LIC trims stake in listed companies, FPI exposure at 10-year low in July-Sept

This probably indicates that the country's largest domestic institutional investor is taking a cautious stance on the markets, or simply profit booking as markets rose 10 percent during the quarter

Image: Shutterstock LIC, most likely, has taken a cautious stance of stock markets and reduced its stake in companies

LIC, most likely, has taken a cautious stance of stock markets and reduced its stake in companies

Life Insurance Corporation of India (LIC) has reduced its stake in listed companies in July-September period, the first full quarter after its stock markets debut in May this year. The largest domestic institutional investor in Indian stock markets trimmed its stake in listed companies to 3.87 percent in the three months ending September, probably indicating LIC's cautious stance on the markets or simply profit booking as markets had surged during the period.

LIC’s holding in companies listed on the National Stock Exchange (NSE) were at 3.69 percent in year-ago period on an aggregate basis by value percentage, as per analysis based on Prime Infobase data. This compares to LIC’s exposure at 3.92 percent in June quarter of 2022.

LIC’s stake in these companies were around or above four percent in previous quarters. It was only from the September-ended quarter of 2019, when LIC’s holding in these companies started to decline below four percent.

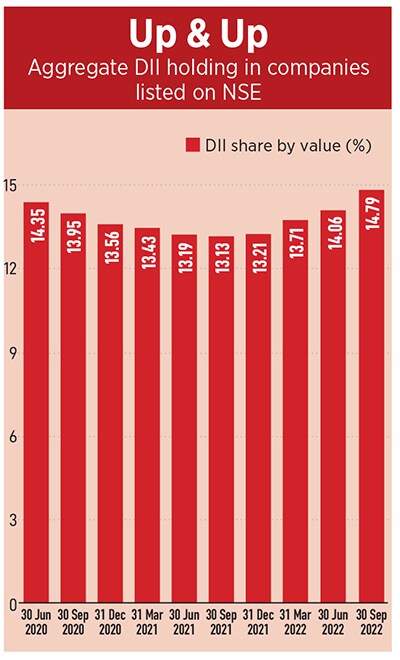

LIC’s stake in these companies were around or above four percent in previous quarters. It was only from the September-ended quarter of 2019, when LIC’s holding in these companies started to decline below four percent.  Domestic institutional investors (DIIs), which includes domestic mutual funds, insurance companies, banks, financial institutions, pension funds investors had a share of 24.03 percent in listed companies in September quarter, which is at an all-time high. This compares to DII’s share at 23.54 percent in the June quarter. In the same period, DIIs had pumped in Rs17,597 crore during the quarter. In value terms, DII holdings in these companies increased to Rs 39.26 trillion by end of September, a jump of 17.46 percent over the last quarter.

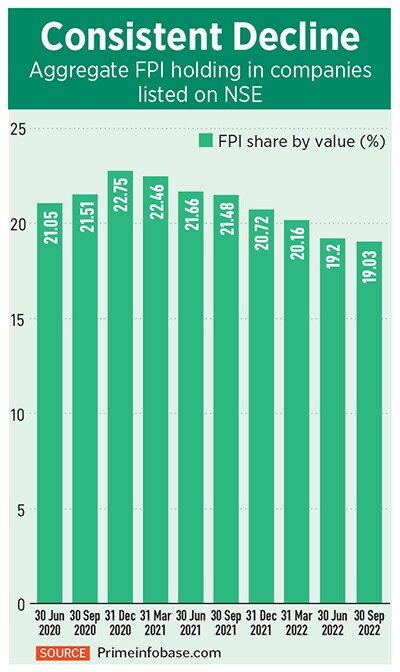

Domestic institutional investors (DIIs), which includes domestic mutual funds, insurance companies, banks, financial institutions, pension funds investors had a share of 24.03 percent in listed companies in September quarter, which is at an all-time high. This compares to DII’s share at 23.54 percent in the June quarter. In the same period, DIIs had pumped in Rs17,597 crore during the quarter. In value terms, DII holdings in these companies increased to Rs 39.26 trillion by end of September, a jump of 17.46 percent over the last quarter. Data showed FPIs pulled out Rs 21,878 crore from sectors like information technology and oil, gas and consumable fuels during the quarter while investing Rs 22,689 crore in financial services and health care.

Data showed FPIs pulled out Rs 21,878 crore from sectors like information technology and oil, gas and consumable fuels during the quarter while investing Rs 22,689 crore in financial services and health care.