How Vishal Bali is giving a fresh life to India's crippled healthcare sector and making his investors richer

At a time multi-specialty players dominate the landscape, the executive chairman of Asia Healthcare Holdings has turned around loss-making entities like Motherhood Hospitals and Nova IVF and pushed them on a growth trajectory

Vishal Bali, executive Chairman, Asia Healthcare; Image: Nishant Ratnakar for Forbes India

Vishal Bali, executive Chairman, Asia Healthcare; Image: Nishant Ratnakar for Forbes India

Vishal Bali relishes being pushed against the wall. It’s when the chips are down, Bali says, that he can quickly identify a worthy execution plan. Of course, years of experience in running two of India’s biggest hospital chains and, most recently, building one of India’s fastest-growing healthcare businesses help. But there is nothing quite like the thrill of turning around something that others consider impossible.

Bali is currently the head of Asia Healthcare Holdings, an investment platform of TPG Growth, the equity fund owned by the alternative asset management firm, TPG, that specialises in investing in single-specialty hospitals in the country. For Bali, the business couldn’t have been any different, having built up and run multispecialty hospitals all his life. Bali was formerly the CEO of Wockhardt Hospitals and Fortis before joining AHH.

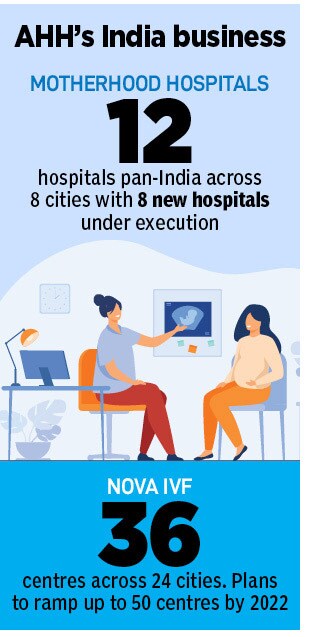

AHH was launched in India in 2016 following the acquisition of the cancer hospital chain Cancer Treatment Services International (CTSI) for $38 million. Today, the chain owns Motherhood Hospitals, a pan-India specialty hospital chain offering premium maternity and child healthcare services across eight cities, and Nova IVF, a fertility treatment provider with 36 facilities across 24 cities.

“When you get pushed against the wall, being told that this is not the thing to do, your execution brain tells you there is something that one can build over here,” says Bali, the executive chairman of Asia Healthcare Holdings. “I am building an enterprise and I'm enjoying this journey.”

Bali’s push towards single-specialty hospitals comes at a time when hospitals across India chase a multi-specialty line of operations, particularly led by the likes of Narayana Healthcare, Manipal, Apollo, Fortis, and Aster among others. In May, Manipal Hospitals had acquired multispecialty hospital chain Columbia Asia Hospitals Private Limited.

Around the same time, the company also took majority control of Bengaluru-based Rhea Healthcare with an investment of $33 million. Rhea was then operating three mother and childcare hospitals under the brand 'Motherhood' in Bengaluru, Chennai, and Hyderabad.

Around the same time, the company also took majority control of Bengaluru-based Rhea Healthcare with an investment of $33 million. Rhea was then operating three mother and childcare hospitals under the brand 'Motherhood' in Bengaluru, Chennai, and Hyderabad.