amidst other series of questions. In its response to the stock exchanges, the Adani group refuted the allegations. However, there was hectic selling in Adani group shares leading to a massive loss of around $100 billion after the Hindenburg report was released.

On January 24, Hindenburg Research, a US-based research firm, released a report levying various allegations on the Adani group encompassing multiple litigations, related party transactions, shareholding ownership by few overseas investors in non-promoter group entities amidst other series of questions. In its response to the stock exchanges, the Adani group refuted the allegations. However, there was hectic selling in Adani group shares leading to a massive loss of around $100 billion after the Hindenburg report was released.

“It is pertinent to note that Care Ratings in its assessment had not factored in this equity infusion. Care Ratings notes substantial capex being undertaken by Adani group, especially in diverse areas, exposes Adani group to inherent project execution risk. Nevertheless, the company management has conveyed its flexibility to moderate the pace of undertaking capex, given substantial portion of such capex is discretionary in nature. Going forward, significant increase in the external debt/PBILDT (profit before interest, lease rentals, depreciation and taxation) due to large debt funded capex shall be critical rating monitorable for Adani group of companies rated by Care Ratings,” the ratings agency said on February 2.

Also read: Will MSCI weightage rejig trigger further sell-off in Adani companies?

Debt and fundraising

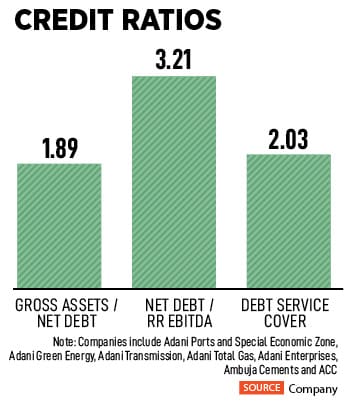

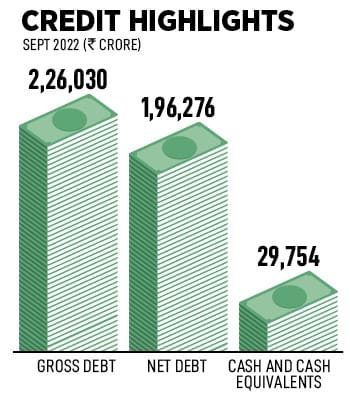

As of September 2022, the group level net debt stood at $24.1 billion or Rs196,276 crore. Its cash balance was Rs31,646 crore ($3.9 billion) as of December, an increase from Rs29,754 crore in the preceding three months. The group’s assets are 1.89 times its net debt.

“The portfolio level net debt to run rate Ebitda ratio has decreased from 7.6 times in FY13 to 3.2 times in FY22. In the same period, run rate Ebitda has grown at a CAGR of 22 percent, whereas the debt has grown only at 11 percent CAGR,” the company said.

“The portfolio level net debt to run rate Ebitda ratio has decreased from 7.6 times in FY13 to 3.2 times in FY22. In the same period, run rate Ebitda has grown at a CAGR of 22 percent, whereas the debt has grown only at 11 percent CAGR,” the company said.

Its portfolio companies’ debt service coverage is currently at 2.03 times. The debt-service coverage ratio (DSCR) is a measure of the cash flow available to pay current debt obligations. A DSCR of less than 1 means negative cash flow, indicating that the borrower will be unable to cover or pay current debt obligations without drawing on outside source, mainly, borrowing further.

But credit ratings agencies may not be convinced, just at that.

S&P revised its rating outlook to negative on Adani Electricity and Adani Ports. “The negative outlook reflects the risk of a deterioration in the credit profile of Adani Ports and Adani Electricity Mumbai due to governance risks and funding challenges for the larger Adani group,” S&P said. According to S&P, allegations may hit the group's ability to raise fresh equity or borrow. “Adani Group entities—rated and unrated—have significant growth ambitions. They will need an ongoing supply of equity and debt capital. The recent allegations may hurt the group's ability to raise fresh equity or to borrow, particularly in US dollar public bond markets,” S&P said.

