IDBI Bank: Lot of value, difficult to extract

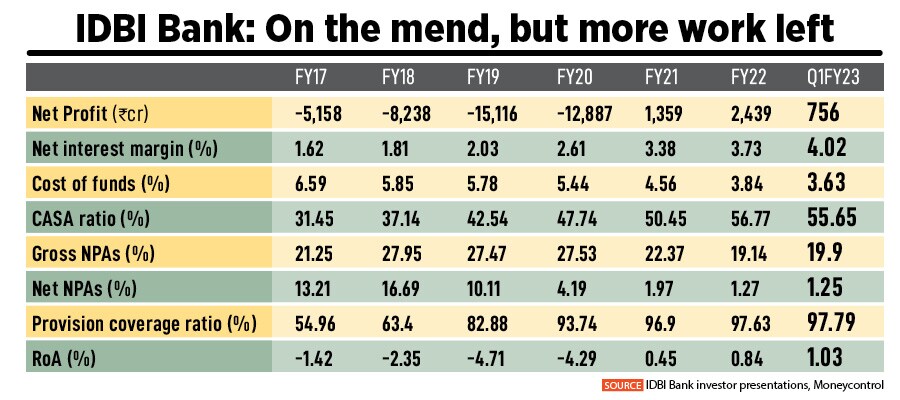

The legacy-rich IDBI Bank is finally ready for a new ownership. While the bank has turned profitable and provisioned for bad loans, the tricky path to growth and becoming a retail-focussed enterprise is a challenge for the new owner

IDBI Bank, a subsidiary of LIC, which by legacy has been largely focussed on corporate banking, is finally up for a strategic sale from its two promoters, LIC and the Government of India (GoI).

Image: Amit Verma

IDBI Bank, a subsidiary of LIC, which by legacy has been largely focussed on corporate banking, is finally up for a strategic sale from its two promoters, LIC and the Government of India (GoI).

Image: Amit Verma

The true test of the work that veteran banker and IDBI Bank managing director Rakesh Sharma and his team have put in—to not just turn around a bank that was once in an ICU-type state, but also make it an attractive asset to acquire—will be reflected in the coming months.

IDBI Bank, a subsidiary of Life Insurance Corporation of India (LIC), which by legacy has been largely focussed on corporate banking, is finally up for a strategic sale from its two promoters, LIC and the Government of India (GoI). This opens up a fresh opportunity for entities to acquire and operate a bank, where the Reserve Bank of India (RBI) has been sparing to grant a universal banking licence.

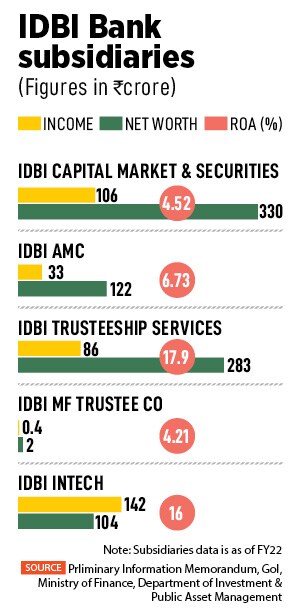

The 159-page preliminary information memorandum issued by the Department of Investment and Public Asset Management (DIPAM), Ministry of Finance, says interested parties can submit their Expressions of Interest (EoI) either as a sole bidder or as part of a consortium (with a maximum of four members).

This is an attempt to attract only serious bidders for this legacy-rich bank. But as with previous processes for a banking licence, large industrial and corporate houses will, once again, not be permitted to participate in this bidding process, either on their own or as part of a consortium.

This is an attempt to attract only serious bidders for this legacy-rich bank. But as with previous processes for a banking licence, large industrial and corporate houses will, once again, not be permitted to participate in this bidding process, either on their own or as part of a consortium.

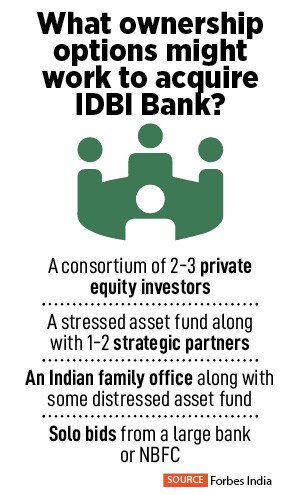

The possibilities that a private equity investor will form a consortium with other partners, or a stressed asset fund may combine with a strategic partner, are likely options. A local Indian family office could also join hands with a distressed asset fund (see table). “A number of them are talking to each other. There is phenomenal value in IDBI Bank, but to extract it is not easy,” says the bank source.

The possibilities that a private equity investor will form a consortium with other partners, or a stressed asset fund may combine with a strategic partner, are likely options. A local Indian family office could also join hands with a distressed asset fund (see table). “A number of them are talking to each other. There is phenomenal value in IDBI Bank, but to extract it is not easy,” says the bank source.