S&P revised its rating outlook to negative on Adani Electricity and Adani Ports

Image: Sam Panthaky / AFP

S&P revised its rating outlook to negative on Adani Electricity and Adani Ports

Image: Sam Panthaky / AFP

Moody's also downgraded four Adani companies to negative from stable, while maintaining the stable outlook on other four companies. However, Moody's said it could change the rating outlook to stable if the entities can demonstrate their access to the capital markets to meet their growth funding and refinancing requirements; and if their management can effectively implement timely and effective counter-measures to preserve the companies' credit metrics, including a reduction in capital spending or financial leverage with support from the promoter. “A revision in the outlook to stable is further predicated on there being no material increase in related party transactions to provide funding support to other group entities,” Moody’s said.

Fitch Ratings said there is no immediate impact on the ratings of the Fitch-rated Adani entities and their securities following a “short-seller report” alleging malpractices at Adani group, and expects no material changes to its forecast cash flow.

Fitch Ratings said there is no immediate impact on the ratings of the Fitch-rated Adani entities and their securities following a “short-seller report” alleging malpractices at Adani group, and expects no material changes to its forecast cash flow.

The company remains bullish on its targets and business plans. It said the balance sheet of each of their independent portfolio companies is very healthy. “After FPO withdrawal, debt may increase to $25 billion, overall profitability may see a 0.5 percent hit in FY23, but CAGR revenue for the group companies will remain intact. Group companies are on path in achieving 12-18 percent CAGR revenue growth in FY23,” the company tells Forbes India.

Also read: What punctured markets' euphoria on Budget day?

Green projects: At stake?

The ports-to-power conglomerate had committed a $70 billion investment in clean energy by 2030, which may possibly face a threat. In February, Total Energies said it will put on hold the $4 billion hydrogen investment with Adani, as it awaits audit results launched by the Indian conglomerate in response to allegations of financial irregularities by Hindenburg Research.

“It may see a near-term impact due to global investor concerns about the latest controversy,” says Sankar Chakraborti, group CEO-Acuite Ratings & Research, and chairman-ESGRisk.ai. However, he adds that India's green project finance is still in its early stages.

“It may see a near-term impact due to global investor concerns about the latest controversy,” says Sankar Chakraborti, group CEO-Acuite Ratings & Research, and chairman-ESGRisk.ai. However, he adds that India's green project finance is still in its early stages.

“Given the key role that India has to play to reduce carbon emissions and drive the global mission towards sustainability, it will attract long-term ESG funds. Further, the government will also play a key role by leading the mobilisation of green funds through sovereign green bonds. We, therefore, see no deep-rooted impact of the controversy on India's green investment commitments,” adds Chakraborti.

Who owns the Adani group companies?

Shareholding pattern of listed Adani group companies is simple. All the seven key Adani group companies listed on the stock exchanges are promoter-led with minimum public float. Except Life Insurance Corporation of India (LIC), institutional investors are missing while retail participation is visible in a few companies. According to the Securities and Exchange Board of India (Sebi), a listed company should have minimum public shareholding of 25 percent while newly listed ones are granted three years to meet the requirement of 25 percent public float.

Typically, companies with high public shareholding and low promoter ownership see active shareholder activism where shareholders influence and shape corporate decisions and policies.

Also read: LIC trims stake in listed companies, FPI exposure at 10-year low in July-Sept

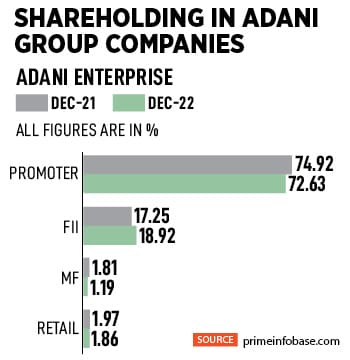

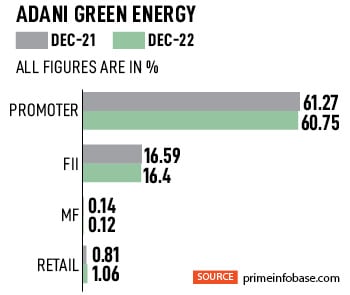

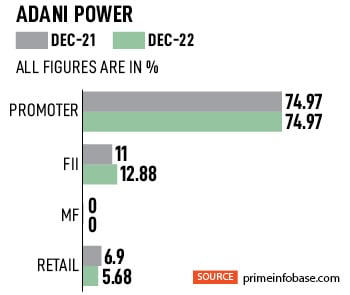

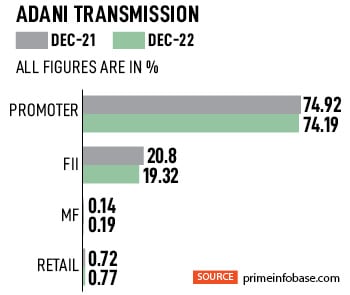

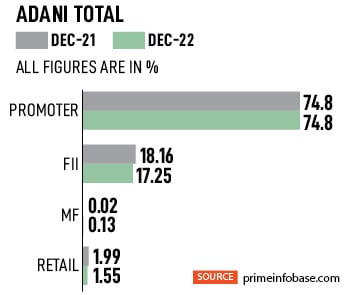

Except Adani Ports and Adani Green Energy, four companies—Adani Enterprises, Adani Power, Adani Transmission and Adani Total—have promoter holding of around 72 to 74 percent in at least the last 12 quarters starting March 2020, shows a Forbes India analysis based on data provided by Prime Database. The analysis considers only six Adani companies, Adani Wilmar, newly acquired companies ACC, Ambuja and NDTV, were not part of this analysis.

As per the latest shareholding pattern declared to the stock exchanges, retail investors are highest in Adani Power with 5.68 percent in December-end. However, this segment has seen a fall from 6.9 percent in the December quarter of 2021. Retail investors are defined as individuals with up to Rs2 lakh shareholding in a company. Mutual funds have nil investment in Adani Power, while foreign institutional investors (FII) holding is at 12.88 percent which has also reduced from 13.23 percent in the September quarter of 2022.

As per the latest shareholding pattern declared to the stock exchanges, retail investors are highest in Adani Power with 5.68 percent in December-end. However, this segment has seen a fall from 6.9 percent in the December quarter of 2021. Retail investors are defined as individuals with up to Rs2 lakh shareholding in a company. Mutual funds have nil investment in Adani Power, while foreign institutional investors (FII) holding is at 12.88 percent which has also reduced from 13.23 percent in the September quarter of 2022.

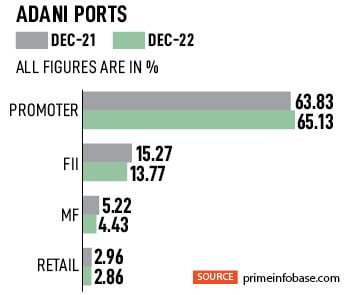

Mutual funds participation is highest in Adani Ports by the end of the December quarter (4.43 percent), though that segment has reduced from a high of 5.22 percent in December year-ago period. FIIs ownership stands at 13.77 percent, consistently reducing from 17.53 percent in March 2020, while promoter ownership has risen to 65.13 percent at the end of the December quarter from a low of 62.79 percent in March 2020.

In Adani Power, Adani Transmission, Adani Total and Adani Green Energy, mutual funds have almost nil investments.

With hardly any analyst covering Adani group companies’ listed stocks, except for Adani Ports, it may appear difficult for investors to understand their financial health. On Bloomberg, 21 analysts cover Adani Ports, while two track Adani Enterprises, one each for Adani Green, Adani Total and Adani Power, two for Adani Transmission.

Analysts and fund managers cite steep valuations as the key reason for not tracking the company or finding any of them viable for investment.

“The valuations are extremely high… how do we justify them while investing? We would rather focus on other companies with higher value proposition,” says a research head of a stock broking firm.

Another research analyst says, “It is difficult to understand the financial health of some businesses of Adani group companies. How do we comment on their financials then? Valuations, of course, are at unjustifiable high.”

Also read: LIC: Tough road ahead as stock continues to drag

LIC: The big support

Even as public free float and institutional holdings in Adani companies are low, India’s biggest domestic institutional investor LIC has exposure in five of six key companies analysed by Forbes India. According to data provided by Prime Database, LIC has the highest exposure (among Adani companies) in Adani Ports at 9.14 percent by December-end which has seen a sharp cut from 11.9 percent in March 2020.

In the other four companies, LIC has been increasing its stake. At the end of the December quarter, LIC’s stake in Adani Transmission was at 3.65 percent, increasing from 2.42 percent in March 2020. LIC’s ownership in Adani Total Gas was at 5.96 percent after it started investment from March 2021 at 2.11 percent. Similarly, in case of Adani Enterprises, LIC’s stake has jumped to 4.23 percent in December after it started investing at 1.32 percent from June 2021.

In the other four companies, LIC has been increasing its stake. At the end of the December quarter, LIC’s stake in Adani Transmission was at 3.65 percent, increasing from 2.42 percent in March 2020. LIC’s ownership in Adani Total Gas was at 5.96 percent after it started investment from March 2021 at 2.11 percent. Similarly, in case of Adani Enterprises, LIC’s stake has jumped to 4.23 percent in December after it started investing at 1.32 percent from June 2021.

In Adani Green, LIC started investing only in the last two quarters with its stake climbing to 1.28 percent in December from 1.15 percent in the preceding three months.

However, the sharp sell-off in Adani stocks does not worry LIC. LIC had said that its exposure to Adani group was equivalent to 0.974 percent of its total asset under management (AUM) at book value. The total AUM by LIC is over Rs41.66 lakh crore as of September 2022.

LIC's total holding under equity and debt is Rs35,917.31 crore as of December under Adani group of companies. “The total purchase value of equity, purchased over the last many years, under all the Adani group companies is Rs30,127 crore and the market value for the same as at close of market hours on January 27 was Rs56,142 crore. The total amount invested under Adani group amounts to Rs36,474.78 crore to date,” LIC had said in a media statement.

Also watch: Wealth builds wealth: India's 100 Richest in numbers

Outflow of foreign money?

Adani group companies are likely to see a possible further outflow of nearly half a billion dollars of foreign money starting March as a consequence of an index review and rebalancing of weightage by MSCI. In February, the index provider reduced the weightage of four Adani group companies in the MSCI Global Standard index, which will be effective after closing of trade on February 28.

However, cuts in the four companies’ weightage are minor. Adani Enterprises, Adani Transmission, Adani Total Gas and ACC have seen a reduction of weightage in the index by 0.02 to 0.3 basis points. That would roughly work out to an outflow of $428 million, according to estimates by Abhilash Pagaria, analyst, Nuvama Alternative & Quantitative Research. “MSCI has also changed the Foreign Inclusion Factor in a few names and the major downward revision has been seen in Adani Transmission, Adani Total Gas and Adani Enterprises. This will lead to meaningful outflows in these names,” Pagaria says.

However, cuts in the four companies’ weightage are minor. Adani Enterprises, Adani Transmission, Adani Total Gas and ACC have seen a reduction of weightage in the index by 0.02 to 0.3 basis points. That would roughly work out to an outflow of $428 million, according to estimates by Abhilash Pagaria, analyst, Nuvama Alternative & Quantitative Research. “MSCI has also changed the Foreign Inclusion Factor in a few names and the major downward revision has been seen in Adani Transmission, Adani Total Gas and Adani Enterprises. This will lead to meaningful outflows in these names,” Pagaria says.

Adani Enterprises and Adani Transmission may see an outflow of $161 million each by a sale of average 6.9 million and 9.6 million shares respectively on the index. Adani Total Gas may potentially face a sell-off of 6.9 million shares resulting in a drain-out of $110 million while ACC may see a cut of 0.5 million shares and sale of $12 million.

“MSCI has received feedback from a range of market participants concerning the eligibility and free float determination of specific securities associated with the Adani group for the MSCI Global Investable Market Indexes,” MSCI said in a statement.

What next?

“Our fundamental strength lies in mega-scale infrastructure project execution capabilities, organisational development and exceptional management skills comparable to the best in the world,” Gautam Adani said.

The company believes the current market volatility is temporary and, as a classical incubator with a vision of long-term value creation, it said that the Adani group will continue to work with the twin objectives of moderate leverage and looking at strategic opportunities to expand and grow. “We will also continue to evaluate all current and future opportunities with a strategic lens, and take appropriate decisions based on our financial strength, synergies and adjacencies,” it said in a statement.

The company believes the current market volatility is temporary and, as a classical incubator with a vision of long-term value creation, it said that the Adani group will continue to work with the twin objectives of moderate leverage and looking at strategic opportunities to expand and grow. “We will also continue to evaluate all current and future opportunities with a strategic lens, and take appropriate decisions based on our financial strength, synergies and adjacencies,” it said in a statement.

However, analysts feel that there will be challenges for the conglomerate going forward if valuations of its key businesses are not brought to a reasonable level.

Research firm Bernstein feels Adani Green can clear the group companies’ entire debt if needed. “For Adani Green, we see an enterprise value of Rs45,100-56,400 crore. This is enough to clear the entire debt taken by Adani Green. Even after this, they would be left with under-construction assets,” analysts at Bernstein said.